I'm worried about Chicago

Slowing national population growth plus remote work spell big trouble for Midwestern cities

The large hedge fund Citadel announced last week that it’s leaving Chicago.

That’s hot on the heels of two even larger companies, Boeing and Caterpillar, departing for greener pastures. This has naturally prompted a lot of narrowly partisan and narrowly political bickering in and around the state of Illinois. But stepping back, I think it’s an opportunity to reflect on some more fundamental issues. In particular, while the shift to remote work is a challenge for all kinds of places, I think it’s a dire threat to places like Chicago that were affordable but slow-growing before the pandemic.

These are the kinds of places that get discussed least in the American discourse, which tends to pay a lot of attention to the struggles of the expensive coastal metro areas (New York, Boston, Seattle, San Francisco) and the fast-growing Sun Belt ones (Atlanta, Houston, Dallas, Phoenix). But as we are reminded every time we look at the Electoral College, there are still a lot of people living in these low-cost, slow-growing parts of America. Of these places, Chicago is by far the largest. And while it’s perhaps not quite as economically successful as Minneapolis or Columbus, it’s also clearly the economic center of the region.

So if Chicago enters a downward spiral — which I think it will — that bodes poorly for a whole bunch of other central cities but also I think really for the region as a whole.

Expensive cities are going to get cheaper

I grew up in Manhattan, a place I love, but everything in Manhattan is impossibly expensive — including both the housing and the office space.

This to me is a really good reason not to live in New York. But how did it get so expensive? Well, there was a lot of demand for New York, but that demand ran up against what’s known in economics as “inelastic supply.” In other words, it’s really hard to build more. Some of that is due to fundamentals; the economics of knocking down a building that is already enormous in order to replace it with an even more gigantic building are really bad. But a lot of it is due to zoning, historic preservation, and other supply constraining policies.

The low supply elasticity means that when demand for NYC surged, the response was much higher prices and a slightly larger supply.

A city like Houston, where the history and policy are different, has seen the other outcome: a huge surge in the number of homes (and people) and only modest increases in price. All things considered, the Houston way is better.

But one thing New York does have going for it is that even though Midtown is currently unusually empty due to the Zoom shock, it shouldn’t stay empty for too long. Before the pandemic, Midtown Manhattan office space was very expensive due to high demand and inelastic supply. Now that demand for office space in general has fallen, the price of Midtown office space will fall a lot, but at the new cheaper prices you’d still expect someone to lease it. Ultimately, all the retailers serving the office commuters should have customers. And the same thing happens on the residential side. To the extent people leave the city now that they no longer “have to” live there for work, the price will fall, and someone else moves in at the new lower price.

This price adjustment is a problem for the tax base, and local officials might completely bungle it. But it’s fundamentally a solvable problem. There is tons of “shadow demand” for both dwellings and office space in New York.

This is to say that I expect post-pandemic New York to more closely resemble pre-pandemic Chicago — a city that was poorer than New York but that had very appealing big city amenities and noticeably lower prices. The first two times I went to Chicago, all I could think about was, “why doesn’t everyone move here?” Then I went in February and I found out. But still. For anyone who liked cities but wasn’t a billionaire, it had a lot of appealing qualities. But that greater affordability means that Chicago doesn’t have the same cushion in the face of a relative decline in demand compared to America’s exurbs and rural areas.

Chicago housing might get too cheap

Housing costs are up a lot nationally as part of overall inflation, which can create sort of distorted impressions of what’s going on. I’ve spoken to Realtors, for example, who were under the impression that the D.C. real estate market was “going crazy” at least until recent Federal Reserve interest rate hikes.

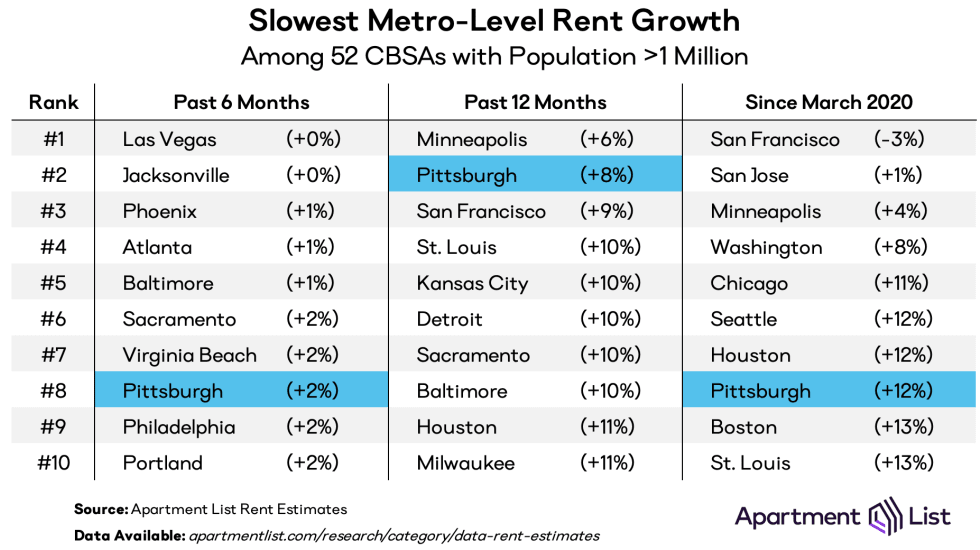

In reality, though, the D.C. area’s 8 percent increase in rents is one of the smallest in the country. There’s been a large relative decline in housing demand in D.C., but in the context of overall rising prices. The right way to think about this is that metro areas like D.C., the Bay Area, Seattle, Chicago, Houston, and St. Louis have gotten cheaper relative to the national average, relative to wages, and relative to the cost of construction.

If you zero in on the city of Chicago, as opposed to the metro area, you can see that it’s gotten cheaper since the pandemic struck and people place less of a premium on convenient commuting access to the Loop.

And while cheaper is in some ways good, it can actually be bad if your city was already cheap. Before the pandemic, Issi Romem wrote a great analysis that compared the cost of houses in different metro areas to the cost of building a house. Places with very high ratios on this chart are places where land is super-expensive and new housing is hard to build. That’s bad. Then there’s a healthy Chicago/Atlanta zone where homes are more expensive than construction costs, but only a little bit more expensive.

But then you have the Detroit Zone where the cost of buying a home is less than the construction cost of building one.

Once a city slips into this zone, bad things happen. Suddenly if you’re a landlord, it doesn’t make sense in cost-benefit terms to do timely repairs on your building. If you’re an owner-occupant, you’re of course going to treat yourself better than a profit-seeking landlord would and so you do the repairs anyway. But that just means your house has become a sinkhole for money and sweat equity. Construction jobs tend to vanish. If a home gets foreclosed on or becomes badly damaged, there’s a tendency for it to become vacant, dealing a blow to the city’s tax base and creating a source of blight. If your home value to replacement cost ratio is really high, then a negative shock to demand just means the city reaches a new more affordable equilibrium. But if it’s already modest, as it was in Chicago pre-pandemic, then you can easily tilt into a cycle of decline.

The downward spiral

When cities start shrinking, things can get really bad.

The tax base shrinks, but legacy pension obligations don’t, and the ratio of taxes to public services becomes worse.

With the number of customers in structural decline, it’s harder for any local restaurant or retail business to succeed, so people with aspirations to found their own business tend to migrate elsewhere.

Under-used infrastructure is wasteful and expensive to maintain.

Because the existing stock of buildings isn’t worth replacing or refurbishing, your city’s capital base wastes away.

We have seen lots of examples of this happening to American cities, mostly in the midwest but also in a lot of smaller northeastern industrial cities. Sometimes a city in decline turns around the way Boston and New York have, by reinventing themselves as information-age havens. But this is the exception rather than the rule, and I think it’s also more attributable to good luck1 than to any smart policy choices made by the leaders of those cities.

Chicago becoming distressed is potentially very dire because so many other midwestern cities were already depressed before the pandemic, and their central business districts will be experiencing similar blows from remote work. And since cities are impacted by the cities they’re connected to, Chicago joining the cycle of decline will, I think, tend to drag down Detroit and Cleveland and St. Louis.

San Francisco vs. Austin and New York vs. Miami have a kind of fun regional rivalry dynamic that is intensified by the fact that these cities symbolize larger ideological trends. But the entire Midwest slipping deeper into a funk as its cities decay and its biggest employers depart is just depressing, and people don’t generally seem to want to talk about it.

The rising tide we don’t have

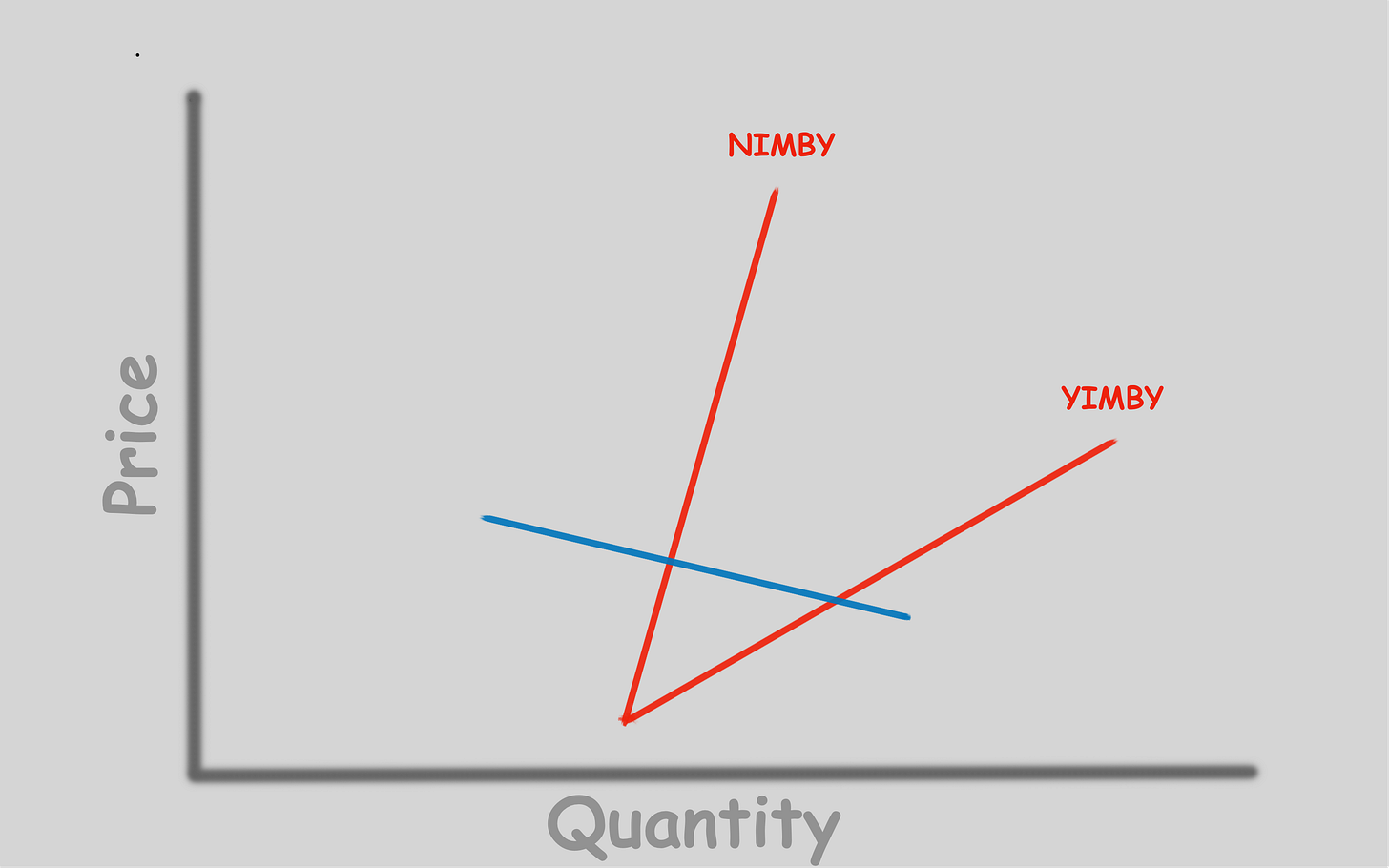

Someone is sure to say, “You’re always complaining about NIMBYs and how the rent is too damn high and now you’re telling me it’s bad if Chicago gets cheaper?”

The thing to remember is that in this post, we’ve been talking about prices falling due to a fall in demand.

That’s different from prices falling due to an increase in the elasticity of supply.

My general view is that whether we’re talking about labor or housing, restricting supply in order to raise prices is a terrible idea. But prices rising due to strong demand is good. The problem facing Chicago and other midwestern cities is that low demand is not an affordability strategy — it’s a recipe for failure.

And the solution, fundamentally, has to come from outside the region. The only reason that falling relative demand for Chicago is translating into falling absolute demand for Chicago is that overall American population growth has slowed to a crawl as the once-robust flow of immigrants has turned into a trickle and the birthrate has continued to decline. In the longer run, we should be doing much more to support parents and children. But in the shorter term, the country would benefit from significantly more immigration. I’d be thrilled to defer to immigration skeptics about exactly which immigrants we let in and under which terms, but it should be more people. Make them speak English, make them pass some public charge test, make them have college degrees or score over 100 on an IQ test or whatever you want.

But it ought to be more people. Per capita GDP in Illinois is higher than Norway and more than 50 percent higher than Italy, to say nothing of the many countries around the world that are poorer than Italy. Whatever Chicago’s problems, there are billions of people on the planet who could secure superior opportunities in life by gaining permission to live there. And there could be big advantages to the United States in accelerating our population growth rate rather than allowing cities with below-average demand to slip into spirals of decline.

See Ed Glaeser’s “Reinventing Boston,” 1640-2003. Basically, 21st-century Massachusetts was very lucky that 17th- and 18th-century Massachusetts made large investments in education for religious reasons that happened to pay off economically hundreds of years down the road.

I live in downtown Chicago (the Loop) after moving here from Boston in 2012. I work at a museum, wife runs a farmer's market business and daughter is in CPS while doing ballet on scholarship at Joffrey up the street. We don't own a car. I was always optimistic about here because it had all the big, modern city things with low prices. If you want to live a city life in the USA and are not rich, Chicago was your last chance. I don't think that has gone away.

Budgetary governance has improved in the 10 years I've been here (from abysmal to adequate) as have schools. My daughter attends a regular community (not selective enrollment) public elementary school and has had a terrific experience.

MY alluded to it, but the lakefront is AMAZING. I can't think of a single big city in the world that set aside it's entire waterfront for the public good and refuses to allow construction on it. DuSable Lakeshore Drive is one of the most beautiful drives in the country. Some of the best architecture on one side, and wonderful parks, beaches and lakes on the other. It really needs to be more well known as one of the USA's best jewels.

But crime is changing the brand of the city. If that continues I worry. At my museum we are seeing members fail to renew because they are worried about "driving downtown". And I don't know how to fix it. The police have basically stopped doing their jobs (arrests are down like 60% or so) and are hyper right-wing.

Construction is still going on all over the place in my community (South Loop). A 50+ story residential building is going up 2 blocks away and it began *after* the pandemic. So that's a sign that investors still believe at least. One local rumor is that some of the older office buildings in the financial district will be renovated into residential units.

Our host needs to be a little more careful with supporting statements. Yes, Caterpillar is moving its corporate headquarters but not from Chicago. The company has been headquartered in Peoria for a lot of years. Boeing's move is yet another example of senior management doing stupid things. The company left Seattle following the merger (another stupid move) with McDonnell Douglas) to in part get away from unionized workers at their main plant in Washington state and secondarily to capture a host of tax breaks offered by Illinois. Those conveniently expired this past year necessitating another move to capture more breaks, this time to Northern Virginia.

In both cases, the number jobs leaving the state are modest and principally executive and not manufacturing (I'm pretty sure Boeing does not have a manufacturing presence in IL while Cat certainly does).