Don't ignore Republicans' awful budget

More debt, big Medicaid cuts, and trillions in regressive tax cuts

To start with some self-criticism: Back when the American Rescue Plan was coming together, I thought that if American fiscal policy “overshot” somewhat on the demand side, that would have positive consequences for American politics. Interest rates would rise to contain inflation (this happened) and people would find the higher interest rates annoying (this also happened), and then, as a result, the political system would return to being worried about debt and deficits.

I thought that this would be good, because it would force us into a more real politics, one that wasn’t so dominated by pure symbolism — we would be dealing with hard fiscal tradeoffs and less culture war nonsense.

This did not happen, at all.

Joe Biden and the Democrats surprised me by not returning to the classic Obama/Clinton message of balanced deficit reduction. I found this incredibly annoying, because when Obama was president, the conventional wisdom among pure political hacks was so strongly in favor of a deficit reduction message that the White House ran with it, even though it was inappropriate to the economic circumstances and Obama’s economic team was mixed on the substance of it. But just a few short years later, the conventional wisdom among political operatives had pivoted so hard against deficit reduction that they weren’t focused on it even when it was substantively warranted. The came the debate, the candidate swap, and what I hoped would be a chance for Kamala Harris to shake the etch-a-sketch and ditch Biden’s extensive set of proposals for new spending in favor of a “reduce the deficit and bring down interest rates” message.

She declined to go down that road. Trump won. And now, while a million crazy things are happening in the executive branch, congressional Republicans are moving forward with a fiscal agenda that is incredibly irresponsible and will add trillions in debt, despite DOGE’s efforts to saves pennies through measures like refusing to help Milwaukee address unsafe levels of lead in their public schools’ drinking water.

Republicans are telling some people that there will be trillions of cuts to social safety net programs while promising other people that there won’t. But all possible versions of the GOP fiscal agenda result in huge increases to the budget deficit. In some, those increases are partially offset by cuts to programs for the poor; other times the deficits are just really large. But every version involves the opposite of sound Obama-style deficit reduction.

What we should be doing is aiming for balanced fiscal consolidation: higher revenue and lower spending, while trying to shelter the most vulnerable from the impact of cuts.

But Republicans want to reduce revenue, raise the deficit, and ensure that the pain of budget cuts falls on the vulnerable.

Republicans’ confusing budget moves

This has all been a bit hard to keep track of, but the first mover in Republican budget drama this year was the House of Representatives, which passed a resolution calling for $4.5 trillion in tax cuts partially offset by big cuts to Medicaid and SNAP.

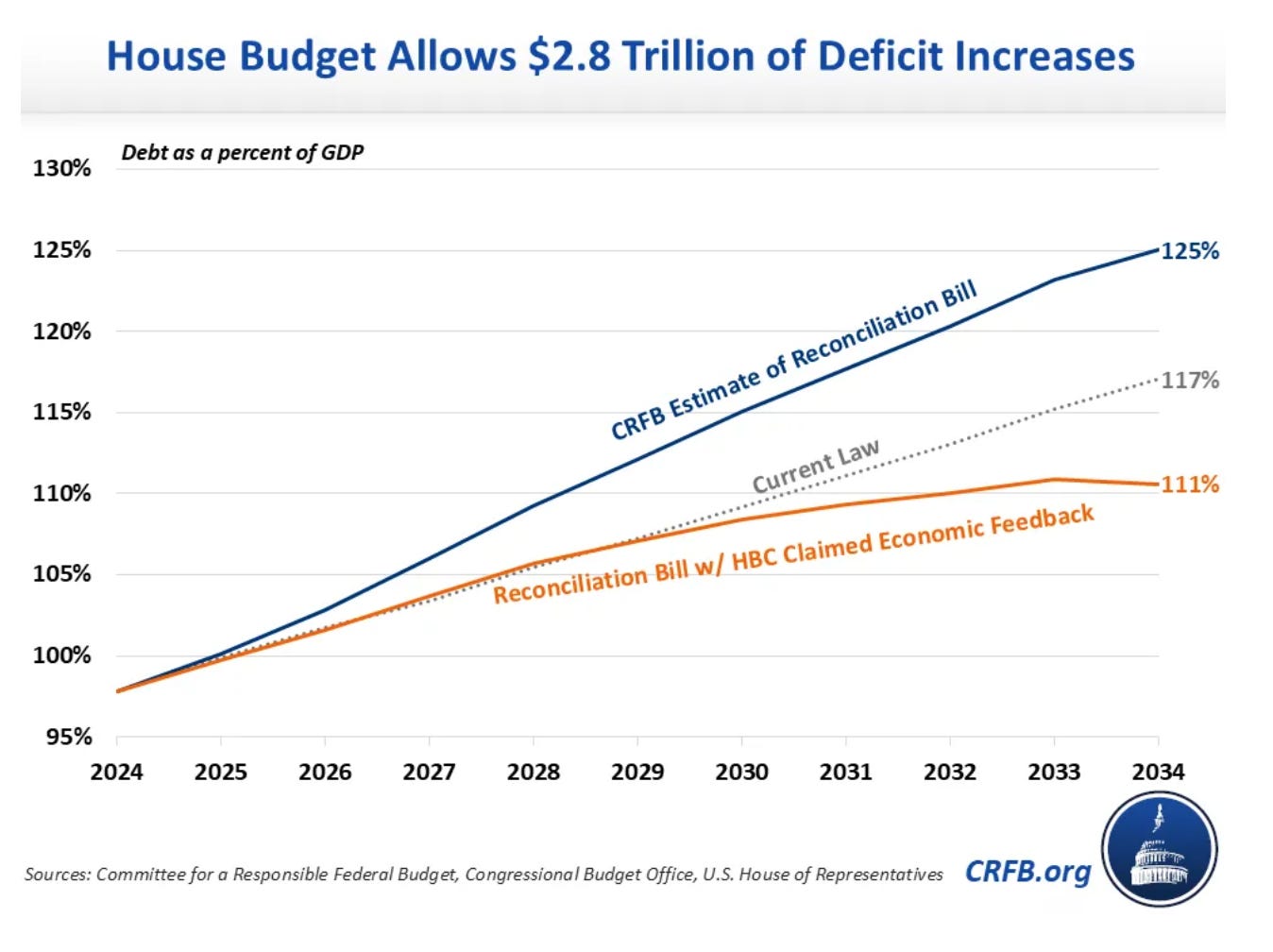

This ultimately amounted to roughly $2.8 trillion in deficit increases that they chose to pretend would actually reduce the deficit via magical levels of economic growth.

The way this was written, the biggest spending cut by far is TBD but needs to come from the House Energy and Commerce Committee. This is the committee that is responsible for Medicare and Medicaid, and the only way to achieve cuts of that scale would be to cut Medicare or Medicaid. Republicans have sworn up and down that they don’t want to cut Medicare, and their draft “menu” of spending cuts is full of different ways to cut Medicaid, so in practice, this is a plan for huge cuts to Medicaid.

But the Senate didn’t have the stomach for that.

So instead they wrote reconciliation instructions that call for increased military spending, increased spending on immigration enforcement, and $5.3 trillion in tax cuts, offset by a token $4 billion in spending cuts. The fiscal consequences of that plan are truly dire, doubling the pace of debt growth and likely incurring around $1 trillion in extra interest rate costs alone.

Of course, the House and Senate can’t just pass different laws.

So House leadership went back to get their members to agree to the Senate version. Right-wing members of the caucus objected to the absence of spending cuts, but eventually flip-flopped and helped pass it after both House and Senate leaders made informal promises to cut spending.

Right before the vote, Speaker Mike Johnson said, “Our two chambers are directly aligned; we’re committed to finding at least $1.5 trillion in savings for the American people while also preserving our essential programs.”

As pure legislating, this doesn’t make any sense.

The House already passed a budget resolution with $1.5 trillion in cuts, and then the Senate didn’t agree with it, so they came back with the no-cuts budget. Then the House passed the no-cuts budget, even with the Speaker explicitly saying he wants cuts.

They’re talking out of both sides of their mouth in a desperate effort to hold their slender margins together. But turning this into a kind of Schrödinger’s Budget Resolution is also making it harder to criticize them. By continuing to advance this legislation procedurally while hiding the ball in terms of its actual contents, Republicans have thus far managed to avoid it becoming a central political story. I’m always fond of pointing out that the actual low point of Trump’s term one approval ratings was not during any of the major scandals or controversies of his presidency, it was when the news agenda was dominated by ACA repeal and the Tax Cuts and Jobs Act.

Suggesting this has been a deliberate effort to keep the budget out of view is perhaps giving too much credit to a shambolic process. So far, though, it has been largely out of view, which is good for Trump and Republicans, but bad for America.

A good time to worry about the deficit

The gyrations in the bond market since “Liberation Day” have attracted a lot of attention. We are accustomed to situations in which stocks go up and bonds go down (“risk on”) or else the opposite, where stocks go down and bonds go up (“risk off”), the presumption being that American government bonds are a quintessential safe asset. Trump’s erratic policymaking seems to have undone this dynamic, and now stocks and bonds either both go down (when Trump does something crazy on trade) or both go up (when Trump backs away from the craziness).

These kind of market moves are interesting and important. But the bigger issue here is the basic cost of financing federal debt.

Interest payments as a share of GDP were really high in the 1980s as a result of Ronald Reagan’s bad fiscal policies, but they fell steadily in the 1990s and were consistently low for the first two decades of the 21st-century. This was a long period in which I thought deficit concerns were overhyped. But then interest rates went up under Biden, so debt service costs soared.

The good news is that by 2024, this was leveling off rather than continuing to rise.

With inflation largely in the rearview mirror, it seemed like we should have been set for interest costs to start declining, and then maybe Congress could do something useful on the budget deficit. Instead, Trump has us heading in the wrong direction.1 Tariffs are poised to push inflation up and make it harder for the Fed to cut interest rates. These GOP tax bills are incurring a ton of new debt that will be much more expensive to finance than the debt originally incurred by the Bush tax cuts or during Trump’s first term. And dumping it into a climate of already rising interest rates and diminished confidence in the basic soundness of the United States risks pushing interest rates up further.

This is of more than just budgetary interest.

Loans to the federal government are inherently safer than any other kind of dollar-denominated loan. So when the federal government’s borrowing costs rise, the interest rates on things like mortgages and corporate bonds go up too.

You can’t “re-industrialize” the country (or even do something more prosaic, like create construction jobs) if you’re wrecking the underlying finances of the country.

And that’s what these budgets would do. Annoyingly, Trump seems to have convinced a healthy share of the public that this is why DOGE is a good idea. In reality, DOGE is saving minimal sums of money — sums that are largely offset by things like Trump’s giveaways to Medicare Advantage plans — while pursuing ideological vendettas and centralization of power. But even Elon Musk’s claim that he can cut spending by $150 billion is trivial compared to the scale of the tax cuts congressional Republicans are aiming for.

Boring us into oblivion

I have to admit that I struggled writing this article.

“They’re going to do a bad budget” is not outrageous in the same way that mistakenly sending a man to prison in El Salvador and then pretending you lack the authority to comply with a court order to bring him back is outrageous. Even in the economic policy sphere, it’s just not as riveting as the tariff drama, where Trump’s endless see-sawing and the whipsaws in financial markets are grimly fascinating.

At the same time, I am extremely concerned that Republicans are either going to bait-and-switch a second time on these budget resolutions and enact draconian Medicaid cuts after all, or else plunge ahead with the hyper-irresponsible Senate version, provoke some kind of bond market crisis, and then push for doomsday cuts to the social safety net.

And while the whole point of the budget reconciliation process is that nobody can stop the Republican Party from doing either of those things if that’s what they want to do, I really do think we have an obligation as a public to pay attention to this and not just treat it as tedious legislative arcana. Health insurance for millions of people and the basic financial wellbeing of millions more is on the line. It’s not an affront to Econ 101 or to the rule of law in the way that so many other Trump outrages are, but it is nonetheless incredibly high stakes for the future of the country.

Right now, though, there is essentially no clarity on what’s actually in this legislation, even though it has cleared several procedural hurdles.

One interpretation of that, highlighted in this Politico story, is that there are just a lot of unresolved questions. At each step down the road, leadership has made promises to different blocs of members — promises that are often contradictory. In principle, that means the whole thing could collapse in a humiliating way at any time.

My concern, though, is that at the last minute, the White House will step in, make a bunch of decisions, and then when Trump says “vote for this,” the whole caucus will go do it the same way they defer to Trump on everything. In this scenario, there will have been almost no scrutiny of exactly how much is added to the deficit and how much is cut from Medicaid and where else those cuts are.

I’m acutely aware drafting this column that it’s hard to make all of this compelling when I can’t tell you exactly whose interests are being threatened.

Are they going to screw with the FMAP formula in a way that is devastating to low-income people in blue states? Or, are they going to mess with Medicaid expansion dollars in a way that screws over West Virginia, Kentucky, and Arkansas? The former makes the vote math easy in the Senate (there are basically no blue state GOP senators) but very hard in the House (a huge share of their vulnerable frontline members are from New York and California). The latter is in some respects safer for the midterms, but asks many GOP Senators to cast votes that would be quite damaging to their own states. Or they can just do it the way that doubles the national debt, with all the downsides that entails.

Whatever choices they make, there will be ample political vulnerability. The suspicion that Republicans favor the interests of rich people and will make your life worse in order to indulge them is the enduring vulnerability of the GOP. And that’s exactly what’s happening here. It’s extremely hard to organize against a budget bill that’s so full of blanks, but I’m afraid that unless we start talking about it now, we’ll have final text sprung on us too late to get anyone engaged.

While the Biden administration’s lack of interest in deficit reduction disappointed me, Harris’s proposals were all “paid for” and designed to at least avoid making things worse.

I have interacted with so many people who believe that because DOGE exists, the administration will be bringing deficits down rather than expanding them significantly (despite all evidence to the contrary). Can’t tell you how many times I’ve heard some form of “it’s refreshing that somebody is finally doing something to balance the budget!” Even if you show them the charts of planned deficits in the House reconciliation plan, there is a ton of psychological resistance to believing what the GOP is really up to.

DOGE may be an ideological project but its main function appears to be as an extremely effective political smokescreen.

I think one thing that everyone is missing is that when the budget process started to now the bond market has changed. The tariffs broke the exceptionalism of US debt. The bond market is going to look very differently at a largely unfunded tax cuts than they might have previously and reaction is probably going to be more like Truss tax cuts than people expect.

Republican's can obviously ignore the bond market but that will only make everything else more difficult and given the US credit market there is likely to be immediate pain felt by everyone.

Doesn't mean that Democrats should rely on the bond market discipline but it will factor into making the process a lot hard that Republican's admit.