The $1.9 trillion relief plan is not too big

The time is right for a real full employment push

If you like this post, please consider becoming a Slow Boring member. Discount subscriptions are available to small groups of four or more and to students and educators — and larger discounts are very possible for larger groups, get in touch to explore those options. Otherwise, enjoy the post and feel free to share.

How many jobs can the American economy add once public health challenges are in the rearview mirror? I think that’s a better question to ask than directly engaging with the question of whether Biden’s $1.9 trillion relief package is too big or whether it’s optimally structured. My view is that with the appropriate policies, we could add lots of jobs.

Back in 2019, the U.S. economy added 167,000 jobs per month. Then, in January 2020, we added 315,000, and in February 2020 we added 289,000. And then the pandemic hit.

My basic view is that the economy at that time was doing fine — that 2019 was a good year for American workers who were getting some much-needed raises, but that the pre-pandemic economy also clearly wasn’t “out of” workers, and jobs were growing at a decent clip. If not interrupted by the pandemic, I think the economy was poised to start sucking new people into the labor force along a number of dimensions, with young people eschewing low-quality, for-profit colleges in favor of full-time work, with re-entering prisoners and recovering drug addicts finding themselves eligible for entry-level jobs that would’ve turned their noses up at them in 2017, and with a lot of the restaurant industry struggling with its experienced workers getting more lucrative job offers in better-paying industries.

But if you look at the official documents published by the Congressional Budget Office and relied upon by a lot of policy organizations like the Committee for a Responsible Federal Budget, this is wrong.

They say that back in 2018 the economy was producing goods at services at above its long-term potential and was due for a slowdown. Then in 2019, we were also above potential all year. The rapid job growth in January and February of 2020 only pushed us even further above potential. And then the pandemic not only pushed us below potential but lowered the CBO’s estimate of what the potential is. So according to this view, a “full recovery” doesn’t mean recapturing the state of the economy in February 2020; it means something more like recapturing the state of the labor market in December 2017. This makes a big difference not only to how you think about the $1.9 trillion relief bill, but to a whole range of other policy debates, so it’s important to get it right.

Listen to financial markets

The whole concept of “potential” output is a little bit weird, but the basic idea is that if an economy is “below potential” then you can stimulate it to push it closer to potential. But if it’s already at or above potential, then efforts at further stimulus will only generate inflation.

A great thing about inflation is that instead of trusting the CBO bureaucracy to estimate when it’s going to come — or listening to economists with their dueling op-eds — we can actually look at financial markets. This is important because the genre of famous economists arguing about politics features a lot of the dysfunctional dynamics I deplored in “How To Be Less Full of Shit”: vague predictions, motivated reasoning, and a lack of quantified probabilities. By contrast, while bond traders certainly aren’t perfect, they need to make very precise guesses about the future when deciding what to buy and sell. The hedge funds and investment banks who play in these markets have a lot of resources at their disposal to pour into research. And they have a strong financial incentive to get things right, rather than engage in biased thinking about politics.

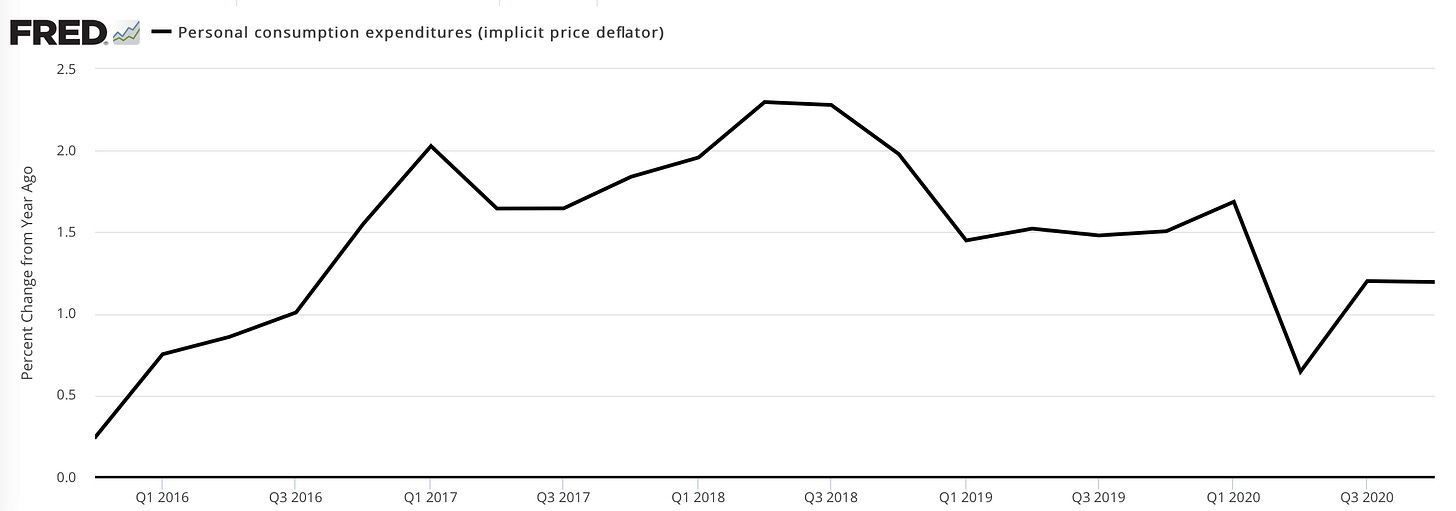

So because the government sells both regular bonds and inflation-protected bonds, if you look at the difference between the interest rate on a regular bond and the interest rate on an inflation-protected bond, you get a market estimate of how much inflation is expected in the future — i.e., the value of inflation protection.

Here’s what it looks like:

Now, one nuance — the inflation index used for these bonds is the Consumer Price Index. When the Fed targets a 2% inflation rate, they say they use the Personal Consumption Expenditure Deflator which for technical reasons1 runs about 0.5 percentage points lower than CPI. So the sort of numbers we had back in 2005, 2006, and 2007 were healthy, but inflation expectations consistently ran too low in the wake of the Great Recession. They crashed during the pandemic. And now are rebounding strongly — but still rebounding to a level that is below the Fed’s target.

That forecast presumably builds in some odds that the $1.9 trillion package will fail in Congress or be cut down to some smaller scale. But financial markets are forward-looking, and the participants aren’t idiots, so this forecast builds on the strong odds of a big stimulus bill passing. And it says inflation is likely to be if anything, a bit on the low side.

Obviously markets can get things wrong, and if you think this forecast is off, there is money to be made in bond-trading. But as a journalist, I have the humility to say that I think it is unlikely I can outsmart the financial markets here. And if you see elected officials or famous economists claiming that they can, I think you should be suspicious.

The CBO’s unwarranted pessimism

Now let’s go back to those CBO estimates of potential output, the ones being cited to indicate that $1.9 trillion is too much:

Forget the pandemic. Forget the stimulus debate. Forget the Biden administration.

Try to remember American politics and society as it was in the summer of 2019. Do you remember the economy overheating as it entered month 18 of above-potential output? The big debate over the Trump administration’s plan to curb inflation? Bernie and Liz and Pete and Amy arguing about what to do about the runaway inflation problem?

Of course you don’t remember that because none of that was happening. Before the pandemic hit, the United States enjoyed six straight quarters of below-target inflation. And out of the 20 pre-pandemic quarters, we were below target in 17.

There is a lot of reluctance in economic journalism circles to say mean things about the CBO because they play a crucial role in keeping political debates tethered to something. Without CBO scores of legislation, members could just make up the most wild, irresponsible assertions about the impact of their policies. Of course, even with CBO scores of legislation, Republicans just run around asserting that regressive tax cuts will pay for themselves with growth so it’s not always clear what practical value that anchor has.

But the fact is that the CBO is clearly wrong about this. And media is living a strange double-life on this subject. People who never in a million years would’ve written “inflation is raging out of control” in September of 2019 will nonetheless cite future CBO forecasts of the output gap with a straight face, even though the CBO can’t even accurately forecast the 2019 economy with the full benefit of hindsight.

What’s more, as I wrote in “Low Interest Rates Are a Curse,” this is not just a one-off. Throughout the 21st century, the CBO always mis-forecasts interest rates, always in the same direction, and never changes its methodology to correct it.

I don’t know exactly what is going wrong here since the CBO puts a lot of hard work into modeling lots of complicated issues and generally does a pretty good job.

But their macroeconomic forecasting is bad. Not just bad in the sense that forecasting the future is difficult and you’re bound to make mistakes — it suffers from a systematic problem that they refuse to correct. It’s weird. It’s bad. But you shouldn’t listen to them. And small differences in the output gap estimate make a big difference here.

Redoing the math with better numbers

Because the American economy is a $20 trillion behemoth, small errors generate giant changes in numbers.

So CRFB says we face an output gap of about $600 billion over the next two years, next to which Biden’s stimulus looks huge. The Lawrence Summers op-ed that kicked off this conversation characterizes it as a $50 billion per month output gap, relative to which Biden is proposing $150 billion per month in stimulus.

But that’s based on the view that the economy was overheating in 2019. As Ernie Tedeschi — a labor market economist formerly with the Treasury Department — points out, if we instead simply assume that the economy was at potential in 2019, then the numbers add up. [Note: I don’t want to make a substantive change to this text because the email version can’t be corrected but I don’t think the math in these Tedeschi tweets is right — stand by for a new article that will, among other things, go through the correct numbers]

Tedeschi is being polite here, though. While there is absolutely uncertainty about the economy, there is simply no rational basis for using “the economy was 1% above potential in 2019” as the baseline for our thinking. It’s not just that there was no inflation danger in 2019 — inflation was comfortably below target and the Fed was cutting interest rates!

This matters for more than the debate about the COVID-19 relief bill, because it does seem likely to me that we’ll see some spots of inflation soon, and I’m worried that people will freak out.

The coming transitory inflation

It’s hard to know what’s going to happen over the next 3-9 months with vaccinations, variants, seasonal effects, and everything else happening in the epidemiological world.

But say you assume optimism on public health; what happens then?

It seems likely that after a year or more of restrictions and fear, there will be an unusually large surge of demand for bars and restaurants and travel. But we know a lot of bars and restaurants closed during the pandemic. So you’ll have a ton of customers pouring into a limited supply of dining establishments — a recipe for higher prices.

Similarly, it takes airlines time to get planes out of storage, to get pilots recertified to fly, and even just to run the numbers and decide which routes to run. If tons of people decide they want to go on vacation and that collides with a chaotic situation on the airline front, that’s a recipe for higher prices.

We don’t know exactly what the long-term future of remote work is, but we do know that at least some of the people currently working from home will go back to commuting. And some of the people who are currently unemployed will get service sector jobs as customer demand for bars and restaurants returns. That’s more cars on the road, more demand for gasoline, and a recipe for higher prices.

In a sane world, the Fed will look at this kind of price pressure and just be chill. Recovering from the pandemic will create a surge in commuting, but the long-term steady-state is going to be lower gasoline demand, both because of more remote work and also because of electric cars. Restaurants will charge higher prices to meet the glut of customers, but the huge wave of closures we’ve seen over the past 12 months was about the pandemic. The buildings still exist, the cooks still know how to cook, and new establishments will open. If airlines are making money hand-over-fist, they’ll invest in getting their capacity back in line as quickly as possible.

That’s the general dynamic we want to see. As long as unemployment is high — and make no mistake, according to Jason Furman’s calculations it’s still a lot higher than the official measure — we should be allowing select price increases in order to push through the recovery period and get things reopened.

This is by far the biggest economic thing I worry about. Not that the fiscal package will be too small, but also not that the fiscal package will be too big. I worry that at some time later this year there really will be inflation, driven mostly by energy prices but with real stuff happening in foodservice and travel, too. People will say “ah well we hit our potential” and the Fed will raise interest rates with unemployment stalling out higher than it needs to.

Recall that back in 2015 and 2016, the Obama administration and the Fed decided we were already at full employment. We’ve heard a lot about Biden trying to avoid what he sees as the miscalculations the Obama-Biden team made in 2009. But I’m genuinely not sure how much better Obama really could have done, even with full hindsight. By contrast, the subtler errors of 2015-16 were clearly avoidable and I worry that we’ll repeat them.

Imagining full employment

My personal view is that we were below potential in 2019 and that the acceleration of job growth in early 2020 is strong evidence for that. More broadly, I think it’s been so long since we enjoyed true full employment in the late 1990s that people forget how to even think about it.

But here’s an analogy.

In D.C., I live right near a commercial strip on 14th Street that runs from Thomas Circle in the south to U Street in the north. About 10 years ago, this strip became a really hot upscale dining area — but then in the summer of 2019, there were a bunch of trend pieces about restaurant closures.

The neighborhood, which was gutted by the 1968 riots, has experienced a flurry of development over the past two decades, turning it into a nightlife hotspot replete with accolade-winning restaurants. According to Washingtonian, the average rent per square foot has just about doubled from $40 a decade ago to $75-$90 now. And that jump in cost, along with an increase in competition, has had consequences for many of the businesses lining the strip.

This is a common form of urban neighborhood evolution. Restaurants weren’t closing for lack of customers, they were closing because a formerly hip gentrifying area was becoming too expensive. Edgy, innovative restaurants were closing and instead we were getting “an influx of chains (Shake Shack, Barcelona, Jeni’s Splendid Ice Creams) and companies that are used to paying premiums in New York City, like the Meatball Shop or the Vin Sur Vingt wine bar replacing Drafting Table.”

I think of that dynamic as “full employment for commercial real estate.” It’s not just that 14th Street was no longer full of vacant storefronts and empty lots. The real estate market was so hot and prices were rising so fast that perfectly decent businesses were being plowed under and replaced by chains. And while chains are less cool than independently owned restaurants, they are better-managed and have higher productivity so they can afford the higher rent. More interesting, more innovative restaurants need to branch out into new, more marginal neighborhoods — Petworth and Park View, Ivy City, H Street NE, wherever.

America’s policy goal should be to create that situation, except for the labor market.

We should get some of the stories where employers say “oh no there’s a shortage of trained workers and I have all these vacant jobs.” Then some other employer should say “fuck it, I’m going to address the shortage of trained workers by raising pay across the board.” Then the first employer should watch all of his staff quit because they got jobs working for the other guy. The “restaurants are closing because of higher rents” narrative is a feel-bad story, because nobody gets excited about landlord profits. But when you push the labor market to the point where small businesses are closing because of higher wages, you have a really exciting story about empowered workers and rising living standards.

And when hip restaurants expand into new, more marginal neighborhoods, we might worry about gentrification and displacement. But when low-wage employers can’t afford their old workers anymore and need to reach out to more marginal candidates — people with spotty work history, people with serious disabilities, people with criminal records, people with drug problems — that’s a triumph for American society. And I actually have more faith than most experts seem to in the ability of a robust labor market to actually solve problems.

The flywheel of growth

Everything up to this point I think is well-grounded in the evidence, and I have a very high level of confidence in it. I think you should wield the basic facts and arguments above against your intellectual enemies and batter them into submission.

What comes here forward I think is probably right, but I will admit is much more speculative. But I believe that one of the major causes of slow productivity growth is a failure to achieve full employment. And I think there are four main causes of that:

Institutional conservatism: Managers don’t like to make dramatic changes, even when the expected value is high, if they can possibly get away with it.

On the job training: Training under-qualified workers is difficult. Conditions of full employment reward companies that figure out how to do it well, but that ability atrophies when you have 20 years of labor abundance.

Policy feedback: A lot of productivity-enhancing policy change creates visible job losses. Politicians will not tackle that kind of rent-seeking if involuntary unemployment seems like a major social problem.

Incentives to innovate: Smart people with technical skills work on useful productivity-enhancing problems if there’s real demand for solutions, but otherwise they design high-frequency trading algorithms.

An example of the first:

I was talking pre-pandemic to an executive at a fast-casual chain — the kind of place that serves the lunch market in the office districts of several east coast cities — and he explained that they like it better when customers order their bowl in advance online or on their phone and then just come to the restaurant to pick up. Reducing human interaction means that customer indecision or error doesn’t slow the entire line down and increases throughput. So I asked him why they don’t completely eliminate in-person ordering and make everyone use their phone. He said that makes sense in theory, but it would make customers mad, so they’re just trying to nudge people to the app with loyalty points.

That’s all fair enough. But I think it goes to show that if wage pressures build, some fast-casual restaurants will have no choice but to respond with higher prices while others will be able to achieve productivity gains by going app-only. And by the same token, America’s vast sea of chain sit-down restaurants can be replaced by more labor-efficient fast-casual dining. Less Olive Garden, more Noodles & Company. Save the full-service experience for restaurants that are aiming to be really good.

Training is the flip side of this. At the slightest sign of a healthy labor market, business owners start complaining that they can’t hire enough workers with the skills they need. But that’s how a healthy labor market should work. One way companies ought to compete is by being better at training workers as an alternative to paying very high salaries to recruit ones who are already trained. This is hard to do well! If you let the economy run with high unemployment for 20 years, the skill-set will atrophy because it’s not rewarded by top executives. But we can fix it.

On policy: Some changes are what economists call Pareto Optimal and they genuinely make everyone better off. But that’s rare. Often you get something like the rise of desktop publishing software in the 1980s, which was good for the world but bad for my mother, a highly-skilled analog graphic designer. Graphic designers were not able to block disruptive change with rent-seeking regulation, but many other small business owners or little professional guilds are more successful. Busting up these arrangements raises growth, but “destroys jobs” and is much easier to pull off in a political economy of labor scarcity rather than high unemployment.

Innovation! Back five to 10 years ago, I was worried that a lot of hardworking and intelligent people with technical skills seemed to be deploying their skills on creating structured credit products. There was a brief window of optimism when a lot of that talent shifted to the technology industry, but then it turns out a huge share of tech talent is working on selling more targeted ads. It would be better to have all these smart people working on developing labor-saving, productivity-increasing technologies rather than ways to get people to spend more time on Instagram. Labor scarcity raises demand for labor-saving innovation.

Stimulate!

Admittedly that last section is all speculative. But if I can convince the world of anything it’s that we should be way less deferential to CBO estimates of the output gap.

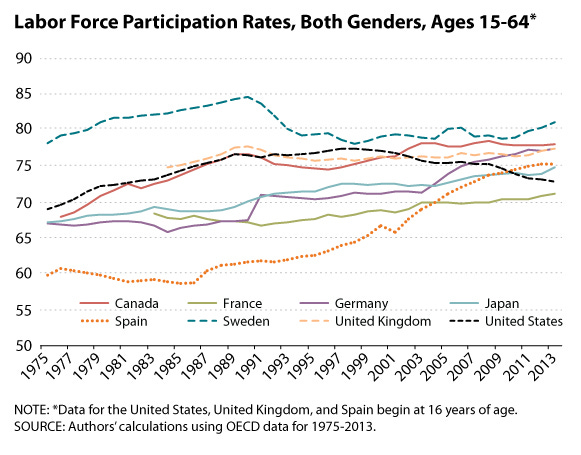

If you look back at the share of prime-age adults in the United States who have a job, we peaked back in 1999, and never got back to that level during either the Bush or Trump labor market peaks. It’s become conventional in U.S. policy circles to assert that it’s simply not possible to get back to that peak. But if Canada and Germany can do it, then why can’t we? And note that while the France line is below ours, that’s because of early retirements. If you look at 25-54 then France soars above us!

In a really tight labor market, we’d see participation soar. There’d be fewer young people enrolled in shady fly-by-night, for-profit colleges or obtaining quasi-useless master’s degrees because it would be relatively easy for a diligent person to get promotions and wages. Disability insurance claims would fall as employers work harder to accommodate people’s needs. You might see more summer jobs for teens. Or companies making active efforts to do recruiting in America’s most troubled neighborhoods.

People from a free-market perspective tend to be the most skeptical of massive fiscal stimulus packages. But in my view, it’s an excessive fear of overheating that’s prevented markets from contributing to the solution to our biggest problems.

David Wessel has a good explanation of the details here.

This is quite possibly the worst-researched Slow Boring post I've ever read. While I appreciate the general argument that government officials should work harder to achieve full employment and be less scared about inflation, your understanding of macroeconomics is clearly faulty and your criticisms miss the mark. Three quick points:

1) Fundamentally, I you seem to misunderstand the underlying concept of "potential output". Your post implies that when the economy exceeds potential, we should be seeing runaway inflation and exceedingly tight labor markets. In some sense, this is right. But exceeding potential is not a switch that is turned to "On" or "Off". Instead, it's like a dimmer switch. If we exceed potential output by a little bit, inflation will accelerate a little bit. If we exceed potential output by a lot of bits, then we're likely to get runaway inflation. Now, we can argue what constitutes a little bit vs. a lot of bits, but my view is that a 1% gap between GDP and potential is not a lot. Consistent with that view, inflation was a little higher in 2018-2019 than it was in preceding years but not radically higher.

Put another way, you should not think of potential output as a limit that cannot be exceeded for fear of runaway inflation. Rather, you should think of it as the maximum output an economy can produce without generating ~inflationary pressure~.

2) Your post implies that you have no idea how CBO constructs its estimate of potential output. This is a weird take, given that their methodology is publicly viewable in a document written by Shackleton (2018). Basically, CBO uses a supply-side model in which they estimate potential labor hours, potential capital services, and potential labor/capital productivity. Those factors are estimated by looking at historical trends in each series. It's fair to quibble over specific modeling assumptions, but I'm not sure you've actually read through their methodology. Here's a link: https://www.cbo.gov/publication/53558

3) Before you accuse CBO's forecasting of being "bad", I'd encourage you to read CBO's Economic Forecasting Record (2019). The report examines two-year and five-year forecasts made between 1980 and 2017. It compares forecasts made by CBO, OMB, and the Blue Chip consensus of private sector forecasters. The report finds that CBO's forecasts are generally more accurate than OMB's forecasts and roughly comparable to the private sector forecasters. This finding extends to the agency's interest rate forecasts, which seem no better and no worse than those produced by other organizations. Essentially, forecasting interest rates is highly challenging, and this is especially true in our anomalous interest rate environment. Instead of dunking on the CBO, you should understand the inherent difficulty of their task. Here's a link to the forecast accuracy report: https://www.cbo.gov/publication/55505

I'll conclude with my own thoughts on this issue. I think Larry Summers and the CRFB are being overly cautious with regards to the need for more fiscal stimulus. I'm much more closely aligned with Janet Yellen, who argues that the risks of a too-small stimulus far outweigh the risks of a too-big stimulus. But your decision to criticize a nonpartisan bureaucracy for making average to above-average forecasts is an odd way to channel your frustration. Instead, you should direct your ire toward the people who are ~actually~ calling for less stimulus instead of scapegoating the CBO.

This falls apart for me in a couple of ways.

1) I agree with you that we should run the economy a bit hotter to try and attain greater full employment, but policy to achieve this should not come at the expense of government fiscal situation.

2) More to the point, having just recently lived through the great recession, why would you be willing to trust the market's perception of risk so completely? I would completely back allowing the fed to run hot for a couple of years, but would want the US budget to be improving in the process (lowering debt/GDP). Running them both to the max seems like setting ourselves up to run off a cliff with no safety net. Your argument here sound very much like the motivated reasoning that republican's give when they talk about their tax cuts paying for themselves. They have the solution they want regardless of whether it matches the problem.

3) In a very specific instance, I want a government that is trying to find good solutions to problems it can solve. I don't want a government where the parties are competing over who hands out more cash. That is ripe for horrific results and terrible government. $1,400 checks to people who aren't unemployed and especially to people who make over the national median income is appallingly bad policy.

4) More broadly, many progressives hold up the example of the Nordic countries as the social democracy they are aiming for and rebut suggestions that they are Venezuela or Argentina. One of biggest differences between the two is that the Nordic countries are willing to pay for the benefits. The the SA countries experience severe economic pain from wild spending that wreck their budgets but they are unable to stop spending because they have to buy votes.