The case for a tax swap

Progressive states should try to make their tax systems a little more progressive

This piece is written by Milan the Intern, not the usual Matt-post.

Back in July, I saw that Intuit was pulling out of IRS Free File — a program where tax prep companies offer free versions of their software to Americans earning below a certain amount in exchange for the IRS not building their own system — effectively killing it. I used Free File to do my taxes in 2020, so I was irritated because I either won’t be able to file for free in April or will have to do it manually.1

But then I did some Googling and got more annoyed that I, a teenager working his (very cool!) first real job, pay the same 5% of my salary to Beacon Hill as a partner at Bain Capital because Massachusetts has a flat income tax. That struck me as kind of unfair, and since I’ve been on the state issues beat here at Slow Boring, I decided to do some digging to see if this kind of tax regime is common in other states, and if so, what can be done to make things a bit fairer.

Oh, the taxes you'll levy!

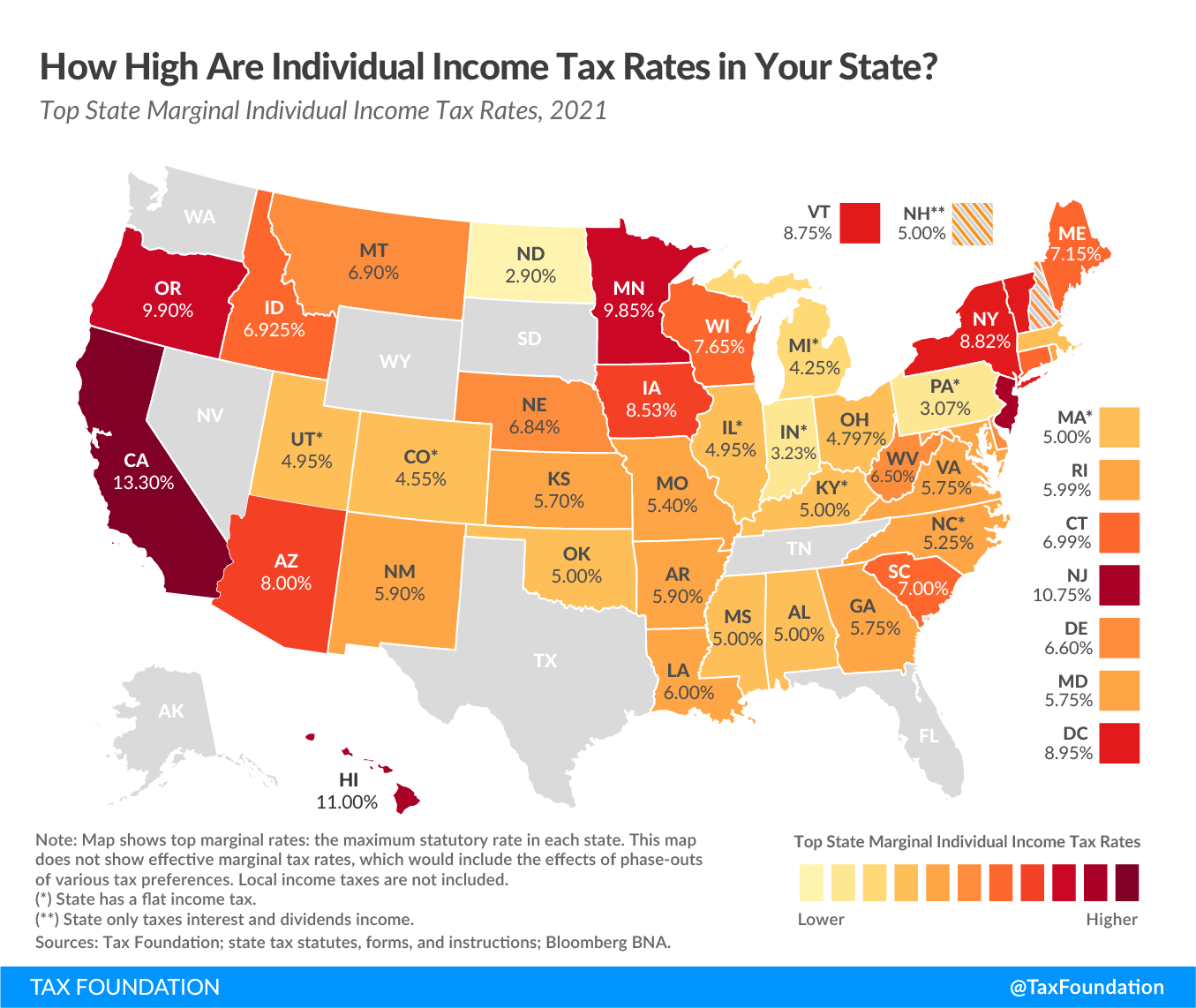

Top marginal state income tax rates are on the low side, and several states don’t charge income tax at all. Some states charge corporate taxes, also at a lower rate than the federal one.

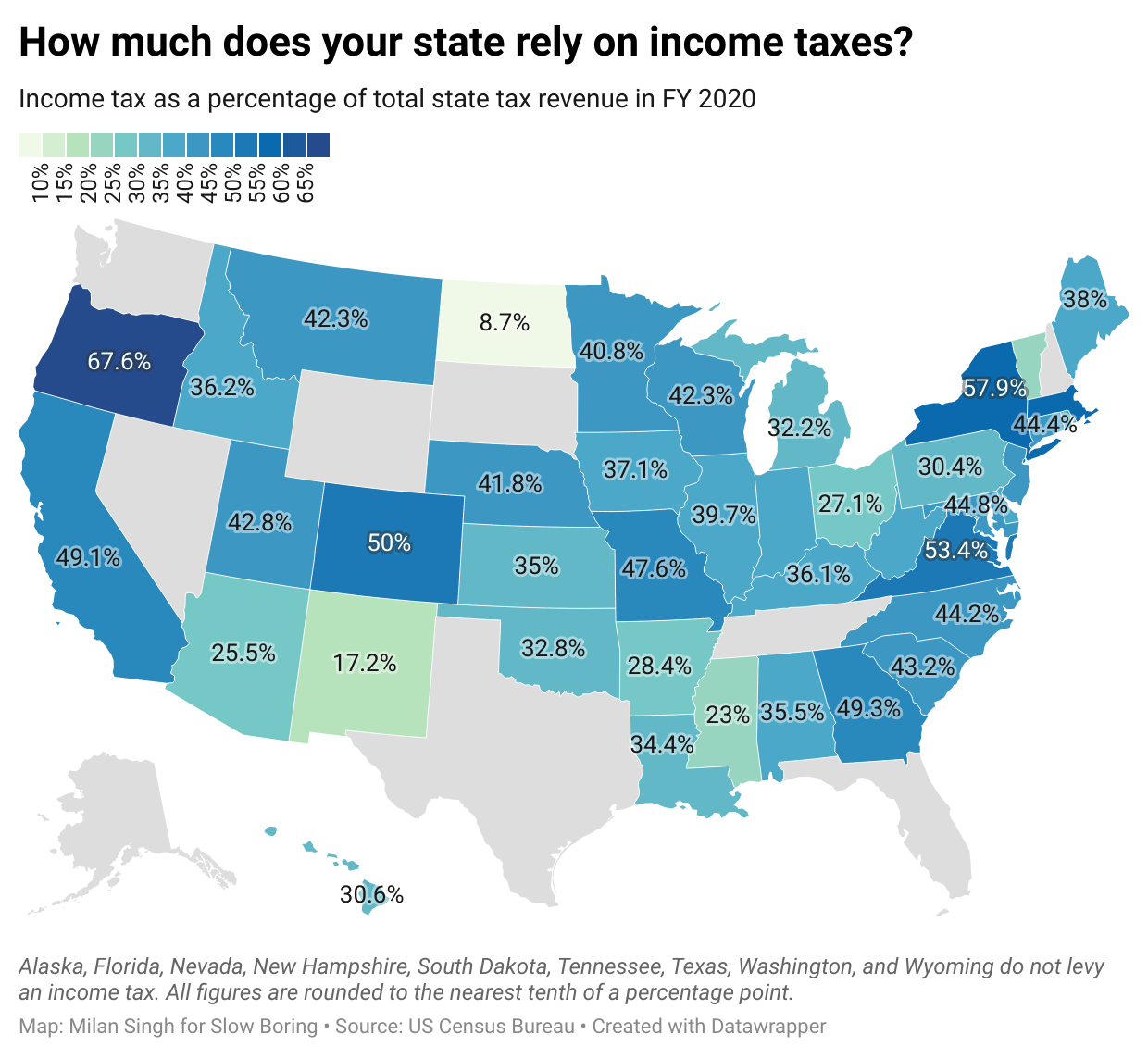

Another way to look at this is to ask what share of a state’s revenue comes from income taxes. California has the highest top rate, but New York, Virginia, and even Georgia are more dependent on income tax as a share of their tax base.

The other revenue workhorse is sales tax, which is levied in almost every state.

In some states, sales taxes drive a huge share of revenue.

States with low income taxes tend to have higher sales taxes. These are generally conservative states, but not always — look at blue Washington and New Mexico or purple Arizona and Nevada.

Low-tax red states brand themselves as pro-business and argue that low income (and corporate) taxes will drive business investment and job creation. In 2012, Kansas Republicans drastically cut the state’s income tax, arguing that it would increase growth and therefore make up for the shortfall. This didn’t really work out — revenues collapsed, school budgets were cut, and the tax cuts were eventually repealed.

New Hampshire is low-tax but not necessarily in a pro-business way. Instead, it has a “Business Profits Tax” and a “Business Enterprise Tax” that function as a kind of value-added tax or VAT. Meanwhile, a lot of blue states have progressive income tax systems and argue that their higher taxes allow them to furnish better public services. This relates to the fight over whether or not to expand the SALT deduction, which mostly helps wealthy residents of largely Democratic high-tax states.

An early Slow Boring column asked whether the higher cost of living in blue states is balanced by better public services, and a recent article in American Affairs by Aaron Renn contended that red-state Indiana’s pro-business tax regime hasn’t delivered the promised results. Renn argues that Sun Belt states are growing thanks to warm weather and misattributing it to low taxes. An Yglesian’s point would be that though California is slow-growing, it’s certainly not cheap, and migration from California to places like Texas is driven by housing policy rather than taxes.

State tax systems are regressive

The Institute on Taxation and Economic Policy does regular reports on the distributional impact of different states’ tax systems. The most recent edition came out in 2018, and one of the big themes of the report is that even many low tax states tax the poor fairly heavily.

Because wealthier households save and invest a much larger share of their income (recall that buying a house to live in is considered an investment rather than consumption), a flat tax rate on consumption tends to soak up a much higher share of poor households’ incomes.

The ITEP report focuses almost exclusively on whether taxes are progressive or not, and that’s all well and good but shouldn’t necessarily be the only consideration.

For starters, there are taxes where the goal is to reduce socially undesirable activity by making it more expensive — for example, cigarette and alcohol taxes. People debate the progressivity of these (broadly speaking, the poor don’t drink much but do smoke more), but at best these are taxes that fall harder on the middle class than the rich. And something like the gas tax is clearly regressive.

That said, as some of the more conservative states are already relying on regressive sales taxes, there’s an inherently strong case for reducing those and making up the revenue with welfare-improving taxes on pollution, traffic congestion, and health hazards.

Meanwhile, more liberal politicians should consider trying to raise taxes on the rich — not in order to finance new spending but to reduce the sales tax burden on the poor and the middle class.

A revenue-neutral tax swap

In May, the Massachusetts legislature voted to put a constitutional amendment on the ballot that would impose a 4% surtax on incomes over $1 million per year and use the revenue to fund education and the MBTA. And then in June, Charlie Baker pitched a two-month sales tax holiday in light of an unexpected budget surplus, which the Democratic leadership on Beacon Hill shot down. A better idea would have been to try to cut a deal pairing the sales tax holiday with the millionaires’ tax — achieving Baker’s popular idea of lower taxes for all while avoiding Democrats’ concern about putting a long-term hole in the budget.

Now if you look at the maps from the Tax Foundation, you’ll notice that states like Arizona, Nevada, New Mexico, Colorado, and Washington — the first two being swing states, the latter being more solidly blue — all rely pretty heavily on sales tax and either have fairly low income tax rates (flat in Colorado’s case) or none at all. I think they should try the opposite of what David Perdue is proposing in Georgia.

What I mean is they should increase income tax rates for top earners — moving to a progressive income tax system if one is not already in place in a given state — to get more revenue from the rich. Wealthy folks would no doubt complain that this would lead to jobs leaving the state and government wasting money, but I would balance the income tax hike with a sales tax cut, which would mostly benefit regular people.

For example, Massachusetts has $5 billion in excess tax revenues and more in federal Covid-19 relief money, which complicates the case for the millionaire’s tax given that we are not exactly lacking for cash. Back in 2010, there was a ballot question on cutting the state sales tax from 6.25% to 3% that lost, and it was estimated that it would’ve cost the state $2.5 billion annually. Now the state Department of Revenue thinks that the millionaire’s tax will bring in around $2 billion every year, so if you either do a slightly smaller sales tax cut or raise the top income tax by a bit more, you would get yourself a revenue-neutral tax swap.

Obviously, this won’t pay for any new programs, but you’d make the bill for existing ones a bit fairer by putting a little more money back in the pockets of working families and asking the rich to chip in a little bit more. And I think that’s something worth doing.

I would love for the IRS to just use the information they already have to fill out the forms for me, but the tax prep industry spends a lot of money on lobbyists to make sure that doesn’t happen, so if anyone knows about any good tax software that I can use to file for free it would be much appreciated.

You are missing a lot of the other factors that go into the relative merits of different taxing methods. The main three being how hard is the tax to collect, how easy is it to avoid, and how neutral is the tax (i.e. how much does it change peoples behavior. For all of these income taxes are worse.

With Salestaxes/VAT's the vast majority of people do not file a return, and the businesses which due file a far more simplified return then a corporate tax one, since it is based on real receipted events rather then GAAP accruals. This means that far less time is forced to be spent by people on it, and far less money is turned into deadweight loss paying jerk-offs like me to prepare taxes.

With Salestaxes/VAT's it is far harder to falsify your return. While I can claim that I made my money in Camen, it is far harder to claim that's where I ate my lunch if I am in LA. And since it s based on real purchases, with subjective deductions it is far harder to slip out of what your owe. And in a VAT system specifically it is far harder for companies to falsify their returns, since your taxes owing is your counterparties tax credit, so the government can find underreporting easily. The overall impact being that is costs the gov far less money to collect per dollar, and the burden is more evenly spread within a class.

Finally Salestaxes/VAT's are more neutral/cause less harmful changes in incentives. With a VAT there is a very limited impact on someone's marginal desire to work, and in so far as they are evenly applied they are not biasing what sorts of consumption those people choose to engage in. So beyond a moderate disincentive towards consumption, and incentive towards investment (which seems good in an inflationary environment?) they don't cause much deadweight loss from suboptimal choices. Where income taxes do have a disincentive impact on people choice to work at the margin. Like for every point you increase the income tax rates there is some amount of people working less or retiring. Which again is suboptimal for society (particularly when we have a labour shortage), since that is now less stuff overall being produced that people find valuable.

Also on being progressive, I want to point out that how progressive a single element is in isolation, isn't really relevant. What matters is how progressive the system is as a whole. Like Salestaxes/VAT's can easily be very progressive if ether you are 1) giving low income people a rebate on them, like they do in Canada, or 2) spend the money you raise on services or programs that disproportionately help lower income groups. Even if people lower down pay more in sales taxes, if they get even more back in transfers they are further ahead. So you are better off finding the methods of taxation that are better at raising funds at minimal costs and making people whole, rather then trying to contort collection, so you only send a bill to Bezos.

Milan, I recommend you stop saying the word “fair” or “unfair” as justification. E.g., “you’d make the bill for existing ones a bit fairer“, “That struck me as kind of unfair”. There just isn’t a universally accepted definition for “fair”.

One could say that the rich can more easily afford a higher tax rate, or that reducing sales tax would have a stimulative effect since lower income quartiles spend a high proportion of their income.

But it isn’t “fair” or “unfair” for higher incomes to pay a higher percentage. In some sense, it is more “unfair” to charge an individual more for the same (or less!) services that they use. When I get a haircut, they don’t charge me based on a percent of my income, nor do they increase the percent as my income goes up.

By the way, I overall agree with raising the progressivity of income taxes (even though this would impact me negatively). It just grates me every time I see the reasoning being given that somehow the current state of affairs is “unfair”. Progressives do this all the time and it drives me nuts.