The real economic challenge in 2021

Strong growth is a given, but we need a drive for genuine full employment

With Congress passing a roughly $900 billion Covid relief bill that is both very large (this is a bit larger than the Obama stimulus in nominal terms and only slightly smaller in inflation-adjusted terms), it’s time to think about the economic outlook for next year, which I think is widely misunderstood in many quarters.

There’s one set of people who are underrating how quickly the vaccine will generate a jump in economic activity in the New Year — far sooner than “herd immunity” is achieved.

There’s another set of people who, based on a false analogy to the last recession, are wrongly expecting an agonizingly slow recovery that’s highly dependent on Congress doing more fiscal stimulus.

Last, there’s a group who — because they are aware that the first two groups are wrong — are too complacent about the real challenge we need to meet.

The truth is we can likely expect a very rapid spurt of growth next year no matter what Congress does. But the question then becomes: What happens next? Do policymakers declare mission accomplished over a single strong year of growth, or do they acknowledge that we’ve had twenty years during which we never reached sustained full employment and we desperately need to do better?

A year of good growth is a lot better than a year of bad growth. But if the Biden administration and the Fed are smart, they can deliver what we really need which is a multi-year run of good economic conditions.

The economy will rebound very quickly

If you ask public health experts, they’ll warn you that just because vaccinations are happening doesn’t mean we’re ready to go back to normal.

In an interview with Hallie Jackson on Monday, Dr. Fauci outlined his key three points:

Vaccines should be available to healthy adults without underlying health conditions starting by late March or early April.

That doesn’t mean everyone will be instantly vaccinated; herd immunity would maybe exist by the fall.

He’ll keep recommending public health measures like masks for “several months into the second half and beyond of 2021.”

This all seems plausible enough to me. But in economic terms, you have to remember how things were in the United States as recently as two months ago. Back then there was no vaccine, but even in the blue states, people were drinking in bars and restaurants. The current surge in cases, hospitalizations, and deaths, and the cold weather are dragging the economy back down.

In practice, what policymakers have been doing all year is trying to flatten the curve and prevent hospital systems from becoming overwhelmed, rather than trying to stamp out the virus the way Taiwan or New Zealand did.

Now check out this CDC chart of age-specific hospitalization rates:

I’m not one of those people running around urging the non-elderly to stop worrying about the virus. I’ve had friends my age get sick and it sounds pretty awful. I’m on team Stay Safe and Take Precaution.

Still, the moral of this chart is that if you can vaccinate the over 75s, hospitalizations per case will go down a lot and so the number of cases you can sustain without being forced to order business restrictions goes way up. A little back of the envelop math from Intern Marc is that the over 75s are 7 percent of the American population, but 59 percent of deaths. Give them a vaccine with 95 percent effectiveness and you’ve eliminated 56 percent of the death risk, assuming the future deaths are the same age composition as the earlier ones. If you can reach the 29 percent of the population that’s over 55, you eliminate about 88 percent of the death risk. This is true for many countries, and Harry Lambert, a British journalist, demonstrated it for the UK in the New Statesman.

That means restrictions on activities will start to be lifted well before herd immunity, and senior citizens will simultaneously start greatly increasing the pace at which they go do things. Movie theater crowds will not be all the way back in March, but economic growth is about rates of change not levels. And at that point the theaters will be open, vaccinated people will have no compunction about attending and neither will reckless people.

You’ll be looking at a steadily improving situation as more and more people get their shots.

The recovery won’t be sluggish

During the last recession, the housing price bust set into motion a chain of events that led to a slip in aggregate demand that the Fed allowed to become a collapse and then Congress never filled it with fiscal policy. That led to an extremely slow recovery, in which the number of jobless people fell slowly but surely for many years. That experience conditioned many people to expect something similar this time around absent massive ongoing fiscal stimulus.

I myself used to be in that camp, but the analysis seems wrong.

Now I want to stop and say something clear: None of what follows is to minimize the extremely real economic pain being felt this winter by people who have lost their jobs and now lost their unemployment benefits. There is an urgent humanitarian need to provide people with relief, and the government’s borrowing costs are extremely low. Congress must act.

But unlike in the Great Recession when everyone got poorer, these days most households’ finances are actually in fine shape—thanks in part to a nice boost from the CARES Act.

The typical household is in okay shape economically and has mostly been doing less stuff because of the pandemic. As restrictions lift and vaccines are disbursed, people are going to spend that money. And as that money is spent, it will generate a spurt in hiring at bars and restaurants, hotels, and other low-wage service providers. That will put cash in the pockets of people who have not done okay during the pandemic, which is good on its own terms, and it’s also good because that money is very is likely to be spent and recirculate rapidly into the economy.

As you can see on Krugman’s chart, back in the 2009-2012 period, everyone was stuck with a tremendous debt overhang, despite a recovering economy. The government could have fixed this with more aggressively stimulative measures, but it didn’t, so we had this extremely long, drawn-out recovery. Next year is not going to be like that. People are ready to go to their favorite restaurants, to travel to see family, and to go on vacation. I have no idea what the long-term stable equilibrium for office work will be, but some percentage of the people currently working from home will go back to their offices and breath some life into downtown coffee shops and lunch spots.

In terms of rates of change, 2021 is going to be a very good year.

I’m still worried about the levels

The problem is that while fast recovery from a deep hole is better than slow recovery from a deep hole, what you really want is to get out of the hole entirely. And we’re in a really big hole. A lot of people have stopped looking for work, which is making our unemployment numbers (which are pretty bad) look actually better than they really are. Harvard economist Jason Furman, who was Obama’s top economic advisor in the second term and got to learn a thing or two about frustratingly slow recoveries, shows that even if all temporary layoffs end tomorrow, we are still looking at elevated unemployment.

There used to be four coffee shops by my house that I would visit pretty often. All four of them have taken a hit during the pandemic because it’s unfriendly to their business along multiple dimensions. You don’t have as many people stopping for cup on their way to work or school. You don’t have as many people meeting up with someone for a cup of coffee. And you don’t have people sitting with their laptop in the coffee shop to do work.

When a coffee shop facing reduced demand says it doesn’t need as many workers, that’s a temporary layoff. The problem is three of these four coffee shops have closed entirely — that’s a permanent layoff.

So what happens to the Logan Circle coffee shop industry as vaccinations roll out and the weather warms up so you can comfortably enjoy a patio coffee? Well, the one surviving coffee shop (a great local business that I wholeheartedly endorse btw) ought to experience a windfall of increased demand and muted competition. Under the circumstances, they ought to do some combination of staying open longer hours than they did pre-pandemic (which creates jobs) and raising prices. Those higher prices ought to create a nice cozy profit opportunity, which every independent bar and restaurant owner who made it through this year from hell richly deserves in my view. But it should also lead other entrepreneurs to seize the opportunity by opening new coffee shops, either with slightly different vibes or lower prices.

And that ultimately is how we ought to get to full recovery. The vaccine wanes, demand comes roaring back, prices soar in select sectors because supply (and competition) has vanished, and those soaring prices induce new business formation. But will that happen?

The inflation bogeyman

I’m not going to try to do a precise macroeconomic forecast. But here’s my worry about the economic situation next summer.

Gas prices will be up as commuting resumes.

Restaurant prices will be up because of supply crunches.

Tons of people will be making up for a lost year of travel, doing summer vacations, but airlines and hotels won’t have suddenly doubled capacity so prices will be rising there too.

None of this adds up to an “inflation problem” exactly. Hotel prices surging is not the same thing as people being unable to afford groceries. But prices will be going up, statistically speaking. And the unemployment rate will be falling. Highbrow magazines are already warning about inflation.

There will be pressure on the Fed to start raising interest rates. Or at least to start talking about raising interest rates to reassure people that they are aware of the situation. When Janet Yellen was Fed Chair in 2014-2015, she made a version of this mistake, giving in too quickly to conventional wisdom about the limits of labor market recovery. When Donald Trump was president, he openly flouted “norms” and yelled at the Fed to goose the economy. And however unprincipled his motives, it was the correct decision. Will Joe Biden do that? Will Jay Powell, a smart guy who’s done a good job but who is decidedly a Republican, be as aggressive in boosting the Biden Economy as he was the Trump Economy.

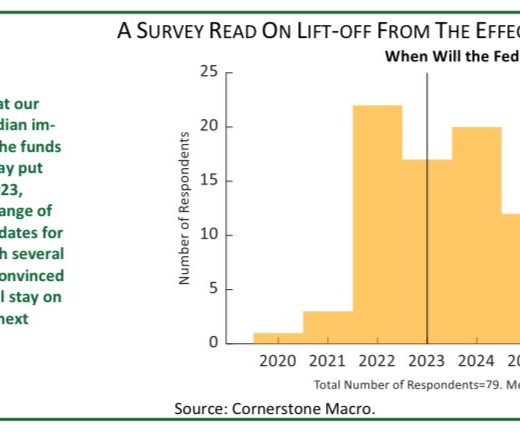

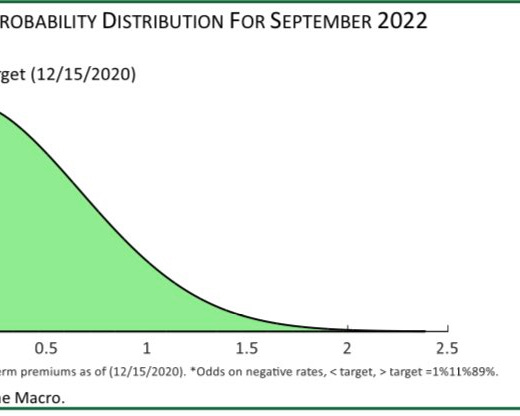

Now in theory, the Fed has a new “average inflation targeting” framework which says they should allow inflation to happen in the future to compensate for the fact that it’s been below target this year. But will they really do that? Cornerstone Macro’s survey suggests that most market participants think they won’t.

It sounds odd to put a lot of weight on pure verbiage, but under the circumstances, I think it could be very helpful this winter for Jay Powell to do a very public and clear promise to keep interest rates low even if the economy is growing fast and even if inflation peaks above 2 percent — really put his reputation on the line. It would be first-order helpful in talking down interest rates and ensuring access to capital. And it would also make it easier for him to resist pressure to move prematurely if doing so would involve an embarrassing reversal.

Eyes on the prize: Full employment

Back in 2018, there were a lot of articles with headlines like “6 reasons that pay has lagged behind US job growth” and “7 reasons why wage growth is so slow.”

In retrospect, this wasn’t that mysterious. The labor market recovery had simply been very slow and 2018 turned out to be a year of accelerating wage growth. Then in 2019, things accelerated further.

But the existence of articles puzzling over slow pre-2018 wage growth underscores the dangers of a sluggish recovery. Not only does sluggishness directly reduce wages, it generates complicated explanations for the sluggishness which distract policy attention from the urgent need to simply keep on keeping on with job creation.

The biggest risk that I see to the economy in 2021-2022 is that we become so pleased with the specter of fast growth that we forget about the urgent need to generate a truly full recovery with 2019-style full employment and rapidly rising wages. I’m glad Congress got a new deal on relief this year. With that done, the next thing we need to do is get the vaccine out. But we need to not just enjoy rapid growth in 2021 but actually stay the course until we have an economy where low-wage employers are desperate to hire marginal candidates and experienced workers of all skill levels are enjoying raises.

"The problem is three of these four coffee shops have closed entirely."

<throws computer across room>

*This* is just don't get. I don't get how this isn't a bigger deal. To me this is catastrophic.

Brad DeLong pointed out some time ago that the most successful social program is often a "high pressure economy" --meaning an economy close to full employment. That makes the labor market more competitive, encouraging people to enter the labor force and raising wages. Not saying this is the only social program we need, but it is fundamental. A low unemployment rate makes other social programs cheaper and more effective.