Low interest rates are a curse — we need massive fiscal imprudence

Only madness can bring back sanity

So far in its lifespan, Slow Boring has featured a decent amount of culture war provocation. But my true policy love is nerdy economics stuff. One big benefit of independence is not having to participate in the tech platform virality rat race.

And I’ve come to think that there’s a nerdy economics explanation for why our politics has come to be so dominated by culture war provocations: the interest rate on government debt is too low.

First, though, I want to tease something that’s coming a bit later today — an essay by veteran Democratic operative Aaron Strauss on an idea called “relational persuasion” that he thinks, in tandem with an appropriate message, can help campaigns win. It’s a cool piece based on serious thinking by a smart guy who sincerely wants to win not just harvest RTs by telling people what they want to hear. I think you’ll enjoy it and I hope to get the chance to publish more guest commentaries from time to time.

But back to interest rates and the culture war!

Cheap money and reactionary populism

What’s the connection? If you pay attention to politics, you’ll have heard a lot about the national debt and the federal budget deficit over the years. What you haven’t heard for a long time is that the interest rate on that debt is an actual present-day problem. Because it isn’t!

Contrast that with both the mid-1980s and the early-1990s when federal interest payments as a share of national output were high and rising.

Under those circumstances, there is an urgent practical benefit to debt reduction, because it frees up actual budget capacity to do things you want to do.

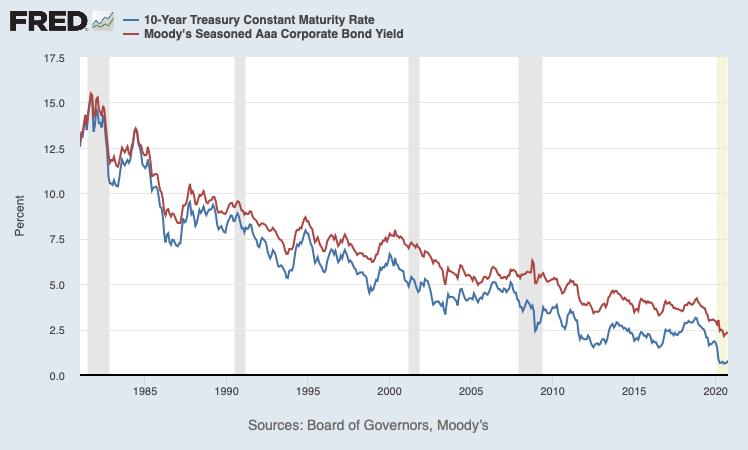

The reason debt service costs got so high back in the day is that the interest rate the federal government had to pay to get people to buy bonds was really high by contemporary standards. All else being equal, investors would rather lend US dollars to the US government than to anyone else who might want to borrow US dollars. So when the federal government’s borrowing costs go up, everyone else’s costs go up along with them. As you can see below, when government bond interest rates were higher, so were corporate bond rates.

Because everything moves in tandem, these high interest rates were a practical problem in people’s lives. Corporations that had big investment plans found it hard to raise money. The high bond yields depressed stock prices. Small businesses, which are riskier, found it hard to get loans. Mortgages became more expensive. And even if you didn’t want a mortgage, the fact that other people had to pay more for theirs depressed the value of your house.

Today’s deficit debates aren’t like that. Nothing concrete is at stake. Trump cut taxes, increased military spending, increased domestic spending, failed to repeal the Affordable Care Act, and watched as Social Security and Medicare spending continued their relentless upward march and it was… totally fine. The deficit exists as a purely abstract political football. Members of Congress who want to object to something can cite the deficit as the reason for their objection. The public might agree with them or they might not, but either way, nothing bad is actually going to happen. And it’s left our politics a bit unglued.

Budgeting when nothing matters

The essence of politics in an era of stubbornly low interest rates is that there’s no tension between cutting taxes for rich people and business owners and doing anything else that you might like to do.

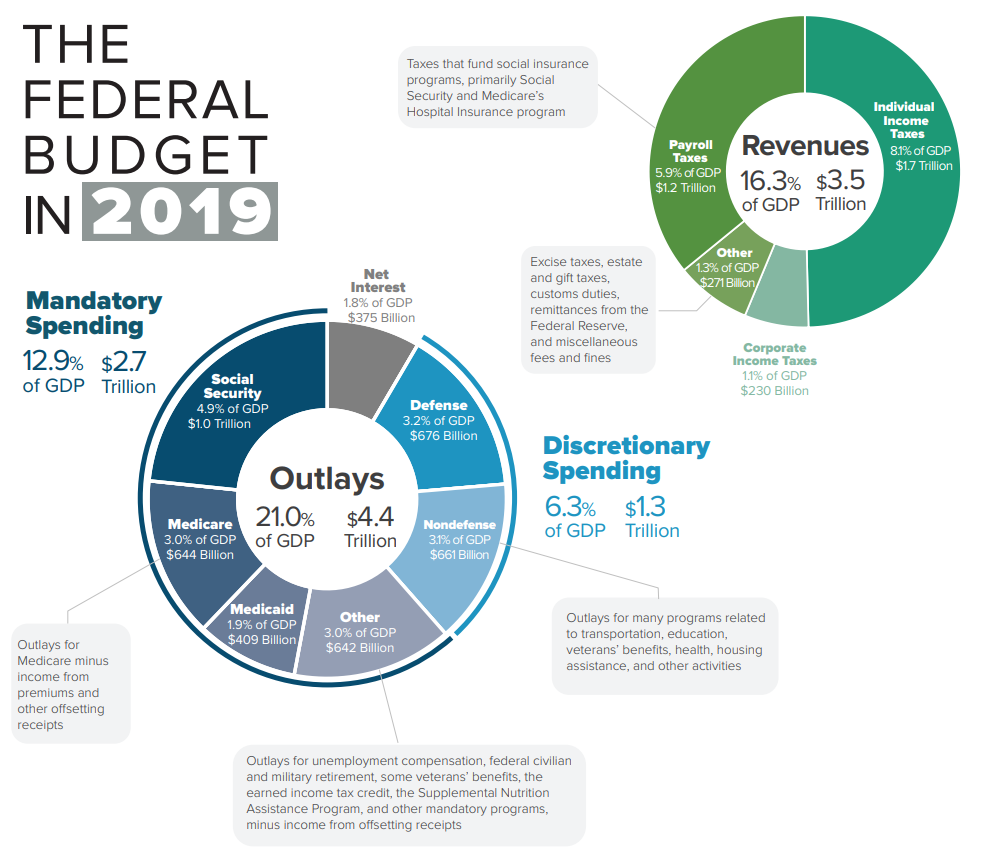

And that’s important because it happens to be the case that even though “spend more money” is an idea associated with the left, a huge share of the budget actually goes to things the populist right approves of. Social Security, Medicare, and national defense together comprise a majority of the federal budget.

Now add to that interest (which you can’t cut) and there’s just not much money left.

To enact the Trump tax cuts while keeping his commitments to seniors, veterans, troops, cops, and farmers in a world of high interest rates would have required absolutely savage cuts to things like education, Medicaid, and transportation infrastructure. There’s just no way you could make it work. In fact, we learned in both 2005 when George W. Bush tried to cut Social Security and again in 2017 when Trump tried to repeal the Affordable Care Act that Republicans’ political standing evaporates instantly when they try to cut these popular entitlement programs. .

A political alliance between business owners and cultural traditionalists only works if you manage to avoid any kind of fiscal tradeoff. In a world of tradeoffs, an anti-tax party is bound to lose the support of some older, rural, or working class people who either need those government programs or else affiliate symbolically with the military and veterans. Alternatively, a culturally conservative party needs to become less in-thrall to business interests in order to raise the revenue that right-populist cultural priorities require.

In my view, a lot of people on the left misunderstand the Obama administration’s interest in ensnaring Republicans in bipartisan deficit reduction talks. There were both policy flaws and political flaws with that strategy, but part of what made it appealing is that if you can force the Republican Party into a situation where a real budget constraint applies, then you force them into a lose-lose situation. Democrats, by contrast, have a popular and workable answer to budget constraints: tax the rich. That only goes so far if you’re talking about adding trillions to the budget, but it’s perfectly sufficient for the type of policies that Obama/Biden Democrats espouse.

In theory, low-interest rates could be a huge opportunity for some kind of gigantic leftist debt-financed Green New Deal. But in practice what's been happening is they give the populist-right an edge over a Democratic Party that is led by the center-left, rendering the leftist vision influential in the takes game but irrelevant in Congress.

So why have interest rates been falling?

One explanation is on the supply side. In the 21st century we’ve seen the emergence of what Ben Bernanke called a “global savings glut,” which means a pile of excess money exists. Where does the glut come from?

Rich people save more than non-rich people, so rising inequality in the US and Europe has led to a bigger pool of capital.

After the Asian Financial Crisis in the 1990s, a bunch of developing countries’ takeaway was that they should assemble large foreign currency reserves to ward off crisis rather than counting on the IMF.

There was a decades-long commodity boom associated with Chinese economic growth, and oil exporters like Norway and the Gulf states socked a lot of their profits away in sovereign wealth funds.

So you have more financial capital sloshing around — where’s it going to go? There are lots of ways to transmute financial capital into physical capital, but the biggest one by far is the construction of large buildings full of business equipment.

Yet during this time, we also saw the rise of the software startup as the quintessential business category. It costs money to start up a company like Google or Facebook. But you’re talking “pay some salaries, rent some office space” money. Something like Tesla where you’re building actual factories is much more capital-intensive. But Tesla has been the exception. Much more common is an idea like Uber where you run a car service without owning any cars, or AirBNB where you run a hotel company without owning any hotels (these days, even actual hotel companies increasingly just license a brand rather than owning assets).

There’s also always “boring capital” like houses and random strip malls and doctors’ offices near the houses. The issue here is that population growth has been slowing, often very sharply, almost everywhere in the developed world. Because children live with their parents for ~20 years after being born, there is a very predictable relationships between the number of kids that were born 10 years ago and the housing demand 10 years in the future. So when babies are born, houses get built to eventually house them. And when houses are built, some other buildings get built nearby to flesh out the neighborhood. So when there's slow population growth, there is much less demand for the most basic form of capital goods.

Population is the dominant factor

After leaving Obama’s administration, Larry Summers spent a lot of time talking about low interest rates during Obama’s second term . He called it “secular stagnation” rather than “low interest rates,” which I think was confusing. He also underplayed the population angle somewhat, which I find odd since he got the term from an economist named Alvin Hansen who, writing in the 1930s and 1940s, thought the post-WII world would see low interest rates thanks to slow population growth.

Hansen was obviously mistaken. But to me the best explanation of why is simple — he got the economics right, but didn’t predict the Baby Boom.

At any rate, Summers is the constant object of factional infighting in the Democratic Party, but he was basically right about secular stagnation, and I think that we should go back to Hansen and see population as the dominant factor. I was talking about this with David Beckworth, an economist who specializes in monetary policy issues, and he put together an empirical analysis which shows that the data is consistent with the Hansen Thesis — interest rates are low where population growth is slow.

Normally I think you should be suspicious of people who walk around peddling their pet theory of the world, like me with this population growth and interest rates stuff.

But the evidence is overwhelming that there’s something wrong with the conventional view of interest rates. Here, courtesy of the Roosevelt Institute’s Mike Konczal, is a chart comparing the Congressional Budget Office’s forecasts of what interest rates will be (in black) with where they actually go (in red). You can see that for the past 25 years, the CBO forecast is always off and always because they guess too high:

The CBO guys are not dummies, and predicting the future is hard. But if your predictions are always off (and always off in the wrong direction), then there is something wrong with your underlying model. The CBO is thinking too much about the federal budget (that's their job, after all) and not enough about the underlying drivers of interest rates — mostly population growth.

The failure of prudence

Now one view of this, the old Obama administration view I think, is that even if interest rates aren’t a current problem, they could become a problem in the future. And it’s better to head the problem off with timely action now than face a chaotic and dangerous situation later on. But I think something we’ve seen over the past 10 years is that this doesn’t work in political economy terms.

Obama fought to increase tax revenue, and he succeeded. The price he ended up paying was needing to accept spending cuts throughout much of his term in office. The combination left the economy under-stimulated, so that while we had consistent job growth in his second term, we never got to real full employment, and we never achieved rapid wage growth. And rather than prudently staving off fiscal crisis in the future, Obama-era prudence simply set the stage for imprudence under Trump, who cut taxes sharply while increasing both domestic and military spending.

Obama might as well have let Republicans have their way on extending the Bush tax cuts in exchange for letting him do more stimulus. The country’s fiscal position would’ve ended up in the same place anyway, but he could have delivered faster economic growth, delivering a popularity for the Democrats that could have beaten Trump. More people are thinking along these lines as we await a Biden administration. Jonathan Chait argues, for example, that Biden should be willing to swap tax cuts for implementing his own spending ideas. Lots of people I speak to in Democratic wonk-dom are sort of broadly on board for exploring this possibility. But they are generally still thinking with a prudence mindset: what’s the least-bad tax giveaway I can make in exchange for the most awesome spending?

My view is that all of this is wrong, and sensible people should think of the low interest rates as positively harmful. They simultaneously empower dangerous right populism and far-left utopianism, while eroding any incentive for people to think seriously about cost-benefit or spending prioritization. If the low rates dynamic does end, it will be somewhat awkward to adjust our politics.

But it will be an adjustment to a healthier political economy paradigm:

One where if you want to be the party of rural America, you either need to wean rural America off its extensive federal subsidies or else you need to fight for higher taxes or less spending on retirees and the military.

One where if you want to propose a big new government program, you need to argue that it’s actually a better idea than one of the dozens of other possible uses of funds or explain how you’ll raise the new funds.

One where making an idea more efficient actually lets you help more people or makes the idea easier to pass.

To me, though, the critical thing is that to get to that more sensible world you need to actually get out of the low interest rate paradigm first. And that means abandoning any thought of prudence. But ideally doing so in a thoughtful way.

How to get interest rates up

As you may know, I recently published a book called One Billion Americans, so I’ve thought a lot about population growth. And my argument is that when you think of interest rates, you should consider budget deficits, but primarily, you should think about population growth and the demand for physical capital. You can raise rates in all of these ways:

Expanding legal immigration.

Deregulating land use, to make it legal to build more and larger buildings on expensive parcels of land.

Tax cuts that encourage investment in physical capital.

And so are spending on programs that target funds to people who are either likely to spend the money on having kids or buying more housing (or both). Spending on programs that make people more likely to have kids or buy houses.

It seems fairly unlikely that major immigration legislation is going to happen, but expanding legal immigration would definitely be a good idea.

In practice, the biggest real possibility given the present configuration of political forces is a mix of targeted tax cuts and spending programs. The tax bill Trump signed a few years ago contained a provision that lets corporations immediately deduct the full cost of capital investment from their tax bill. But it was structured as a temporary provision that’s going to phase out soon. Democrats could agree to make that permanent in exchange for Republicans agreeing to create a child allowance program or a much more generous Child Tax Credit.

The bigger CTC would be highly effective short-term fiscal stimulus, and would raise interest rates by encouraging population growth. And while I don’t really think the corporate tax deduction thing would do much to stimulate the economy, Republicans believe it’s a good idea, which is what counts in Congressional math. And while I think their argument is probably wrong, it’s not totally out of the question that it’s correct either. The only reason not to do a deal like that is it would substantially increase the deficit, which it’s conventional to say would be bad for the country in the long-term when interest rates go up. But once you see that it’s not clear deficits really are driving interest rates and low interest rates are driving our politics crazy anyway, you can learn to love the idea of going for this deal.

“My view is that all of this is wrong, and sensible people should think of the low interest rates as positively harmful.”

This is _potentially_ true in the political economy sense you describe above, but I think this is very dismissive of the enormous benefit low interest rates provide to borrowers — typically people without means and small businesses — at the relative expense of the wealthy. They also provide strong incentives for holders of capital to fund innovation with substantial social spillovers for income rather than rely on stable low-risk yields to support their lifestyles like in earlier decades. The set of trade offs is quite complex.

I feel like there was a lot of discourse about Matt leaving Vox to writ hotter takes about PC culture, but I am not sensing the real reason is the editors there were limiting the number of articles he wrote with Federal Reserve data. If true this is an excellent turn of events. This was a really interesting article, I had always been thinking of low interest rates as a missed opportunity to invest in useful things, but had not thought about the consequences in the political economy.