Mitt Romney's child allowance plan is pretty exciting

But can he actually get Republicans on board with this?

In “One Billion Americans” and more recently in “What The Inflation Contrarians Get Right and How to Fix It,” I advocate for the creation of a universal child allowance — a cash benefit that would go to the parents of all children, with perhaps a larger bonus for parents of the youngest kids, to help offset the considerable costs of child-rearing.

This is an idea that’s been percolating for some time in progressive circles (see this old Dylan Matthews article), and under Justin Trudeau, it crossed over from Europe into Canada. A bunch of Democratic Party senators pushed for a version of the child allowance idea under the heading American Families Act, and Joe Biden is also proposing a one-year version of a child allowance as part of his COVID-19 relief plan.

One of my big ideas in “One Billion Americans” is to try to take conservative values seriously but try to show how progressive policy specifics are often the best way to do that. A child allowance to me fits that bill perfectly, and I really recommend “The Conservative Case for a Child Allowance” from my Niskanen Center colleagues Samuel Hammond and Robert Orr.

And now Mitt Romney has stepped up to the plate with a legislative proposal that looks like the universal child allowance proposal even more than the Biden plan. Because of the way Romney pays for the plan, Democrats aren’t going to like it. But I think the right way to think about it is that Romney is trying to pay for the plan in a way that Republicans might find acceptable. If he can get some actual Republicans with votes in Congress (so far he’s doing a lot better with columnists) to agree with him about that, then it would be a great opportunity for Democrats to do some dealmaking. If not, then Romney at least sets a bar that progressives should try to exceed when they outline a plan for a permanent version of the one-year mini-boost from Joe Biden.

The big idea — cash for kids

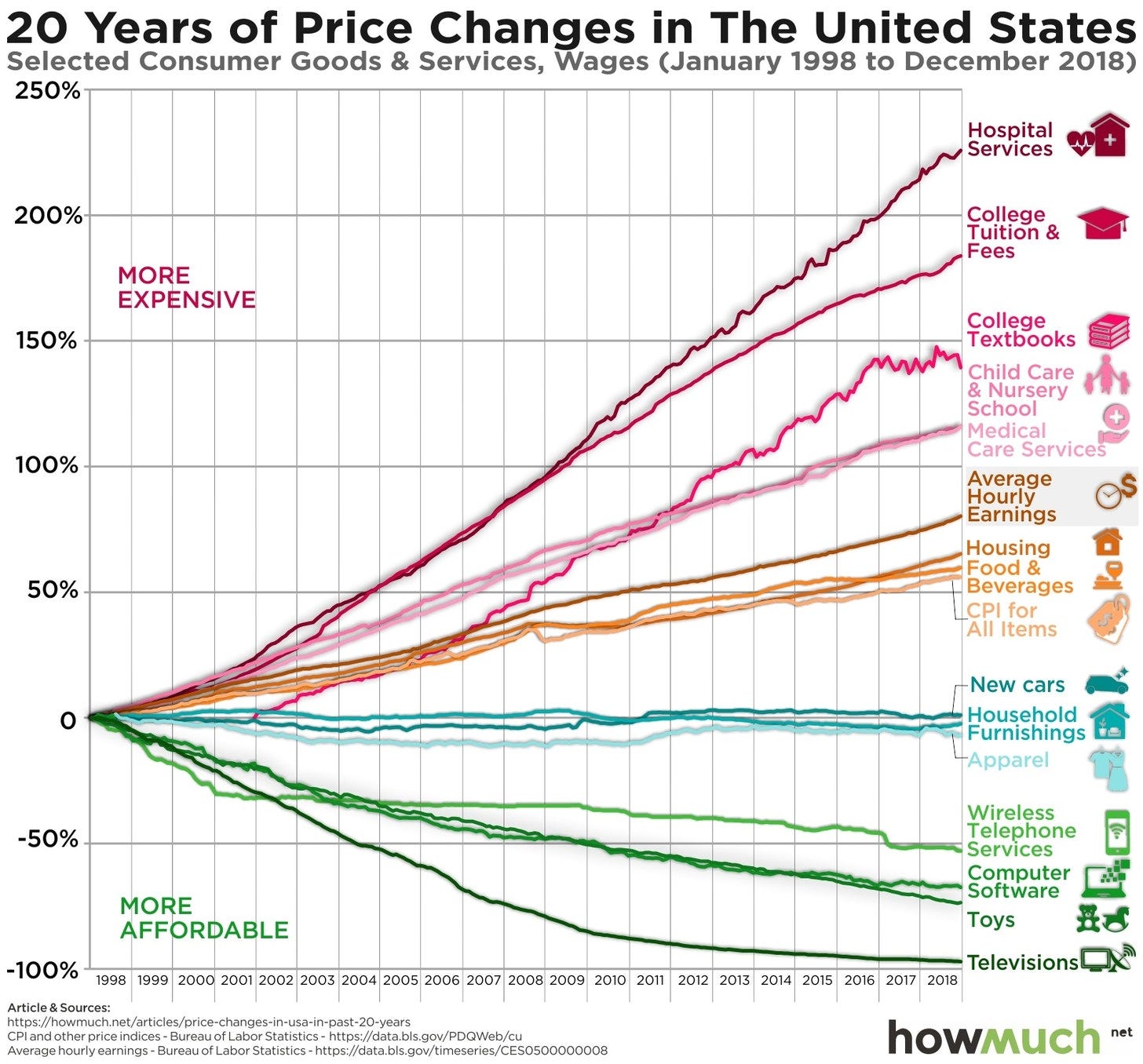

The way I think about this (which is admittedly different from how it’s normally framed in D.C. policy circles) is that for Baumol’s cost disease1 reasons, the price of stuff related to raising children rises over time at a faster-than-average rate.

Translated from economics to English, we have a lot of technological improvements in the world that make things cheaper. But while maybe someday we will have robot nannies, for now, technology has not really done much to make it cheaper to supervise children. And the impact of that is visible in the skyrocketing cost of not just of what we formally call “child care,” but also after-school activities, summer camps, and basically anything else where the existence of smartphones doesn’t change the fact that you want a certain number of grownups around to watch the kids.

The Fed’s view of this is that the rising cost of raising children is offset by the fact that today you can get a 4K television, broadband internet, and a bunch of streaming services for really not much money. And that’s correct from a monetary policy perspective.

But to a normal human being, a social change in which over time people find it harder and harder to raise families and instead stay home alone watching Netflix is bad.

Some people don’t want kids, which is fine. But lots of people say they wish they’d had more kids and they tend to cite financial reasons. We have Social Security to make sure that people can enjoy a decent retirement. And for broadly similar reasons, we ought to have a child allowance — Social Security for parents, if you would — to put flexible financial resources in the hands of people who need it. And while Social Security isn’t strictly “for” low-income people, it does have the happy consequence of creating a situation where the poverty rate for the elderly is lower than the overall national poverty rate, whereas the poverty rate for kids is much higher.

From welfare reform to refundable tax credits

The basic problem of children and poverty is that if your household has more kids in it, you need more income to not be poor.

But for various biological reasons, people generally have children well before they reach the peak of a normal adult American’s earnings curve. And in a practical sense, having kids at home makes it harder to earn market wages even though you need them more. That’s the basis of the quasi-traditional postwar family division of labor where Dad specializes in market work while Mom takes care of the kids and handles other domestic tasks. This does not work well for modern families, and in particular single parents frequently struggle to combine adequate labor market income and discharging their family responsibilities.

The United States used to have a program — Aid to Families With Dependent Children — that provided cash assistance to low-income single parents.

But because AFDC was originally conceived as income support for widows, the program had very steep benefit cliffs that discouraged both work and marriage. Indeed, in most cases an AFDC recipient who increased her labor market earnings would see 100% of her market wages deducted from her benefits, which is so insane it’s hard to believe, but it really happened.2 The spectrum of open-ended government support for non-working, unmarried mothers (generally stereotyped as Black, though in fact, most recipients were white) proved to be politically toxic. And though the most straightforward solution would be to spend more money to prevent these benefit cliffs, Congress had just enacted deficit reduction packages in 1990 and 1993 that paired spending cuts with tax increases, and nobody was in the mood to spend more. So instead we got “welfare reform” by replacing AFDC with the Temporary Assistance to Needy Families program.

The structure of TANF is such that it provides barely any help to anyone, and we now have more “deep poverty” among children than ever.

But welfare reform was successful as a political program. Bill Clinton was resoundingly reelected in 1996. In 1997, we got the S-CHIP program to help give poor kids health care. That same legislative package also created the Child Tax Credit, which gives financial assistance to parents but only if they have labor market earnings. The Earned Income Tax Credit (which, likewise, helps low-income families but only if they have labor market earnings) was expanded in 2001 and then again in 2009. The Supplemental Nutrition Assistance Program was expanded in 2002 and then again in 2009. We’ve also seen several rounds of Medicaid expansion and the Affordable Care Act, plus some expansions of the Child Tax Credit and the creation of something called the Child and Dependent Care tax credit.

The basic post-AFDC political consensus, in other words, is that you can give in-kind services (Medicaid, SNAP) to non-workers but that cash benefits (CTC, EITC, CDCTC) are only for workers. This consensus has started to break down in recent years as the Trump administration (in a reversal of Bush’s approach) let states attach work requirements to SNAP and tried to do the same for Medicaid. Democrats, meanwhile, have pushed to expand the CTC down the chain by making it “partially refundable” and now in their current proposals “fully refundable.” The current Biden proposal goes so far down the road of turning the CTC into not-really-a-tax-credit that not only would it be available whether or not you work, it would be received on a monthly basis (i.e., like a Social Security check rather than a tax refund), even as it’s still formally structured as a tax credit.

This fits a kind of political logic of path dependency and wanting to be able to say “no, no, no, no we’re not just bringing back welfare,” but Romney — who, as a Republican, has some political cover — has the opportunity to straightforwardly structure it as a social insurance payment.

Mitt Romney’s plan explained

The basics of Romney’s plan are pretty simple.

Parents get:

$350 per month ($4,200) per kid age zero to five

$250 per month ($3,000) per kid age six to 17

Benefits begin to phase out for single people if their income is over $200,000 a year and for married couples at $400,000 a year — with the phaseout structured as a tax season clawback, so you still see the full check.

Total benefits are capped, so families with over five or six kids (it depends on their ages) will end up not getting extra money.

Compared to the current CTC, this is way better, offering more money to a wider set of families as well as a simplified administration.

The question, of course, is how are you going to pay for it. This is important because pay-fors are more than an afterthought. During Barack Obama’s second term, there was a pseudo-consensus between the White House and Paul Ryan that EITC benefits for people who aren’t custodial parents should be expanded. But there was actually no prospect for an agreement here because Obama was proposing to do this on top of other income supports for low-income families while Ryan was insisting on doing it instead of other programs that weren’t linked to work.

The situation with Romney’s plan is not nearly so extreme.

But he has chosen pay-fors that conservatives like and Democrats won’t — consolidating not just the CTC but also what’s left of TANF and the bulk of the EITC into the new program, while also completely eliminating the State and Local Tax (SALT) deduction. Put a pin in the SALT deduction because progressive wonks won’t defend congressional Democrats’ position on this, but it’s still important in practice.

The EITC piece, by contrast, is simple. Biden’s one-year Child Tax Credit expansion will be better for low-income families than Romney’s proposal because they get it without losing their EITC (or TANF, to the extent they exist) benefits. The case the folks at the Center on Budget and Policy Priorities have been making is that Congress should pass Biden’s plan as part of the larger COVID-19 relief package, and then the new super-CTC should be made permanent in a way that’s paid for by raising taxes on the rich rather than clawing back subsidies for low-income workers. There is a lot of heat on this topic on left-of-center Twitter, where some people see the simplification benefits of the Romney approach as so large that it outweighs the considerations CBPP is offering.

I would simply flag for readers that there is less analytic disagreement here than the fighting would seem to suggest.

Romney’s proposal is better for low-income families than the status quo.

Biden’s proposal — if made permanent and paid for through a hypothetical tax increase on the rich — would be even better for low-income families.

Romney’s plan, separately, appeals to people who have strong critiques of tax credit administration problems.

By contrast, Romney’s critics on the right have a strong view that any support of cash assistance to non-workers is a mistake.

The right’s evidence-free work argument

Marco Rubio and Mike Lee have both been supportive of CTC expansion in the past, and I think there was hope on the center-right that they might support Romney’s undertaking. In fact, such support was not forthcoming, and they came out of the gate swinging with the argument that “an essential part of being pro-family is being pro-work. Congress should expand the Child Tax Credit without undercutting the responsibility of parents to work to provide for their families.”

Scott Winship, the director of poverty studies at the American Enterprise Institute, likewise blasted Romney’s proposal as a step in the wrong direction, so undermining work that it “would take us back to the bad old days in key ways, and policymakers are playing Russian roulette with low-income families’ wellbeing.”

I emailed Winship last week to see if he had an empirical estimate of the work decline that he thought Romney’s plan would induce or if he could recommend some research for me to read. He wrote back to say that he didn’t want to help me out because I’d been mean to him on Twitter in the past. That’s entirely valid on his part, but it turns out he didn’t have some secret library of relevant modeling that he’d been saving to share with other journalists. So to an extent, we need to assess this debate from first principles.

When conservatives talk about tax policy, they are very focused on incentive effects. The idea is that if Jake the Job Creator has to pay too high a marginal rate, then increasing his earnings isn’t actually very remunerative, so he’ll choose instead to take more vacations or retire early. They are generally less interested in income effects, in which raising Jake the Job Creator’s taxes makes him poorer and thus he needs to work more weeks per year or delay his retirement.

Old AFDC had both kinds of effects — you could get cash without working, so maybe why bother working? That’s an income effect. But also if you did work, you would benefit, so what was the point? That’s an incentive effect.

In a curious inversion of their attitude toward Jake the Job Creator, when it comes to Jasmine the Single Mom, conservatives are now very worried about income effects and don’t really care about incentives. But because Romney’s benefits don’t phase out until you have a six-figure income, he’s really working hard to avoid incentive problems. The reason for Jasmine to work is the same reason I have to try to get more subscribers — she gets paid for working, and in my experience even people who aren’t facing literal starvation like to have money.

I don’t think it’s totally crazy to believe the income effect might be relevant here, but before I made it the centerpiece of my argument against a program that would massively reduce child poverty, I would want to check whether there’s any evidence in favor of my position. Unfortunately, Winship seems to have shot first and started furiously googling for citations later and is now so dug into his position that he cited empirical research on a Negative Income Tax that had an 80% marginal rate as relevant to his argument.

This is an embarrassing situation for Winship, but I hope Republican members of Congress and their staff will recognize that they are potentially working with unreliable information here and ought to try to actually dig into this before they leap to the conclusion that Rubio and Lee got this right. I would also add that empirical work is important here because of not just the magnitude, but because the actual nature of the labor supply response is relevant.

It matters why people don’t work

The empirics here matter for a few reasons.

One is simply that the reduction in child poverty Romney is talking about is very large — millions and millions of children — so I don’t think a reasonable person would want to walk away from that on the basis of 700 people leaving the labor force.

But it’s also important because the nature of the reductions in labor supply matters. The conservative concern about work and poverty, as I understand it, is about the cultural impact of having a lot of kids grow up in communities of concentrated poverty where the normal thing is for people not to work and to rely on government benefits instead. Now economically speaking, one full-time worker dropping out of the labor force is basically the same as two full-time workers going to part-time work. The Congressional Budget Office formally does its labor supply estimates in terms of Full-Time Equivalent workers (FTEs). They judged, for example, that the ACA significantly increased part-time work to the tune of reducing labor supply by two million FTEs — something Republicans in Congress characterized as killing two million jobs.

I’m dwelling on this because it seems very very very plausible to me that Romney’s plan would induce a substantial number of low-wage service sector workers to reduce their hours, cut their child care expenses, and spend more time with their children.

If what you actually care about is work as a cultural norm, this seems completely unobjectionable. Indeed, given standard social conservative views, I think you’d generally see this as a non-pecuniary benefit of Romney’s plan. But if you’re looking for talking points to slag Mitt Romney with, it’s very possible that you’ll get an opportunity here.

Progressives, meanwhile, are sort of torn between two sets of priorities — one which wants to direct more cash subsidies to parents of young kids and one which wants to direct more cash subsidies to purchasers of child care services. I think the former vision is a lot better than the latter, and it’s good that Biden seems to be prioritizing it. My pitch to conservatives would be that the best reason to get on the Romney bus is to encourage Democrats to go further down this money-for-parents road. Because if you smack Romney down specifically on the theory that it’s critically important to force unmarried mothers of school-age kids into full-time work on pain of starvation, then you are forcing Democrats down the latter path, which is much worse for traditionalist families.

Democrats’ objections to Romney, meanwhile, will largely focus on the pay-fors.

SALT in the wounds

The tax code long allowed people to deduct their state and local taxes paid from their federal taxable income. This is highly regressive. Basically all tax deductions are regressive because a given dollar quantity of deduction is more valuable the higher your marginal tax bracket. But SALT is especially regressive because rich people have higher state tax burdens.

That said, blue states have higher taxes than red states and big cities have higher taxes than rural areas, so Democratic members of Congress have a reason to see SALT as benefitting their people.

Perhaps an even bigger issue here is a perception that SALT is a subsidy to high-taxing governments. The idea is that SALT ensures that if a state raises taxes, its residents incur less than 100% of the cost of that tax increase — with the U.S. Treasury effectively kicking in the difference via the tax deduction. Conservatives became very convinced that this interpretation of how SALT works is true, which then turned ending the SALT deduction into the one kind of tax increase on the rich that Republicans could be enthusiastic about. The 2017 Tax Cuts and Jobs Act (TCJA) did not eliminate SALT, but it did cap it at $10,000 per year. Then they used the revenue to offset a permanent corporate income tax cut, which progressives of all stripes were happy to oppose.

But ever since then, there’s been a split between congressional Democrats, who’ve been mostly trying to repeal the SALT cap, and party-aligned wonks who’ve been trying to talk them out of it.

Seth Hanlon’s Center for American Progress report “Repealing the SALT Cap Should Not Be a Top Priority in Reforming 2017 Tax Law” is typical of both progressive wonks’ dislike of the pro-SALT agenda and also the somewhat awkward politics they are navigating in saying so.

In addition to consolidating other anti-poverty programs, Romney’s proposal would fully eliminate SALT and plow that money into the child allowance. That’s why, on net, the proposal is a good deal for the poor despite the cuts to EITC, TANF, etc., because he’s got a substantial progressive tax increase in there to finance a new spending program.

Obviously, “tax the rich to expand benefits for the poor and middle class” is not really something Republicans do.

What the 2017 bill did was tax the rich to enact a tax cut for the rich that conservatives think is better designed. That made it easy for congressional Republicans to say yes and for congressional Democrats to say no. The Romney Gambit is much more difficult for both groups. Nobody in the policy community on either side is saying that SALT repeal is why Romney’s plan is bad. But of course, if the policy community got to decide tax policy on their own, SALT would have been done away a long time ago. In practical congressional politics, it’s a huge deal!

Romney needs some Republican friends

So far, while Romney has not convinced the most mainstream conservative and libertarian policy organizations that his idea is good, he’s done a decent job with the center-right Takes Class.

Ross Douthat: “Why the U.S. Needs the Romney Family Plan”

Cameron Hilditch: “Everyone Should Support Mitt Romney’s Poverty Plan”

Lyman Stone: “I cannot for the life of me comprehend why there would be any hesitancy at all in supporting a deficit neutral plan which fixes a massive marriage penalty and directly supports families.”

Unfortunately, no Republican Party senators or members of the House of Representatives seem to agree with these excellent takes.

And I think that leaves it dead in the water for now.

The question of whether progressives should be wary or enthusiastic about this idea is interesting in an academic sense, but I think not really that relevant. Romney’s proposal is a classic template for bipartisan legislating, as it addresses something a lot of Democrats are very interested in but deliberately tries to do so in a way that’s congenial to Republicans. The administrative side of Romney’s plan in which he runs it out of the Social Security Administration rather than the IRS seems like something that should just be copied — Social Security benefits flow to 97% of eligible people versus 78% for the EITC.

But for the rest, it’s all a question of what happens with the congressional politics. If a decent chunk of Republicans become enthusiastic about this idea but insist on Romney’s pay-fors, Democrats should absolutely embrace a deal on that basis. But as long as that’s not the case, Democrats should keep working on their own plan and let Romney try to drum up some support from somewhere else.

If you want to learn more about this Eric Helland and Alex Tabarrok’s book Why Are The Prices So Damn High is a great center-right perspective on the cost disease and Baumol’s own book The Cost Disease while a bit less readable is more of my kind of social democratic take on it.

In his book American Dream, Jason DeParle compiles suggestive evidence that a lot of off the books work was happening in a way that mitigated the practical consequences.

Hello my fellow nerds and amateur wonks. Is it weird I get excited when I open my email and see a Slow Boring post about child allowance?

First... so recap of my life history... stationed in Europe for 12-years. While there, married an English girl, lived in German and had 2-kids. Because she was a EU citizen, we qualified for kindergeld, aka child money. This was in the last 90s early 00s.

It was awesome. I think it was around $200 to 300 a month per child (I am sure one of you nerds will fact check me). As a young Sgt with two kids, I qualified for the EIC. The kindergeld was invaluable in paying for some of the necessities. I had a lot less financial stress than some of my peers with kids who didn't qualify for the money.

At the time, I remember thinking that this is a "progressive" idea that conservatives should totally steal.

After all, I think there has been studies that show parents tend to become more conservative in their views.

In my various pro-kid twitter wars, singles or those who plan to not have children, tend to argue that why should they pay taxes to support children. I always counter with the argument that its my 5 children who will be paying the taxes and providing the services of taking care of the them when they reach an advance age.

Having kids is tough... man, me and my wife talk shit about them every night. They make terrible mistakes. They are terribly naïve. (I'm just glad that I was the exception and was always right when I was that age ;-)

It's probably cliché to say, but humankinds whole purpose is to reproduce. Even if people choose not to have kids (cowards), I think we all like to think we try and make the world a better place, for future generations.

Also, lately I have got interested in the subject of homelessness among families. We talk about living wages, but even at $15 an hour, a family of 2 or 3 is still going to struggle.

Anyway, sorry I'm not smarter... my kids did it to me.

Have a great day!

When they limited SALT in TCJA, I was pretty upset. My family pays well more than $10,000 in state taxes in New Jersey, and we also pay an awful lot of mortgage interest. Being relatively high income, I figured I was kind of getting screwed.

But we weren't. We aren't even itemizers anymore. The increase in the standard deduction was massive. I think Democratic politicians haven't grappled with the way the increase in the standard deduction really changed the constituencies for various tax deductions--SALT very much included.