The case against coupon government

Provide services or provide money

I am very enthusiastic about most of the ideas in Joe Biden’s family plan, but there’s one area where I think he’s making a conceptual mistake that we see too much of in social provisions in the United States. But I don’t just want to make this about Biden, or Biden’s plan, or child care, because it’s really a very general issue.

And it comes down to this — there are lots of ways the government can step in to try to lift living standards, and one of the worst ways is to provide a targeted subsidy to purchase a particular commodity on the open market.

The biggest program along those lines in the United States is SNAP,1 where instead of giving you some food or giving you some money, the government gives you this cash-like voucher and tells you to go buy food with it. Now to be clear, SNAP is good in the sense that it was good when George W. Bush expanded eligibility, and it was good when Barack Obama made it more generous; it was bad when Donald Trump tried to narrow eligibility. But in terms of program design, SNAP is bad, and it would be better to give people money.

I am not a UBI junkie who would say we should replace the whole welfare state with cash assistance. But this particular category of assistance should, I think, be replaced with cash. Alternatively, if the reason you are providing the targeted subsidy is that you think the commodity at hand is especially valuable, then what you ought to be doing is looking at supply-side issues — both in terms of improving the regulatory atmosphere and also in terms of directly providing the thing.

The varieties of social provision

This is not comprehensive or fully scientific, but here’s a five-fold framework that I use for thinking about the varieties of social provision in the United States.

On the far left, there is direct provision of public services. I say “public services” and not “public goods” because most of these things don’t meet the technical criteria for public goods. But a library, for example, is a kind of public good. Creating group book-sharing systems is highly cost-effective (that’s why universities do it) and towns and cities are reasonable groups to create such systems.

Then all the way on the right, we have Suzanne Mettler’s submerged state where the government is actually playing a huge role in subsidizing middle-class homebuying, but it is obscuring the extent to which it plays this role.2

Cash is cash, you get money.

Then I’m not entirely sure how well the distinction between public financing and vouchers holds up, but what I mainly have in mind is that in the “public financing” case, the government program plays a major role in shaping the market for the underlying commodity. If Medicare or the student loan program changes the rules about what qualifies, that alters the whole health care or higher education system. If SNAP says you can’t buy soda anymore, that doesn’t mean soda goes away — it’s just one more difficulty in the lives of SNAP recipients.

Vouchers are pretty bad

Thanks to the conjunction of my son’s school having Community Eligibility for free school lunches and the Pandemic EBT program, I was getting SNAP benefits last fall and winter when D.C. public schools were closed. Obviously, I did not need SNAP, but I also thought that macroeconomically, there was no good reason not to use the benefits. What I wanted to do was give them away, but there’s no real legal way to do that, so instead we used them and then made offsetting contributions to a local food bank.

That’s fine, but it’s an example of how a cash-like benefit is worse than cash. Even actual poor people sometimes want to help someone else out, which you can do with money but can’t do with SNAP (the formula for calculating benefits is also sort of bizarre).

And while the idea, I guess, is that we don’t want poor people blowing their benefits on cigarettes and booze, the SNAP restrictions also mean you can’t buy diapers or tampons. Back 18 years ago when I smoked, my neighbor was on SNAP. She and I both liked Diet Coke and Camel Lights. I would buy cigarettes in bulk in Virginia where they were way cheaper (it was a red state at the time!) and she would buy Diet Coke with her SNAP and we’d trade. I’m not sure exactly where “sharing a drink and some smokes with a neighbor” crosses the line into “benefits fraud,” but it’s life and I felt okay about it.

The inflexibility seems to me to have high costs in terms of hassle and the potential for time-limited but humiliating or demoralizing hardships, and almost no benefits in terms of actually forcing people into some paternalistically-defined healthy lifestyle.

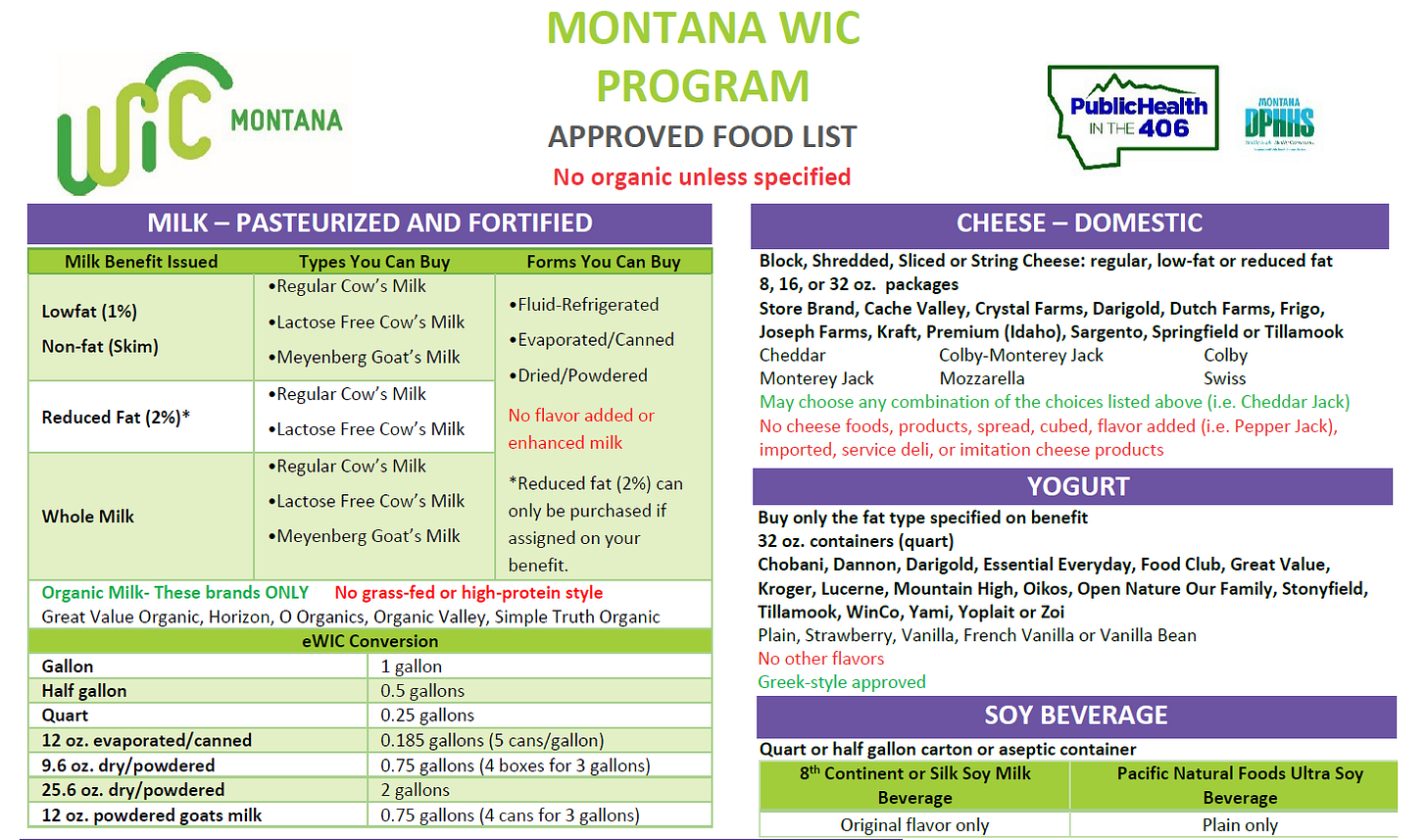

The WIC program tries harder to be prescriptive in the name of nutrition, to the point where you get madness like how in Montana cheddar jack cheese is eligible but pepper jack is not. Organic milk is okay, but grass-fed milk is not. Strawberry yogurt is in but blueberry yogurt is out.

What’s more, the prescriptive health advice is not even any good. The CDC specifically urges breastfeeding mothers to avoid tuna because of mercury contamination so naturally, you can use WIC for canned tuna, but only if you are breastfeeding!

Then there are Section 8 housing vouchers, which I think have some of the most perverse dynamics of all. Only about a quarter of eligible families get these vouchers, so obviously the other 75% are managing to survive — doubled-up with a relative, or living someplace overcrowded or dismal. Then if you’re lucky, you get the voucher — a windfall.

But then you must use the windfall on housing. You can’t spend half of it on housing and the other half on blueberry yogurt or diapers. You can’t be frugal and save in order to finance a move to West Texas where you heard there are lots of good-paying jobs. Most of the people in your situation get nothing, but you get subsidized housing, and it has to be housing. So in metro areas where the housing supply is constrained by zoning, some of the impacts of the vouchers is to push up rent and create windfalls for landlords.

Vouchers for child care

Probably the most obvious critique you could make of a child care voucher plan relative to cash assistance is that it’s non-neutral between stay-at-home and working parents.

To pull the lens out a little, though, even from a perspective of favoring non-neutrality, I think the problem is that you’re not doing public provision. The supply of quality child care centers is just very low in much of the country, either because the population density is too low (rural areas) or because in high-cost areas it’s difficult to get enough centers up and running. Biden has a few initiatives that work on the supply side, mostly looking at workforce training.

But if you had a model to actually start creating government-run daycare centers, like the crèches in France or what I’ve seen in Finland, that could be a good idea. Obviously you’re not going to be able to go from zero to 100 overnight on an idea like that, but trying to move in that direction could be good.

And it would also be smart to look at regulatory issues. Here in D.C., for example, child care centers need to be on the first floor for fire evacuation purposes. That makes sense — nobody wants to see kids get hurt — but I’ve never seen anyone run the numbers on exactly how much that increases costs, and therefore how many kids end up in informal care arrangements and what the safety is like in those informal settings. Diana Thomas’ paper arguing that we should relax the regulatory minimum staff ratio seems persuasive to me. D.C.’s efforts to set minimum educational requirements for child care workers also seem misguided to me.

Now, again, if the city wants to create a public child care center with a low staff ratio and everyone has a certain certificate and it’s on the ground floor of a building somewhere, that seems great to me. A public option can put pressure on the private sector to raise its game. But the point is we actually need to increase the supply of good child care, not keep squeezing the sector with regulations so that kids leak out into unregulated arrangements.

Then conversely, if you give parents money, in most cases a huge share of that money will go to child care. But if it’s cash, then the child care centers still do need to compete somewhat on value because the option of “don’t buy child care” exists. If you voucherize it, you’re pumping more demand into essentially a captive customer base.

First, do no harm

I always hesitate to criticize voucher-type programs like SNAP and WIC and Section 8 because there are perpetual political fights about their existence and all things considered, I’d rather have them than not have them.

Libertarians sometimes do interesting blog posts arguing that Medicaid spending isn’t worth it and recipients would be better off with cash. But Republican Party elected officials don’t try to get more cash to low-income people; they try to cut Medicaid. And I don’t want to see that.

That’s why I’m raising it in the context of the American Families Plan. These kinds of concerns are more important upfront and especially in the context of a big package like this. There’s going to be pressure from some quarters on Capitol Hill to shrink down the overall size of Biden’s proposal, and if something needs to be cut, it ought to be the weakest element of the proposal. There’s also the possibility of trade-offs between different ideas in this package, which includes both supply-side spending and also cash assistance to families.

Once you create a new voucher system, it becomes hard to reform because nobody wants to criticize it lest they give political succor to people trying to just scrap it. It’s better to get it right up front and put money into the best possible ideas.

“Food stamps,” though stamps have not been used in a long time.

Important to note that the main impact of these subsidies is to make homes bigger on average than they otherwise would be, not to increase homeownership per se.

Cash assistance makes sense if and only if the distortions of coupon government are worse than the political odor of stories about people using benefits to buy iphones, big screen TVs and vacations.

I haven’t convened any focus groups, but I did read Hillbilly Elegy. The belief that takers are living better off assistance than low wage workers can live off of their wages is one of the biggest obstacles to working class political solidarity. Furthermore, the distortions aren’t that big. It’s not as if SNAP benefits are materially larger than the cost of feeding a family.

I would throw student loans into the mix. College was much cheaper when it was essentially a public good. Allowing 18 year olds to take out an almost limitless amount of cash that they can only use to finance education is one reason universities are in a facilities and administrative arms race to compete for the "free" cash given to students. This further increases cost, and colleges have no reason to lower tuition since government will provide whatever the student and her family cannot afford--and charge her interest for it.