The welfare state is extremely good

Checks-mania shows the time is right for back-to-basics redistribution

The welfare state — the idea of raising a lot of money in taxes and then giving it to people either in the form of cash money or broadly useful services — is extremely good and has become sadly underrated in our current political debates.

Conservatives are the main problem here. Many of them, like Paul Ryan, believe that social welfare programs discourage work: “What they’re offering people is a full stomach and an empty soul.”

Charles Murray and Richard Herrnstein’s book, The Bell Curve, is best known for its arguments about race. But their main point is entirely race-neutral: by giving extra money to poor families with kids, we encourage dysgenic breeding of folks with low IQs, so we shouldn't do it.

This is all wrong. With reasonable design parameters, a welfare state does almost nothing to discourage core potential workers from working. And there’s nothing wrong with a situation in which the elderly, teenagers, parents of very young kids, and people with severe disabilities and their caretakers don’t work. A strong welfare state has big benefits for its recipients, and it helps stabilize the macroeconomy and prevent deep recessions. Last, but by no means least, a strong welfare state creates a situation where regulatory policy questions can be evaluated on the merits with the knowledge that people will be taken care of rather than used as a backdoor to support jobs and incomes.

Unfortunately, two different currents of left-of-center thinking have also contributed to making the welfare state a bit unfashionable. But it’s great, and we should have more of it. And all the mid-December drama over direct checks in the Covid relief bill shows that the right-wing anti-welfare politics that were so potent in the 1980s and 1990s are basically obsolete today — people like the idea of the government giving people money.

America’s welfare state, explained

The American political system, unfortunately, has always been pretty hostile to the welfare state.

Our government has an unusually large number of veto points, which makes it harder to enact laws. But this is not a symmetrical phenomenon. As Paul Pierson’s classic book Dismantling the Welfare State? Reagan, Thatcher, and the Politics of Retrenchment explores, it is very hard to get rid of programs that already exist. That’s true even in a country like the United Kingdom, whose political system has very few veto points. Margaret Thatcher’s long years in office did not lead to the elimination of the National Health Service. So while it’s a lot harder to create a new program in the US than in a less veto-laden system, it’s only modestly more difficult to get rid of one.

Alberto Alesina, Edward Glaeser, and Bruce Sacerdote have documented fairly convincingly that another major factor is racism; the white majority has been reluctant to support programs that it perceives as benefitting non-whites.

This is reinforced and entangled with a moralizing discourse that focuses heavily on the idea that while it’s fine to help the deserving poor, it is paramount to avoid helping undeserving freeloaders. Theda Skocpol’s book, Protecting Soldiers and Mothers: The Political Origins of Social Policy in the United States, illustrates how we started assembling a welfare state narrowly tailored to help the right kind of people. And per Skocpol’s insights, the politics of cash welfare pivoted in the 1970s when the public image of the unmarried mother shifted from “the widow” to “the irresponsible single mom.”

The widow deserved our help, but the single mother — the welfare queen — was ruining our society.

America’s original cash welfare program, Aid to Families with Dependent Children (AFDC), suffered from very real design flaws that genuinely did discourage work. The best and most natural fix would have been to spend more on the program so benefits didn’t phase out so sharply. But congressional Republicans in the mid-1990s were determined to use the flaws in the program to all but eliminate cash welfare, and after a bit of hemming and hawing, Bill Clinton went along with it and claimed it as a victory. As Dylan Matthews details, that ended up being a disaster for the poorest Americans.

But it did achieve its political objective of opening up space for two other kinds of programs. On the one hand, you have cash assistance programs that are tied to work (Earned Income Tax Credit and Child Tax Credit). On the other hand, you have programs — Medicaid, SNAP, Section 8 housing vouchers — that don’t require work but also don’t give you cash. There’s also TANF, which is a federal program that gives grants to states to help them organize a cash welfare system whose benefits are only temporary (that’s what the T stands for) and conditioned on finding work within two years. The states are given huge discretion on how to run this program, often using the money for things other than delivering cash benefits.

Then America also has a separate, much more generous welfare state for senior citizens — Social Security and Medicare — and there seems to be a social consensus that the elderly are deserving of help. Stuck somewhere in between are disability programs, which are formally part of the Social Security system but politically speaking seen as “welfare” programs in part because there are always questions about the rigor of the diagnostic criteria.

More than full stomachs

To the extent that I have anything original to say about any of this, it’s that the public debate in America has not paid enough attention to the research literature on the actual impact of social assistance programs. We often have a dialogue dominated by a right-wing version of blank slate thinking where the only thing that matters for people is their incentives, and giving money to the poor reduces their incentives to work.

In fact, living in poverty — and especially growing up in poverty — has really bad impacts, and providing assistance can deliver useful long-term benefits.

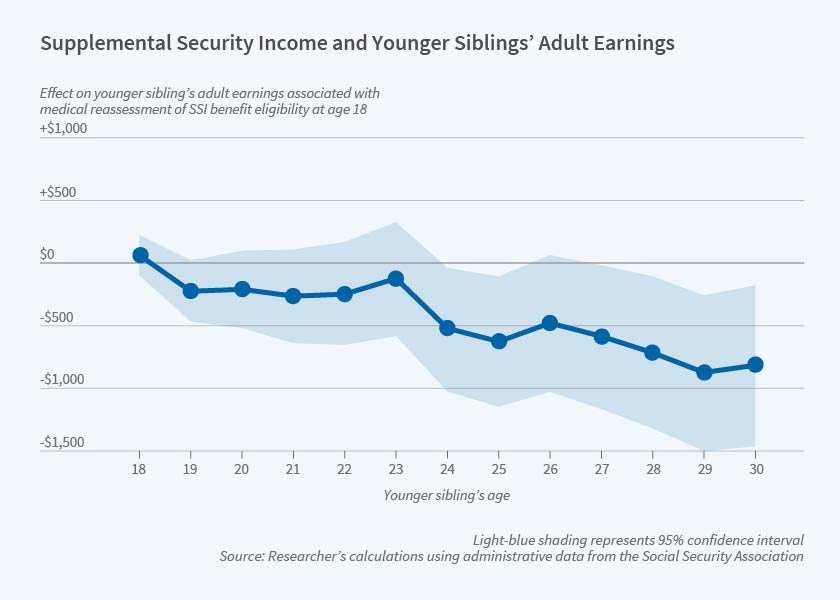

A recent paper by Manasi Deshpande, for example, shows that when kids lose their SSI benefits, it has a negative long-term impact on their younger siblings’ earnings:

This is a powerful finding because the younger sibling’s situation is not the target of the program. It’s simply showing that delivering extra financial resources to the family improves the kids’ long-term situation — better nutrition, more focus on school, whatever it is.

A study of the rollout of the SNAP program, similarly, shows that kids whose parents got benefits while they were in utero or up to age five ended up better educated, living in better neighborhoods, and less likely to be disabled as an adult than kids whose parents started getting the benefits when the kid was in their teens. The children also ended up less likely to receive social assistance programs themselves. All of these effects are modest in scale, but the impact on adult receipt of social assistance is large enough that SNAP “pays for itself” in fiscal terms separate from the benefits to the beneficiaries. SNAP benefit availability also appears to reduce obesity and reduce the number of days kids miss school due to illness.

A comprehensive study of one of America’s first cash welfare programs — mothers’ pensions — showed that women who got the benefits lived longer while their sons earned 20 percent more as adults and were less likely to be overweight (they couldn’t track daughters because of name-changing). By the same token, kids whose parents benefit from more generous EITC benefits have higher math scores and are more likely to graduate high school.

The Trump Administration tried really hard to enact huge cuts in Medicaid. But Medicaid is really good. Medicaid expansion has saved over 20,000 lives since it was enacted. A study of a previous expansion in the 1980s showed that kids who grew up benefitting from expansion paid more in taxes and were less likely to need EITC benefits than those who did not benefit from that Medicaid expansion. A separate study shows that the grandchildren of women who benefitted from that expansion are less likely to have low birth weight. Those kids are not old enough to study adult outcomes yet, but we know that low birth weight kids are likely to have lower IQs and generally worse outcomes in terms of education and income.

Last but by no means least, kids whose families get housing assistance earn more as adults and “childhood participation in assisted housing also reduces the likelihood of adult incarceration for males and females from all household race/ethnicity groups.”

Broad cash benefits are really good

The big problem with this patchwork of programs is that it’s so much a patchwork.

Eligibility rules and procedures vary by state. If you move, you might lose benefits which creates a significant disincentive to relocate even when doing so might have other major benefits. The cash programs phase in and phase out in an odd way that delivers too little assistance to the poorest while creating very steep marginal tax rates on somewhat higher-income families.

Social Security, by contrast, is really convenient. You can earn a living in New Jersey and take it with you to Florida when you retire. And the coverage is so broad that it even takes a bite out of child poverty thanks to kids who live with older parents or older relatives and kids who receive the benefit if one of their earning parents dies or becomes disabled.

And to the best of my knowledge, there’s no real magic to the means-testing programs. SNAP does a lot to help people and so does housing assistance and so does Medicaid, but basically all for the same reason that cash does — the money is fairly fungible and having more money is helpful.

Social Security’s cash benefits are also super helpful:

Using data from a nationally representative survey of older adults, we find that higher Social Security income significantly improves health outcomes among the elderly. Specifically, we find that increases in annual Social Security benefits led to significant improvements in functional limitations and cognitive function, and that the improvements in cognition function were larger for individuals with better cognition.

By contrast, TANF has become an incredibly stingy program that delivers very little help to poor families and in many states barely reaches almost anyone.

So what should we do?

In practical terms, there’s nothing wrong with an incremental approach. We should keep fighting to expand Medicaid in the states that haven’t done it yet. We should try to pass Joe Biden’s proposal to make Section 8 vouchers available to everyone who qualifies. We should listen to the Center on Budget and Policy Priorities and put more money into TANF—it’s 40 percent smaller than it was when it was enacted merely because of inflation. We should also require that states actually use a large share of the grants for cash assistance, instead of for other vaguely-related-to-welfare stuff like abstinence programs.

But in bigger picture terms we ought to do what I advocate in my book One Billion Americans and create what’s basically Social Security for Parents — a truly universal cash allowance for parents of young kids. Michael Bennett and Sherrod Brown have a plan for a child allowance worth $300/month for kids under six and $250/month for kids under 17. It’s a great plan. To be even more ambitious, I would recommend they drop the means testing (theirs phases down to zero for married couples earning over $200,000) and add a one-time baby bonus payment (you could think of it as nine months’ worth of payments during pregnancy). And conceptually, I think you should probably consider eliminating SNAP, Section 8 housing assistance, and weird stuff like LIHEAP and instead just making monthly checks even bigger. You could also scrap the family size adjustment in EITC and turn it into a narrower wage subsidy.

What you’d definitely do is take away the tax code’s backdoor subsidies for parents and instead give middle class — and even wealthy — parents access to this same allowance that everyone gets.

This would massively reduce child poverty with all kinds of ancillary benefits for child development and long-term growth.

The political moment is right

As reviewed above, traditionally there have been formidable political barriers to creating universal social welfare programs in the United States.

The good news is that is likely changing. George W. Bush sent universal stimulus checks to everyone in 2001 and faced no political backlash for doing so. Scott Walker did a program (oddly framed as a “sales tax refund”) to give $100 to every parent in Wisconsin and people liked it. The $1,200 checks in the CARES Act were so popular that grandstanding politicians essentially forced a second round of checks (this time for only $600) into the second Covid relief bill even though wonks didn’t like the poor targeting. Trump said this wasn’t enough — he wants $2,000 checks!

To do a full Universal Basic Income, you would need a sum of money that is so large it requires some big and unpopular offsetting tax increases. UBI also involves a vision of the post-work future that I think does not command political support at this time.

But financial support that’s adequate to be a game changer for low-income families with children and genuinely useful to middle-class families is much more affordable. It’s partially offset by folding in existing tax breaks, and it could be deficit financed in the short term while interest rates are low and with popular tax hikes on the rich in the longer term. A universal child allowance would be eligible to pass the Senate under budget reconciliation rules, so while the veto points problem exists, it’s milder here than for some things.

The racial politics are also shifting. The white population has, famously, gotten smaller and continues to shrink. Measured levels of white racial resentment are declining. Public support for interracial marriage has soared.

This is the tremendous opportunity of the Great Awokening and why, unlike some people who use that term, I think it’s mostly a good thing.

But the Awokening is also one of two strands of thinking on the left that prevent embrace of the welfare state from being as fulsome as it should be. We’ve seen a school of thought which holds that the New Deal was Racist and Bad and progressives should talk constantly about unpopular race-targeting ideas even as this costs Democrats votes among non-college voters of all races. The other is the strain of thought that wants to constantly complain about “neoliberalism” and spend all its time going down various regulatory rabbit holes rather than just taxing and spending.

The welfare state, however, is not just good on its own terms; it’s good for checking the power of employers and big business (because it gives people exit options) and it’s good for racial equity. The top one percent is a very white group of people, while the poverty rate for African-Americans is more than double the rate for whites. Addressing this with an expanded welfare state is a much more potent tool for advancing racial equity than endless diversity and inclusion programs, and it has the added benefit of being a potentially winning political agenda.

To me so much of the draw for universal v. Targeted programs is the reduction of administrative friction. Stimulus checks were popular because people like money, but also because they just sort of showed up without any huge lift by the recipient. Sure UI enhancement is technically a better solution, but the delivery method (state implemented distribution systems) were so broken that a ton of laid off Americans never received the UI that they were eligible for. The map with TANF penetration is striking and should really be a bigger part of the policy conversation

True confession: When I consider targeted anti-poverty programs, I want to know if the recipients are in their situation due to bad luck or due to bad decisions. My default is to see individual agency -- as opposed to luck, legacy or environment -- as the cause of poverty.

The benefit of universal programs is it short-circuits this line of thinking.