Building a better welfare state

The expanded child tax credit will be a bureaucratic mess...like most of our social safety net programs

This piece is written by Marc the Intern, not the usual Matt-post.

It’s time to clear the cruft out of the American welfare state, make existing programs more user-friendly, and move to simplify the overall structure as part of a recognition that the politics of fighting poverty have shifted, and it’s time to move beyond the hide-the-ball politics of the 1990s.

The Biden administration is taking important steps to ameliorate poverty — steps bold enough to indicate that they recognize the changed political landscape on some level. But they seem to me to be underestimating the implications of that changed landscape and are at risk of letting a major opportunity pass them by. One very clear and important example of this is the temporarily expanded child tax credit (CTC) they stuffed into the American Rescue Plan, which — while ambitious and helpful — is also poorly designed for obsolete reasons.

Democrats have frequently bragged about the poverty-stopping effects of the expanded child tax credit, indicating that they want to be seen as taking action on poverty, not sneaking in anti-poverty policy through the back door. But they’re doing it with a tax credit, rather than a more effective direct-spending program, because they’re stuck in the mentality of an era when poverty-ameliorating policies had to go under the radar.

And it’s a much larger issue than just the CTC. For each of the many safety net programs, there are simple, effective, and politically achievable changes the Biden Administration could make that would seriously improve the lives of Americans at the bottom of the income ladder.

The new CTC

The American Rescue Plan — for this year only — increases the size of the child tax credit from $2,000 for all children younger than 17 to $3,600 for each child under six and $3,000 for each child age six to 17 (including 17-year-olds for the first time). The ARP also temporarily makes the CTC fully refundable instead of just partially refundable, meaning that parents with no income can receive the full $3,000 or $3,600 benefit per kid. Lastly, the CTC this year will be given out in smaller portions periodically instead of all at once on your tax return.

Some academics at the Center on Poverty and Social Policy at Columbia University have calculated that these CTC provisions, along with the rest of the ARP (stimulus checks mostly) will cut child poverty this year by 56%. Democrats have hailed this fact, preferring to say child poverty was “cut in half” because that’s snappier.

But this analysis assumes that the aid actually gets to those who are eligible for it, which is not how any program works in the real world. While Social Security has a participation rate of 97% among those eligible for it, the participation rate for food stamps (also known as SNAP) is 84%. The participation rate for WIC, the nutrition program for women, infants, and children, is 51%, and the participation rate for TANF (cash welfare) is an embarrassing 25%. The most comparable program to the Child Tax Credit is the Earned Income Tax Credit (EITC), which has a 78% participation rate.

So it’s extremely unlikely that the American Rescue Plan will cut child poverty by 56% this year. If the expanded CTC has the uptake the EITC did, it’d cut child poverty this year by somewhere about 45%, and the true number is probably a good deal smaller because the poorer a person is, the more likely it is that they are hard to reach. One in three poor children live in families that don’t file taxes, and one in two children in deep poverty (parents’ income less than half the poverty rate) live in families that don’t file taxes. But you’re going to have to file taxes to get this expanded CTC — hopefully, these families will file taxes this year.

The IRS will be administering the expanded tax credit, as they do all tax credits. But many policy wonks fear that the IRS won’t do a very good job with the expanded CTC for a number of reasons. Here are a few:

The IRS doesn’t have any actual experience distributing benefits periodically.

Many poor families don’t file taxes and won’t know how to, since they don’t make enough money to pay taxes anyway.

The IRS has zero outreach budget.

The IRS has incomplete data on family situations, so conceivably a parent with no custody could receive the credit while his sister with custody of his child doesn’t.

The IRS has the brand of an agency that takes your money, not as one that gives you money, because, for most people, that’s true.

Many of these wonks (Matt Bruenig and Don Moynihan, to name two) would thus prefer that the Social Security Administration, which doesn’t have these same problems, administer the fully refundable periodic distribution of money to parents. I generally agree with them, and I think the point can be broadened: Democrats should be trying to make the welfare state more friendly and more efficient to raise participation rates and eliminate poverty. The politics of this are good now in a way they haven’t always been, and I think Democrats should take advantage of this and ameliorate the suffering of millions of poor people who’ve gone unhelped by a government that has promised to help them and then made that help needlessly difficult to obtain.

The history of tax credits

President Lyndon B. Johnson signed legislation creating SNAP, Medicare, and Medicaid, following in the footsteps of President Franklin Roosevelt, whose administration created Unemployment Insurance and Social Security. Following Johnson in 1969 was a 20-year era of Republican presidents, only interrupted by the presidency of Jimmy Carter, who spent much of his term trying to fight inflation.

The era of Republican dominance was finally ended when Bill Clinton took office.

Bill Clinton was a major champion of shrinking budget deficits, not by raising taxes on the rich but by cutting taxes and government spending even more.

Here is an ad where he promises “a future where our government is smaller.” This was around the time when he said “the era of big government is over” in his State of the Union address. Below is an ad where he lauds his cutting of the capital gains tax for homeowners.

Under Clinton, the share of GDP spent on government expenditure reached its lowest since the early ‘50s.

During this 32-year period of shrinking government, the Earned Income Tax Credit and the Child Tax Credit were born.

These are non-transparent and relatively ineffective ways of helping people. But they’re better than nothing and a product of their times.

Helping the poor wasn’t a salient campaign issue during this era as each party jockeyed to be considered the greater “party of the middle class.” Work requirements and wage subsidies via tax credits were fashionable, and giving checks to people was not. Regardless of what you or I think of those Bill Clinton re-election ads, he was re-elected by a wide margin — a larger margin than any subsequent president.

To some extent, helping the poor during that era was a bit like foreign aid to Africa is now. Some politicians, staffers, and potentially even donors personally care about it and think it’s good, but nobody is campaigning on it because campaign professionals don’t think saying “Sierra Leone deserves more of your tax dollars” makes you more likely to win. Today, child poverty isn’t like that. You can tell from the volume at which Democrats are touting their refundable CTC that they think lots of people find this idea exciting. But it’s not clear this was true in 1994.

Maybe this was racism. Maybe it was just a lack of compassion, or maybe it was a distrust of government. But no matter the reason, we’ve inherited tax credits as an institutional legacy of the era during which big government was over. Now we need to figure out what to do with them.

Times have changed

Consider four different kinds of political climates regarding government assistance to the poor:

Rule by economic libertarian. If a welfare-cutting libertarian is in office with popular support (like Reagan), and you care about programs that cut poverty, you should try to save whatever programs you can before the libertarian guy cuts it.

Sneaky Times. In this type of era, there is some popular sentiment behind the government helping people, but a general feeling that it should really only be the middle class (and maybe the working poor) who is helped. If you really want to help the poor during these periods, you should just agree to whatever welfare state improvements you can, since you’re not in much of a position to make demands. Make programs refundable and expand them while talking about how that helps the middle class.

Enthusiasm with Blockage. The people really want to help the poor! You should streamline programs and make them more user-friendly. You may not be able to make a Social Security-type program because of the filibuster and because you aren’t getting close to winning 60 Senate seats, but you definitely have the popular enthusiasm and ability to make important tweaks that ameliorate great amounts of suffering.

Unicorn Times. There is massive popular enthusiasm for helping the poor, and it’s not procedurally impossible since you have more than 60 Senate seats and/or there are nice filibuster rules. FDR and LBJ had huge congressional majorities, so they designed massive programs that took accordingly massive chunks out of poverty. I don’t think Democrats will achieve this any time soon, but that’s a story for another day.

The CTC is a policy that originated in political climate two, and Democrats are expanding it as if we’re still in climate two. But the truth is their eagerness to claim credit for the expansion is evidence that we’re actually in climate three. But instead of revisiting the fundamental design of the program, Democrats are still trying to help the poor in some near-invisible way.

The Republicans have just built their most diverse coalition and their most economically downscale one in decades, thanks to disavowing their old plans to roll back Social Security and Medicare. Many Republicans are eager to flex their “populism,” so I think it’s possible you could get enough bipartisan support behind simple fixes that do a lot of good. One idea, for example, is automatic cross-enrollment. The way this works is that if you enroll in one means-tested program, you automatically get enrolled in any others that you qualify for based on the information in your first application. I don’t really think you’d face a successful filibuster attempting to accomplish that!

A unicorn plan

If you wanted to just max out on simple, universal social welfare, you could do something like this:

Add a universal basic income of around $15,000 per adult and around $4,000 per child to be administered by the Social Security Administration.

Get rid of the alphabet soup of cash and quasi-cash programs like TANF, SNAP, WIC, and SSI.

Pay for the difference with a value-added tax and/or other forms of effective consumption taxes.

On net, consumption tax + UBI is very progressive, since rich people consume a lot more than poor people. Below is a distributional analysis of Yang’s Freedom Dividend, which was a smaller UBI.

The idea here is that nobody in America should suffer in poverty no matter how lazy or able-bodied they are. Eradicating poverty isn’t actually hard — just give everyone an amount of money roughly equal to the poverty rate. There wouldn’t be a strong work disincentive because you’d keep the UBI no matter how hard or profitably you work.

Back to reality

But this is genuinely outside the realm of current political possibility.

That leaves us with the question of what you can accomplish by streamlining the American welfare state without relying on a huge new injection of VAT revenue.

Seeking ideas on this subject, I spoke to Georgetown professors Don Moynihan and Pamela Herd, who wrote a book about Administrative Burdens, as well as experts at three major center-left think tanks. I also read enough Matt Bruenig to start renting a place with an electric stove.

Many of the welfare state changes that these experts suggested are inexpensive but could make a huge difference to the number of poor people the programs actually serve. Here are some:

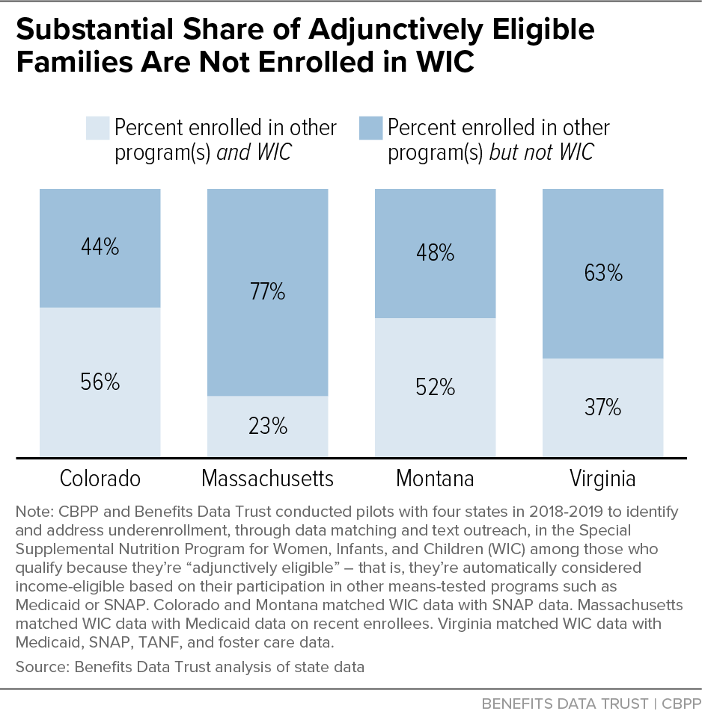

Cross-eligibility and automatic enrollment. For a large portion of the poor, the government already knows what they make through their tax returns, and they should use this administrative data to enroll them in the benefits they are eligible for, rather than making them apply separately. Those who can’t be auto-enrolled should be able to do a single application to a single program, and then the information they provide should get them enrolled in all the programs they’re eligible for. There’s a really common situation that arises where people receive benefits from one welfare apparatus but not another for which they are definitionally eligible for based on their eligibility in the first one. Here’s the Center on Budget and Policy Priority’s measurement of that situation with WIC in a few (mostly blue) states.

When CBPP ran very simple data-matching programs with these states, they found that cross-enrollment really could increase participation rates; in Virginia, they could increase WIC participation among eligible recipients by 98%!

Centralize everything. All welfare programs should be administered at the federal level, especially since these programs are predominantly paid for by the federal government anyway in grants to the states. It’d be cool to have something like a Department of Benefits with a cabinet-level secretary, but I do think you might run into political trouble with that. Better to just put everything in the Social Security Administration: food stamps, UI, a child allowance, and TANF, so it could all be administered centrally and then aided by the 1,230 local Social Security offices that already exist. It’s hard to make the administration of welfare programs more humane if you’ve handed the main administrating job to the inherently decentralized states. Plus, you want labor flexibility so that people can move around to find better jobs and/or cheaper places to live — if switching states requires a whole set of new application procedures, that’s a big deterrent.

Be flexible. During the pandemic, a lot of states have experimented with having remote applications over the phone and sending documents via email. This should stick around, with in-person services continuing to be offered. They should also add more hours. Many of these programs are explicitly or implicitly targeted at working parents of young children, and this is not a group with a lot of scheduling flexibility. The agencies should meet them at their needs.

Make SNAP and WIC cash. There’s no reason to insist that poor people buy food with their public assistance money (they will remember not to starve), and since it costs the exact same in cash as it does in food vouchers, you should not put needless red tape where too much of it already exists. If you want a glimpse of how much needless red tape there really is, watch this video — courtesy of Max Ghenis — from California’s WIC program (one of the best in the country in terms of participation rates: 61%), where they teach you how to make sure to buy only white eggs because brown eggs aren’t covered. The WIC program is full of extremely prescriptive rules like this, including regulating which fat percentage of milk you can get, which itself depends on whether your child is one year old or two years old.

The changes I listed are pretty inexpensive; they could do a tremendous amount of good; and I think you might be able to get some bipartisan support on them! And, since Biden is very into government-via-huge-legislative-package, he could probably throw some extra funding at the SSA (or the IRS if need be) to make this all run extra smoothly — call it infrastructure that we need to build back better.

Whatever you do, do it fast!

Improving the welfare state, especially via these kinds of cheap changes that will make a huge difference in people’s lives without requiring big controversies over tax changes, is something we should do now. Pew asked people in January what should be Congress’ and the President’s top priority, and helping the poor was above race issues and the budget, and far above immigration, climate change, and infrastructure/transportation — despite receiving less media coverage than any of those topics.

The White House is calling for a huge, $400 billion increase in Medicaid funding for home care services as part of its infrastructure plan, which is more than half the size of the defense budget. Underfunding of home care services is worth addressing, but also underscores how much good could be done for the poor with relatively small amounts of money compared to what’s currently under discussion.

So let’s not spend the whole spring arguing over bridges and roads that very few people actually care about. Let’s fix the welfare state instead.

Well crap. Apparently I am the only person up this early on a Sunday Morning. Sitting in front of computer in a hotel room for a meeting that isn't happening.

So apparently I have to be the first to tell Marc that he is full of crap.

Just kidding Marc. You are sort of spot on.

I've been learning a lot more about the mechanics of these welfare problems since my oldest daughter got knocked up, had a baby and moved back home to enroll in school full time.

Currently she receives...

- GI Bill (from me) to pay for school.

- Pell Grants.

- Work study job.

- WIC.

- Subsidized child care.

- Medicaid (or is it Medicare) for the baby. She is on my policy.

- Is applying to for a Section 32 low income apartment (fingers crossed... love my daughter and granddaughter, but kids need to go!),

- Working on SNAP.

- Also, she will obviously qualify for the CTC.

Literally an alphabet soup of programs. It is pretty cool... but... you would not believe how much paperwork is involved in each and every one of these steps. All are handled by different people and agencies. All involve tedious forms documenting all sorts of stuff. I can only imagine how much money is wasted on overhead.

Now I understand... people are shady. There are people who would take advantage of the system. (dont deny it... I know them personally). But sheesh. Why have all these programs with slightly different qualifications. Ran by different people. Using different forms.

In some ways I almost view it as a jobs program for social workers. I'm glad they have jobs. And in Boise, they are super competent and very kind. But...

Wow... on a National Level, so much money is wasted.

Lost my train though. Oh yeah... lets fix the damn welfare state.

My daughter is a pretty bright person, and I am a pitbull when it comes to researching and helping her with these things, but I can only imagine how overwhelming all this paperwork is for a single mom without the social capital that we have.

If you made it down to this, my final point to add is that grandchildren are awesome. My little Syble (it was my grandmothers name)... is so frickin cute. Grandchildren are way better than kids. My advice to you young single people out there is to skip kids, and go straight to the grandchildren.

I wish substack let us post photos... but if you care.

https://www.instagram.com/p/CNhxN3kFHQz/?utm_source=ig_web_copy_link

(hopefully that isnt against the rules)

“There’s no reason to insist that poor people buy food with their public assistance money (they will remember not to starve)”

I think one reason is to keep such programs in climates 3 and 4 rather than backsliding into climates 1 and 2. There’s an excellent argument for broadening the acceptable uses of SNAP/WIC to include foods intended for eating at the point of sale—back when I was a cashier any kind of hot food or prepared items like sandwiches, sushi, prepacked salads, etc were not SNAP eligible, but you could buy sandwich supplies, heads of lettuce, bags of rice and raw fish, etc, and I never fully understood the rationale for the distinction—and the brown eggs vs white eggs rule you mention is a good example of cruft, but some subset of people, however small, will in fact forget not to starve when they have a fungible resource that could be used on other compulsions.

I remember riding a public bus in San Francisco years ago and sitting next to two guys who seemed to be old friends. One of them was very patiently encouraging the other not to spend his remaining cash on scratchers (scratch off lottery-adjacent games) and arguing that he needed to buy food for the rest of the week, and the scratcher enthusiast was sincerely struggling with the choice. I had never seen that level of gambling addiction in person but it’s out there.

My point is, even if cash programs are more efficient *in aggregate* and better for most beneficiaries than food-only assistance programs, outlier stories (however rare) about heads of households buying scratchers and letting their kids go hungry are going to surface and attract outsize attention, and those are the kinds of things that push climate 3 and 4 people toward climate 1 and 2 mentalities. Hence a benefits-inefficient solution might in fact be more public-opinion-durable in the long run.