Online sports betting hurts consumers

New evidence makes it clear that more lawmakers need to take the issue seriously

Today’s post is by our regular Saturday correspondent, editorial assistant Ben, along with Slow Boring alum Milan Singh, a partisan hack at Blueprint, among other things.

In 30 states, as well as DC and Puerto Rico, everyone over the age of 21 is effectively walking around with a mini sports casino in their pocket.

We’ve both written pieces warning that the widespread and mostly unregulated push towards legal mobile sports gambling could have dangerous consequences. At the time, we knew that total sports wagers had grown to well over a hundred billion dollars annually and states with legalized mobile sports gambling had seen a corresponding rise in calls to addiction hotlines. We also knew that previous forms of legal gambling (state lotteries) had disproportionately hurt the financial well-being of poor Americans, and that the extra tax revenue from legalized gambling likely wasn’t worth the cost of addiction. But we lacked data that proved mobile sports gambling led to widespread financial hardship in the states that legalized it.

Now, we have it.

This past month, two research teams released papers showing how legalized mobile sports gambling negatively impacts bettors' financial health. While most gamblers wager responsibly, a concerning minority do not. Large samples of individual financial data show that legalized sports gambling decreases credit scores, increases debt loads, and substitutes positive investment activities. These effects are particularly prevalent among low-income men.

Legislators in states with legalized sports betting — and those considering it — need to take these harms seriously, and reconsider if the mobile sports betting boom is truly worth the tax dollars it provides.

What we now know

The first paper we looked at was “The Financial Consequences of Legalized Sports Gambling” by Brett Hollenbeck, Poet Larsen, and Davide Proserpio. Leveraging the staggered rollout of legal sports gambling, the authors analyzed a consumer credit dataset of 7 million individuals and looked at how online betting impacted consumers’ financial health.

In our interview, Hollenbeck said the findings left him more concerned about legal sports gambling than when he started. And the main finding driving that concern is the fact that there are meaningful small effects on legalized states as a whole, which suggests that the fraction of people impacted are affected pretty seriously.

Here’s exactly what he’s talking about:

In states with legal gambling of any kind, average credit scores drop by 0.3% after four years. However, in states where online betting is available, average credit scores drop by 1%.

Among states with access to online betting, the likelihood of filing for bankruptcy increases by 25-30% after three to four years.

Collections on unpaid debts increase by about 8% in states with online betting.

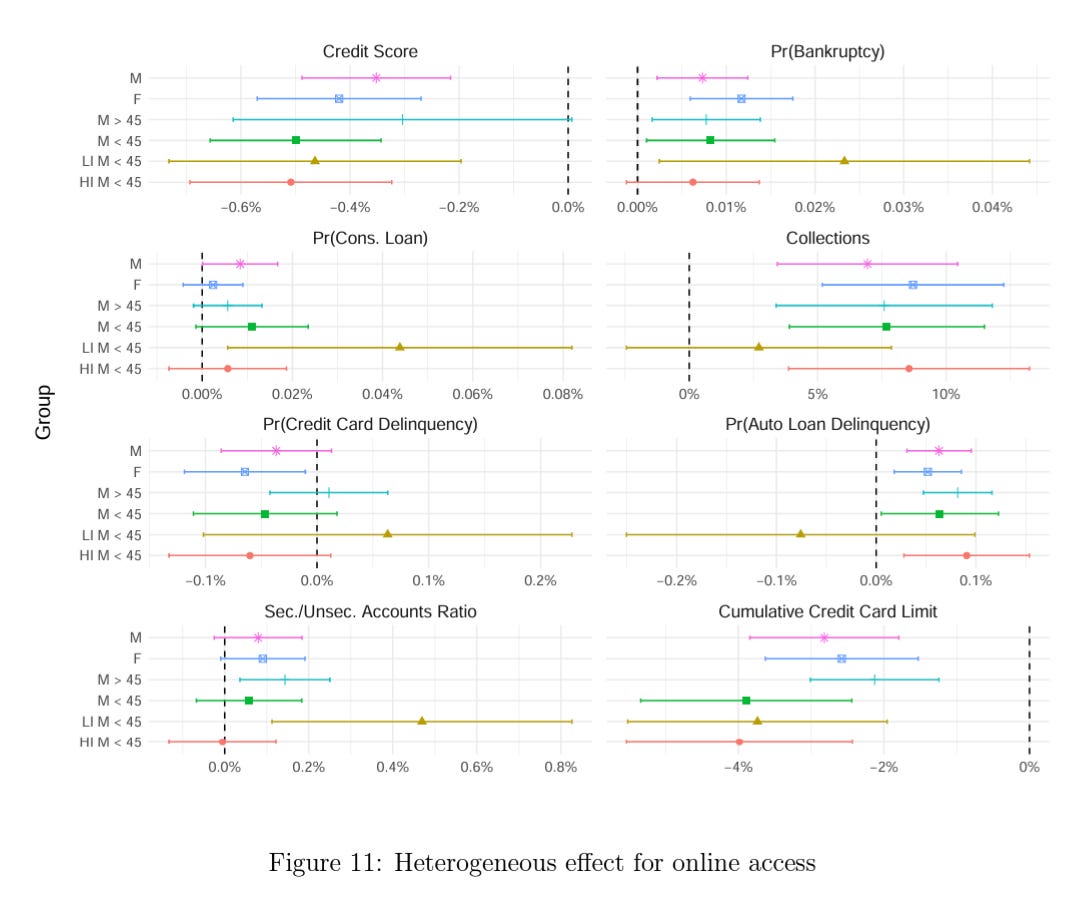

Young men in low-income counties experience higher financial distress, with higher rates of bankruptcy, more usage of consolidation and unsecured loans, and more credit card delinquencies.

The story here is clear. In states with legalized online gambling, aggregate debt loads increase, and this, in turn, drives increases in bankruptcy, decreased credit scores, and more credit card delinquencies. And some of the most financially at-risk people are the ones who are being hurt the most.

The second paper, “Gambling Away Stability: Sports Betting’s Impact on Vulnerable Households” adds another dimension to the story. Authors Scott Baker, Justin Balthrop, Mark Johnson, Jason Kotter, and Kevin Pisciotta analyzed consumer transaction data from over 230,000 households, comparing measures of financial stability, including credit card balances, credit card debt, and bank overdrafts. Overall, they found that “legalization leads to substantial increases in sports betting that do not come at the expense of reduced gambling or consumption.” In other words, gamblers weren’t replacing their weekly poker games with sports gambling, they were betting more overall. They also found that increased sports betting actually replaced investment in the stock market. Roughly, they estimate that $1 of betting reduces net investment by around $2.

Just like the authors of the first paper, Baker and his team found that low-income gamblers disproportionately saw negative effects. Households with lower savings balances spend 32% more on gambling as a share of their income than high-savings households, and households with a history of bank overdrafts spent twice as much as a share of their income as those who did not. Overall, this led to higher credit card balances and less available credit.

The major sports gambling websites have recently created an organization dedicated to supporting “responsible betting.” While this may be better than ignoring the issue outright, their business model simply is not built on responsible betting. In New Jersey, 5% of bettors place nearly 50% of the bets and 70% of the money. Gambling sites’ profits come from extracting losses from those bettors — just like a casino.

As prominent elections prognosticator and noted gambler Nate Silver said in a recent Bloomberg interview, these companies are “hiring MIT aerospace engineers to figure out how to get you to spend more,” and the “lower end of the market is definitely predatory.”

What the mobile gambling industry wants next

In a single word, expansion.

There are 20 states that still don’t allow legal mobile sports gambling. Unlocking those markets and adding tens of millions of gamblers to their apps is obviously critical to boosting profits. That’s why the gambling industry has spent millions lobbying state lawmakers and hundreds of millions supporting ballot measures.

However, the path toward legalization hasn’t been a linear success story. Voters in California shut down the most expensive ballot campaign in history, which sought to legalize sports betting, back in 2022. And opposition from Native American casino groups has made it clear that the most populous state in the country is unlikely to allow mobile sports gambling anytime soon. Efforts in Texas are also facing an uphill battle; legalization will have to earn a supermajority in both chambers of the state legislature, and then be approved by voters via referendum. That’s a lot of veto points, but the Texas Sports Betting Alliance — the main industry lobbying group in the state — thinks it will pass in 2025 when the legislature reconvenes.

The industry will continue lobbying, state by state, until online sports gambling is legal everywhere. But it’s important to understand what the end game really is here. They don’t just want to put a sportsbook in America’s pocket, they want people to have access to the whole casino.

Internet gambling, or “iGaming”, as the industry calls it, refers to apps or websites that offer slots, blackjack, and every other casino game imaginable. It’s currently legal in seven states, and since it was never subject to a federal ban, states like New Jersey and Delaware have had it since 2013.

In an interview last year, New York Times journalist Ken Vogel called legalizing iGaming the industry’s “holy grail” and referenced a speech from the CEO of DraftKings in which he thanked a conference of state legislators for legalizing sports betting, but told them it’s time to add iGaming — “not in the future, but now.”

Other industry executives have gone on record saying this, too. According to Cesar Fernandez, a senior director at FanDuel, “Online casino games should prove increasingly attractive as federal post-pandemic aid dries up and states look for new revenue without raising taxes on their residents.” Legislators in states like New York and Maryland have echoed that logic in their own pushes for legalization, saying it was critical to use that money to pay off the state’s budget deficit.

Unlike sports gambling, we don’t have any aggregate data on the financial harms of mobile casino gambling. And while they can all breed addictive gambling behavior, it’s probably important to distinguish between luck-based casino games like slots, and skills-based games like poker.

However, we know that in New Jersey, Connecticut, and Pennsylvania, where iGaming is legal, calls to gambling addiction hotlines increased by 100 to 300 percent in the months following legalization. If we follow the logic from the new research papers outlined earlier, it’s reasonable to infer that this negatively impacted those gamblers’ credit scores and replaced positive investment activity. The extra money is mighty tempting, but state legislatures need to be clear-eyed about the likely psychological and financial costs attached to those tax dollars.

What can realistically be done to limit mobile sports betting?

We understand that this is a complicated issue. Online gambling will still exist regardless of an individual state’s position on legality, and it’s understandable that states don’t want to let those transactions go untaxed. But the evidence clearly shows that legalizing mobile sports gambling significantly increases betting activity that is harmful to consumer financial health, and steps need to be taken to put some common-sense guardrails in place.

Our “holy grail” for legal sports gambling is to limit wagering to actual physical locations, whether that’s a bar or a casino. This will reduce the accessibility of sports gambling, and hopefully tone down its overall cultural salience.

However, a more realistic step is for every state with legalized mobile sports gambling to start holding some legislative hearings.1 Hollenbeck, Baker, and their respective co-authors should submit their papers as evidence, and the executives of these companies should be forced to answer some tough questions about how their product harms consumers. FanDuel and DraftKings must have a trove of data on the betting habits of their customers. This should be made accessible to researchers in order to ensure that we understand the full extent of the problem.

Filling in the research gaps — understanding financial impacts, or even figuring out the relationship between gambling advertising and gambling consumption — will help policymakers craft policies that will help protect at-risk bettors.

Congress also has some room to act here. The reason gambling policy is what it is today is Murphy v. NCAA, a 2018 Supreme Court ruling that overturned the Professional and Amateur Sports Protection Act (PAPSA) of 1992. PAPSA was designed to outlaw sports betting in the United States, but the law was unconstitutionally structured: Instead of making sports betting a federal crime, PAPSA said that states were not allowed to legalize gambling themselves. The majority opinion concluded by noting that “Congress can regulate sports gambling directly, but if it elects not to do so, each State is free to act on its own.”

So what are some options for federal action?

Rep. Paul Tonko of New York has a bill that includes some common-sense measures. His SAFE Bet Act would:

Ban gambling advertisements during sports broadcasts

Ban bookmakers from accepting more than five deposits from a customer within 24 hours or accepting deposits via credit card

Prohibit the use of AI to offer individualized promotions to bettors

Authorize research from the Substance Abuse and Mental Health Services Administration

In an email, Rep. Tonko noted that the National Problem Gambling Helpline Network “has seen a 45 percent year-over-year increase in calls to their helpline, and it’s estimated that at least 7 million Americans have a gambling problem — though that number is likely to be much, much higher.” But Tonko also made sure to emphasize that he doesn’t want to outright ban the practice, he merely wants more responsible, “less addictive” gambling.

Those are all great steps that would offer some pretty wide-guard rails to prevent truly hazardous sports gambling behavior, while giving state legislatures room to craft policies that are best for their individual state. Some further federal actions could include:

A levy on each leg of a multi-leg bet (called a parlay) to discourage bookmakers from offering enticing bets that customers are extremely likely to lose

Restrictions on offering “free money” promotions to gamblers with a demonstrated financially irresponsible betting behavior

Require that gambling companies disclose what percent of players lose money and how much so that consumers can make informed choices, similar to how we require cigarette packages to include warnings about lung cancer

These are rough policy outlines, not specific prescriptions. But we now have clear data showing that online sports gambling produces undeniable harm, and it’s time that more of our political leaders take notice.

My underrated-but-sneaky way to drive gambling companies out of business:

Right now they're allowed to ban winners- successful gamblers who regularly beat the house. That means that consumers can literally only lose and never win. Once you factor that in, the line between 'gaming' and 'straight up kind of a fraud' gets pretty blurry. What's the distinction then between gaming and a pyramid scheme? It's not a game of chance if, again, by company policy you can literally never win. What's the 'chance' part of a game that's stacked against you? How is that different from already-illegal frauds like a Ponzi scheme?

Solution- make it illegal for gaming companies to ban winners. Will a very small percent of regular winners put DraftKings et al out of business then? The quants, the Wall Street guys & gals, the MIT professors, and so on. Gosh it would be a shame if the market happened to work out that way

¯\_(ツ)_/¯

Nate Silver made a good point the other day about how gambling shouldn’t be easy and should involve “friction”. That’s how I think about most vices like alcohol, porn, sex work etc. My libertarian sensibilities do not like making potentially harmful things illegal simply because they are bad but requiring some hoops offers a type of reasonable control. You will never stop the hardcore addicts but you can gate on ramps and encourage off ramps for harmful behavior.