To means-test or not to means-test

Better fewer programs, but better

Something people like to argue about on the internet is whether programs should be means-tested or universal. It’s often not entirely clear what’s meant by this, since universalists tended to praise the pandemic direct cash transfers, but they were in fact means-tested. The fact that a means-tested program appealed to people who say they don’t like means-tests suggests that the conversation actually admits of some nuance.

But to lay my cards on the table, in principle I do not like means-testing.

To me, ideal program administration is like a library or a park or a bus — there for everyone. Some of these programs charge user fees under certain circumstances. But there’s no “sorry, buddy, you’re too rich for the library.”

And I think there are two main reasons for this. One is that income-verifying everyone before they can check books out of the library would be annoying. The other is that it’s sort of useful to benchmark public services in terms of “do politically empowered middle-class people find this usable?” If your library is so crappy that only the most destitute people actually use it, then you are providing the poor with a really bad library. If your library is popular with users from all walks of life, then that means you have a good library.

This idea, however, bleeds into a popular-on-the-internet idea that I don’t really think holds up, and it’s the idea that universal programs are more politically sustainable. The phrase often used here is that “programs for the poor become poor programs” — i.e. the first on the chopping block because their users aren’t politically powerful enough. I think that view of politics is much too simplistic and makes people think that means-tested programs get created because their designers are idiots or something. The much simpler reality is that taxing the non-rich is very politically unpopular, and while taxing the rich polls better, it’s still an uphill political struggle. Faced with competing priorities, there’s always a strong case for trying to do things cheaper.

Means-tested programs do fine

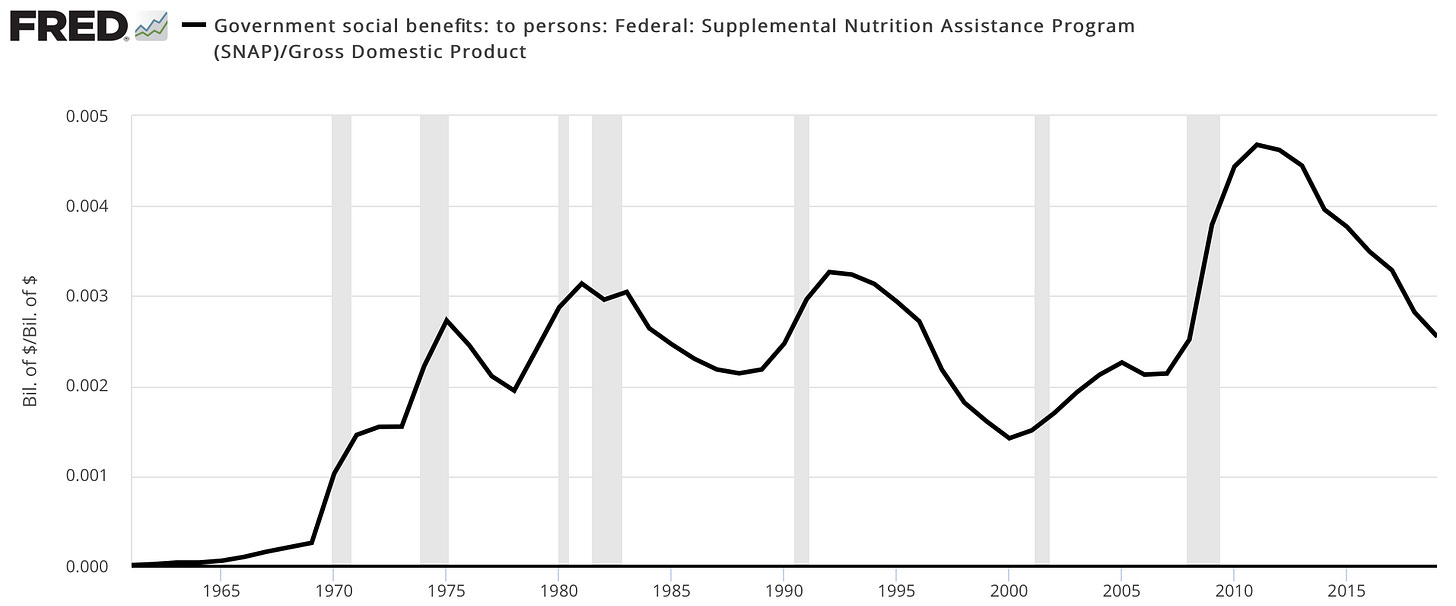

Just to take an example, here’s spending on the Supplemental Nutrition Assistance Program (SNAP) as a share of GDP over time. What you’ll see is that it fluctuates a lot with the business cycle, and also that it’s become a slightly bigger program over time. So even though the early-Reagan peak in unemployment was a little bit higher than the Great Recession peak, SNAP spends much more during the Great Recession and subsequent recovery than it did during the early Reagan years.

I use this not because SNAP is the greatest program success story in the world, but because it has so few of the characteristics that people casually associate with political sustainability. It goes only to the poor, it doesn’t come with work requirements, and it’s almost as flexible as cash assistance.

Yet it endures for three crucial reasons:

Status quo bias is just enormous in politics and changing things is hard.

Voters actually are fairly sympathetic to the plight of the poor and want to help.

Everything benefits some non-poor person, and in this case grocery chains and Walmart lobby on behalf of SNAP.

The same basic dynamic exists for tons of means-tested programs. Medicaid has expanded dramatically since its inception, the Earned Income Tax Credit has become more generous, and the maximum Pell Grant size has risen. The Affordable Care Act’s subsidized exchanges turned out to be less successful than the law’s architects had hoped (a huge share of the good done by the ACA turns out to have been the Medicaid expansion), but they have proven durable, and they got a temporary increase in generosity from the American Rescue Plan that may prove sticky.

With any one of the examples of a means-tested program that’s expanded considerably over the past 30 years, you can pick nits.

Child Tax Credit (pre-Biden) and Earned Income Tax Credit are designed to exclude the poorest.

SNAP has really only grown a tiny bit.

Healthcare programs are so different from cash that people may evaluate them differently.

But I think the aggregate picture is just overwhelming. There is a general tendency toward welfare state ratchet where program expansions are hard but program rollbacks are harder. And it’s also worth saying that universalistic programs aren’t necessarily immune from rollback — back in the high water of right-wing politics during Reagan’s first term, even Social Security got cut a bit.

Means-testing is fine as a political strategy; the problems are of substance.

It’s hard to make means-tested programs work

The one means-tested program that really did get rolled back was Aid To Families With Dependent Children, which as we have discussed before was so sharply means-tested that a poor woman who got a job would see a dollar-for-dollar replacement of earnings with lost benefits.

With modern programs, we are much smarter than that and schedule the phase-outs to be considerably more gradual. Still, because you have multiple different programs that all have their own phase-out schedule, the overlap can become a big deal. Melissa Kearney and co-authors for the Hamilton Project found that “a low-income, single parent can face a marginal tax rate as high as 95 percent” when they looked at this about eight years ago.

There was a big flurry of talk about this back in Obama’s second term, and Robert Greenstein and Sharon Parrott published a corrective noting that even though this is theoretically possible, it’s actually a rare situation. Due to lack of funding, only a quarter of households who are eligible for Section 8 housing assistance actually get it. And funding for the Temporary Assistance for Needy Families (TANF) program is so stingy that only a vanishingly small minority of eligible families actually get help. Program uptake for the other means-tested programs is better than that, but it’s not 100% in any case. The upshot is that this Kearney-type scenario is actually pretty rare and you shouldn’t let those kinds of dramatic pictures dominate your view of the welfare state.

Still, I think concerns about the incentive impact of phase-outs should exist even if we’re talking about de facto marginal tax rates of 50 or 60% rather than 90.

When you’re talking about really rich people, I think it’s easy to tell a story where high rates don’t significantly impact effort. The executives at Apple and Google and Facebook and the big partners in private equity, hedge fund, and VC firms all obviously like money. But they’re also playing a game of status and competition with each other in which money serves as a kind of scorekeeping. Mark Zuckerberg isn’t planning a big new purchase if Facebook stock has a great year in 2021. He’s a competitive and driven person in a high-status role and he wants to rule the world. When these guys do step away from their companies, it’s normally to try to become even more famous and important as philanthropists, not to go sit on the beach.

But a person earning 150% of the federal poverty line isn’t doing a fun or glamorous job. She’s working for a living. Getting into the 95th percentile of diligentness among her coworkers and garnering a promotion into a higher-paying role doesn’t land her on the cover of magazines. She’s not going to be invited onto podcasts to speculate about whether we’re living in a simulation. The point of her efforts would be to earn more money. And when a huge share of those extra wages gets clawed back in the form of lost benefits, that’s a real bummer.

What’s more, one of the main reasons this isn’t as big of a problem in practice as it could be in theory is that the system is so confusing and people don’t necessarily realize what the phase-outs are.

A world of hassles

Back to the Greenstein/Parrott piece: they are making a valid point but also a poor defense of the system. After all, the fact that only a quarter of Section 8 eligible families actually get housing vouchers is bad. Progressives, including at CBPP, have spent years calling for full funding of Section 8 and praising the Biden campaign for promising to try to deliver it. Ideally, we’d want to see SNAP, EITC, and CTC participation at 100%. We want everyone to participate in the ACA exchanges. And if we achieved those goals, the marginal tax rate problem would get worse.

The causation here also goes in both directions.

In practice, outside of a few cities you rarely see an affluent person riding the bus in the United States. But to exclude the rich from the bus would require that everyone provide income verification before boarding, which would be a huge pain. The need to pass various income and asset tests is hardly the only administrative burden in the American welfare state, but it is a significant one. As Annie Lowrey writes eloquently, these burdens constitute a collective time tax that has manifestations for people all up and down the income ladder but that tends to fall especially harshly on the poor.

But the healthcare system is a very salient middle-class example. Providing healthcare primarily through employers means that maintaining continuous coverage requires an annual modest hassle around re-enrollment and a larger set of paperwork every time you switch jobs.

The upside you get for this is lower taxes. Instead of paying a Value Added Tax that would raise the cost of all the goods and services we buy, non-poor Americans accept lower salaries (because employers are subsidizing our health insurance), lower take-home pay (because we’re paying premiums), and higher out of pocket costs. But we also have to do all this paperwork. It strikes me as a bad trade, all things considered. Yet the aggregate size of the healthcare system is so large that a big bang transformation feels clearly infeasible. With smaller programs that’s not the case. But the lure of low taxes remains.

Taxes are very unpopular

Proponents of a more social-democratic model of governance tend to talk as if Democrats are just being dupes and morons by proposing programs with complicated phase-ins or weird backdoor subsidies rather than cleaner spending or taxes. Who cares if some rich people who don’t really need help get benefits; you can just make them pay taxes!

And indeed you can, but politically speaking, raising taxes is really hard. For starters, any kind of tax increase on the non-rich is politically toxic. Carbon taxes are a great idea, but they literally poll worse than defunding the police. Congestion taxes, similarly, are conceptually unimpeachable, but we’re only now on the verge of implementing them in New York City alone because the politics is so tough.

Taxing the rich polls much better, but the toxic politics of taxing the non-rich perversely make it difficult to tax the rich. Because the thing that polls well is not “highly progressive revenue increases,” it’s “literally no non-rich people need to pay more.” So something like treating capital gains as ordinary income, which overwhelmingly hits the rich, doesn’t qualify because some non-rich people do have capital gains. Then, even when you successfully gerrymander your tax proposal to only hit the rich, you start getting complaints about specific classes of rich people. A farm that generates a low six-figure income is worth millions of dollars, but can we really pass an estate tax increase (or close the stepped-up basis loophole) on “family farms?”

Now my view is yes, we can tax the family farms. And the small business owners too. But that’s in part because I don’t share the intuition that it’s inappropriate to ever raise taxes on middle-class people. Given the level of inequality in the United States, I’d like to see tax increases be progressive in the sense of generally falling hardest on the rich. But I’d also like to see an efficient, well-designed tax code rather than one with dozens of carveouts to try to make sure that only the most villainous of fat cats are paying more.

But that’s just another way of saying that the reason Democrats don’t govern like social democrats is that very few people in America actually have the social-democratic ethic.

And by the way, that extends to a lot of soi-disant leftists. You’ll find democratic socialists denouncing gasoline tax increases everywhere they’re proposed. In the abstract, these people will often praise the Nordic social model. But in Sweden, the gas tax is nearly $2.50 a gallon, which not only raises revenue but helps explain why Stockholm has such high mass transit ridership for a city of its size. There is just no political movement in America that is actually pushing this agenda because there’s nowhere in the country that it’s viable.

The value of focus

Given that means-tested programs aren’t doomed politically and that tax revenue is scarce, I am sympathetic to the argument for means-testing as a way to save money.

I would note, though, that with the expanded Child Tax Credit, the Democrats parked themselves in an odd place. By excluding the richest 3% or so of the population, they didn’t really save that much money. But you still generate the full administrative burden of income eligibility. It would really make more sense to either not means-test at all, or else to means-test more aggressively and reduce the cost.

In this case, my preference would be to avoid means-testing. I think eliminating the administrative burden is valuable. But I also like that without a means-test it is a pure subsidy to larger families, which I think makes sense conceptually.

My critique of where Biden-era Democrats are going is that it seems they are trying to advance on too many fronts simultaneously. Setting aside climate-related goals and democracy-related concerns to just focus on the welfare state, they are trying to tackle the CTC but also ACA subsidies and also making Medicare more generous while also addressing college affordability and increasing child care subsidies and also also a big new home care subsidy for the elderly or disabled and also also also doing big expansions of housing assistance and federal assistance to poor schools.

On some level, what’s not to like? This is all fine as an aspirational agenda. But when aspirations crash into reality, you need to cut some stuff. And the current thinking in the party seems to be that if you can implement your dreams, you should do half-assed versions of everything.

That to me does not make sense. The 2020 elections neither gave Democrats gigantic congressional majorities nor terrified the GOP into feeling it had to support a progressive agenda. That’s too bad. But Democrats can still do some stuff. What I’d like to see them do is to take their best idea, the expanded CTC, and make the biggest and best possible version of it. Then these other ideas can live to fight another day. But right now, we’re in a universe where the moderate members really don’t want to vote for $6 trillion in tax increases, and the leadership doesn’t want to tell anyone “no.” But that kind of politics of prioritizing coalition management over decision-making isn’t going to ever get us out of the hole.

But fundamentally, I don’t think there’s a super-easy answer here. The same narrow congressional majority that makes it hard to raise $6 trillion also means that nobody’s vote is dispensable. And while Joe Biden is a very effective politician on some levels, he’s not a visionary who’s pounded the table on behalf of specific ideas. So I think we’re probably stuck with an undesirable muddle.

I’m a little surprised at student loan forgiveness wasn’t included in this conversation. I’ve seen a lot to talk about means testing and student loan forgiveness on Twitter. And then I’ll compare it with other programs. Which I always get annoyed at since the other programs like Social Security a universal, whereas student loans our only held by a minority of the population, and a large part of that minority are better off than average.

I am a huge proponent of the refundable child tax credit. Personally I think it’s sort of dumb to means test it, but I understand the political calculations around it. I don’t look at the child tax credit as a welfare program. I look at it as investing in the future of the country. Theoretically a rich person’s kids in a poor person’s kids will contribute equally, even if we know in practice that it’s more complicated than that.

I’ve learned a lot about welfare programs in the last year and a half, because my daughter became a single mom. And then a full-time student. This is the list of programs that she benefits from: and value per month.

GI Bill (mine) $1326

Pell Grant (full amount) $520

Article 32 Housing (cheap rent) $400 savings

WIC (free milk and stuff) $100

SNAP (food stamps) $200

Medicare (health care for my granddaughter… she is covered under me) $100

Subsidized Child Care (500 a month for full time day care) $500

Work Study (Part-time job she qualifies for because of income) $400

Student Loans (Probably didn’t need this, but we took it anyway just in case they forgive it and it’s a cushion) $500 (6K total)

Various scholarships targeted at single moms or low income. $50

CTC $300

$3896 per month not including student loans since she might have to pay that back. Or $45.5K a year.

Note, the G.I. Bill pays her tuition separately so I did not deduct that.

She got $6000 of student loans. But that money is sort of set aside for emergencies. And we hope it will be forgiven.

I have to confess, she is not doing poorly. But qualifying for many of these programs, and doing the paperwork is a chore. It’s not super easy for everything.

And just in case there’s anyone who resents all this welfare, she is going to school for mechatronics. It’s only a two year program. And then she will end up as a woman in a STEM field making good money.

No, I really don’t help her that much.

The father is Scottish, so no chance of child support.

The article 32 housing, was pure luck. I happened to walk into the apartment complex which was where her child care place was located at and just ask. And they happen to have a rare article 32 housing apartment coming open. We jumped on it. And if anyone has seen the news, I don’t know the Boise he has had the highest rent increase in the country. Up 39%.

I should mention that she qualifies for all of this, despite me making a good living, because she is a single parent. Once you become a parent, they no longer penalize you for your parents income.

She has healthcare on my plan until she hits 23 because she is a full-time student. But she’s about to start her last year. So she will graduate at 22.

Oh yeah. She is getting straight A’s, and kicking ass.

Totally lost track of the whole purpose of my post. So I’m going to end it here.

Yes this post was dictated on a iPhone. So forgive any grammar or spelling mistakes.

I think the entire tax code and conversation has gone off the rails. My parents make about 70k and pay about 7% effective income tax (and less last year if you count all the stimulus checks they received and didn’t need, as they are no longer working and on Social Security. )

I have been lucky and worked hard, and I pay something like 45% all in. 45% seems appropriate. I’d even be fine with 50% or 55%, but not if all the services added are means tested. The CTC pisses me off. That’s the kind of rhetoric and legislation that makes me want to vote Republican (if there were any Romney or Jeb type republicans who weren’t crazy).

Matt is right in a pragmatic sense of what can pass, but it would be great if lawmakers change the rhetoric to make things less an “everyone against the rich” and more about how these programs will lift up everyone. Change the narrative and see if we can get buy-in for broad-based service increases for broad-based (progressive) tax increases.