Maine should capture the remote work opportunity

From Vacationland to Work From Home Land

I’m back in D.C. today, but it was nice to get away to scenic Brooklin, Maine (yes, the town in John Hodgman’s book) for a few days to visit my dad.

He’s had a house up there my whole life, as did his father before him. Traditionally, I always thought that was something that made sense basically because he’s in an unusual line of work where he doesn’t need to show up to an office. Dad would spend all summer in Maine, but that didn’t mean he was on vacation — it was just a change of scenery from the city, and he could work there just as well as from anywhere. For normal people who only had their few weeks of vacation per year to travel, it just didn’t seem to me like anyone would ever be rich enough to warrant owning a home up there.

But during the Pandemic Summer of 2020, my dad was stuck in California and I was working remotely, so the family was up there all summer. And while my 2021 visit to the house was brief, it did include several workdays during which I just worked.

All of which is a long-winded introduction to the idea that I think an increased level of white-collar remote work (which, again, doesn’t mean every company will go remote, just that we could easily see a tripling of remote work even with most companies not going remote) is going to be a real boon to the Maine economy. Some of that is going to be remote workers actually moving up there. But I think a lot of it will be more like my dad’s situation — a larger fraction of east coast metro-area affluent people choosing to invest in summer homes and choosing to spend more time in them.

So Maine is probably an example of a state where conditions will improve even if the government doesn’t change anything at all. They’ve suffered through a long economic cycle of industrial decline (first with apparel moving to the South before it moved to Asia, then a technology-induced reduction in paper demand) and rural population loss, but things are now probably looking up. That said, I dunno, I’m a policy reform guy and like to think about ways that places could do better, and I think that Maine could do a lot more to maximize the opportunities available to it.

Rethinking state/local tax mix

One defining feature of governance in Maine (similar to the rest of New England but dissimilar from the rest of the country) is that a lot of power is concentrated in the hands of town governments rather than counties. Maine has a handful of unincorporated areas, but they’re basically uninhabited. Nearly 100% of the population lives in one town or another, and the towns “fill the map” and provide almost all governance. These towns are also generally really small in terms of both geographic expanse and population.

In that context, I suspect there are some perverse impacts from the way the towns collect property tax while sales tax revenue goes to the state.

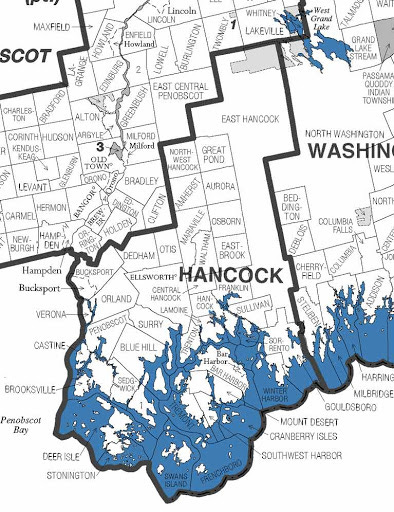

The basic issue is that there’s essentially nothing an inland town can do to generate the kind of property tax revenue that falls from the sky on the coastal towns. If you look at this map of Hancock where I am as I write this, some towns like Castine benefit from tons of coastline while Surry is less fortunate and Otis and Amherst have none.

But towns actually can make decisions that promote a deeper or thinner retail economy. Yet they can’t really internalize the fiscal benefits of commercial development.

So I think there’s a strong case here for huge tax reform:

There should be a statewide land-value tax, with some of the revenue taken by the state government and some of it automatically kicked out to the towns on a per capita basis.

Sales tax revenue should be split evenly between the state and the town where the tax is paid.

Towns should be allowed to tax structures if they want.

The goal here is to simultaneously reduce the inequity between inland and coastal towns, while also aligning incentives correctly so that towns that successfully foster development (whether that’s building structures or garnering retail sales) see fiscal benefit from their efforts.

Seasonal taxation

As long as we’re considering blue sky tax reforms, how about a seasonal variation of tax rates? After all, obviously any hotel or Airbnb owner in Maine is going to charge a higher rate in July than in October, so why shouldn’t the state?

Right now, Maine has a 5.5% retail sales tax that goes up to 7% for lodging and prepared food, and 10% for rental cars.

A change to consider would be to create a high tax season (probably July and August) where the rates are higher than that, and then a low tax season where they are lower. One advantage of this is that a substantial share of summer taxes are paid by tourists or summer people rather than residents. But a further advantage is that with variable taxation, the most price-sensitive year-round Mainers would be able to strategically time their purchases of apparel and durable goods for the low season.

But this isn’t just about taxing tourists. A big problem in the state is that demand for things like restaurant meals is so highly seasonal. Lots of establishments essentially underutilize their fixed capital during the low season by keeping very restricted hours of operation. That’s wasteful. But it also just creates very imbalanced labor market opportunities. Maine is an unusually good state to be a teenager with minimal work experience looking to get a summer job, but it’s relatively difficult to get steady, full-time, year-round work.

Seasonal variation in taxation could try to smooth some of this out in a constructive way — and especially in a remote work context, encourage seasonal residents to perhaps extend their window of time in the state out of the peak season.

YIMBY! (of course)

Maine is obviously not a place suffering from land scarcity or, on the whole, from acute housing shortages.

But Portland has seen rising demand over the past decade and now does have a median value of owner-occupied housing that’s about 50% above the national average. And huge swathes of the city are zoned for 30% lot occupancy, 35-foot maximum structure sizes, and minimum lot sizes of 6,000 or even as much as 15,000 square feet.

Obviously, this is still a small city in Maine that we are talking about, and realistically the demand for multi-family living is going to be limited. And Portland, to its credit, does have multi-family buildings going up in select areas of the city. But precisely because the economics of something like a huge new-built apartment tower are so tenuous in a place like Portland, things like large-lot zoning make a huge difference. The simplest way to add people to a growing city like that is single-family homes on smaller lots or sprinklings of duplexes hither and yon.

Meanwhile, because of its constrained geography, the central peninsula of Portland is already a place with a really solid walk score. The policy should be unlimited mixed-use density in that area, creating a thriving urban hub.

And even though Portland is the only Maine city of any size, it’s not unique in terms of facing some real estate pressure. Touristy towns like Bar Harbor and Camden are expensive, too, and could support modest increments of additional density.

This is really the most important part to get right — especially if you think Maine is going to face a natural “rising tide” of increased remote work. A big influx of skilled workers with above-average incomes should be an economic boon for the state. They will create much more demand for local working-class labor while disproportionately contributing to the tax base.

But what many cities found out during the urban boom of the prior 20 years is that rich newcomers can be a decidedly mixed blessing if their presence generates housing scarcity. You want it to generate a construction boom that employs tons of local craftsmen and bolsters manufacturing. But that only happens if your zoning laws accommodate it.

More parks!

The flipside of this is that while Maine dines out on its natural beauty, it does not feature the kind of extensive public land holdings that we see out west. Instead, Maine has been in some ways counting on underdevelopment to keep Maine appealing, which is not really a sustainable strategy.

What the state needs to do is welcome newcomers and new development while also doubling down on conservation. For a long time, there have been locally controversial plans to try to create a new national park out of what’s now basically timber company land. I think this is an idea that Maine should embrace.

The opposition seems driven by a reluctance to officially give up on the idea of a massive revival in the paper industry, which I think is psychologically and sociologically understandable, but it’s not analytically tenable. Maine’s future is as a lifestyle destination, not necessarily limited to tourism but basically leveraging “gee, this is a beautiful stuff” (especially in light of climate change, etc.) as a key advantage and a second national park would be a big step in the right direction.

Now I think a more plausible objection is that you often can’t hunt or fish in national parks. But the Interior Department does manage lots of kinds of federal public lands where that is allowed. And what I think is called for here is basically a mix of a national park with other categories of preserve that allow for different kinds of sporting and camping activities. I’m not nearly competent enough to draw up a map of what that might look like. But this is a case where I think you don’t want to miss the forest for the trees (ha ha), and the important point is that you want to bring a large share of the North Maine Woods into different kinds of public ownership.

The state should also look into rationalizing the conservation easement situation.

There are a lot of complexities to this, but the basic picture is that if you own undeveloped-but-developable land in Maine, you can create a “conservation easement” — basically a promise not to develop the land — and by doing so, lower the taxable value of the land.

One issue with this is that in many cases, you seem to be giving wealthy landowners a tax break for not developing land that they had no intention of developing anyway. More broadly, the voluntaristic nature of the program means that what gets conserved and what doesn’t is left to happenstance and estate planners rather than advancing coherent goals. To get benefits, you should probably have to actually donate the land. Ideally that would be donated to become part of the state’s public lands, but people love nonprofits, so naturally land trusts would play a role too.

But with real donations, conservation organizations (or the public lands) wouldn’t need to conserve whatever happens to be donated. They could swap donated parcels for other parcels (or for money to buy parcels) in order to execute strategic plans or be better partners to town governments.

Either way, tax reform is important here. Right now many towns view conservation activities as more curse than blessing because they can hammer the tax base of very small municipalities. With more revenue-sharing, this is less of a big deal and you can focus on growth for the whole state.

Clean energy vs. NIMBYs

Last but not least, an issue that’s already quite ripe in the state is face-offs between clean energy projects and NIMBYism.

One huge ongoing fight is about the CMP Corridor project, whose point is basically to bring hydropower from Quebec down through Maine and New Hampshire and into Massachusetts. Both the incumbent Democratic governor and her Trumpy predecessor (and 2022 opponent) Paul LePage support the project. But a goofy horseshoe alliance of conservationists who don’t like construction projects and fossil fuel companies who don’t like hydropower is always trying to kill it.

Naturally, everything is like this. We have Sea NIMBYs trying to block promising offshore wind projects and Tree NIMBYs trying to prevent the conversion of what was very recently farmland into solar projects.

This is not good. In terms of the balance between preserving and exploiting natural resources, I think you need to think in terms of a back and forth. There is just no longer much economic gain to be obtained from heavily logging the North Maine Woods, so in that part of the state, it’s time to double down on conservation and public lands. But there is tremendous demand and social need for clean energy, and that’s worth cutting down some trees for. In the aggregate, this swap is going to mean more forests, a more sustainable energy system, and what’s ultimately a more lucrative economy since paper isn’t coming back anyway.

Be the most remote-friendly state

Basically, though, I think the future for Maine is very bright.

The state has been facing tough economic headwinds for the past several decades that have led to population loss in the northern and eastern parts of the state and left it with a very old and not-so-educated workforce. But it’s beautiful, it has a strong, growing metro area in Portland, and Maine is poised to become a more attractive place for people to live thanks to two of the biggest trends around — a warming climate and an economy that’s more open to people doing white-collar work remotely.

To that end, Maine should just really try hard to make sure state policymakers are on the frontier of whatever kind of policy changes need to be made to facilitate remote work. They should adopt the most remote-friendly policy for state government workers of anyone. They should make sure zoning codes everywhere are as friendly as possible to coworking locations. Whatever call you need to make on the margin about how remote workers are treated for tax and UI purposes, make the calls friendly.

Maine should hope to attract year-round residents whose spending will help stabilize the excessively seasonal economy. But part-time residency is going to be a strong part of the mix, especially for childless workers, and the state should be friendly to that.

But even though I admit this is a lame thing for a policy writer to say, I also think on some level that attitude matters along with policy. It is very rare to have changes that make every single person better off in every single respect. Some people accentuate the negative, and some political cultures come to refract and amplify that kind of negativity. I think the most important thing for Maine is to adopt an attitude that says “a large influx of full-time and part-time remote workers is good for the state and we welcome it” paired with a resolve to change housing policy in Portland and the hottest coastal towns.

Part of the promise and peril of being a state of 1.3 million in a nation of 330 million is that relatively small shifts in national-level population flows can have huge impacts on the state. In the pre-pandemic year, 600,000 people moved to Florida, which was not an unusually large number. Lots of people move to Florida, and that’s been going on for a long time. Obviously Maine is not going to grow its population 40% in one year. But the point is that even pre-pandemic, pre-Zoom, there are plenty of people moving around, and capturing a relatively small share of them could be a complete game-changer for the state.

I just moved to New Hampshire from California as part of a bet on remote work, and that has paid off nicely. The winter was bad, but at this point neither as miserable nor unpredictable as a

California summer. (We had power the whole winter).

You could write a similar article about New Hampshire, though in a lot of respects , we’re already pretty well set up to be a remote work state by having built southern New Hampshire around being a Massachusetts commuter hub.

As a born & raised Mainer, my suggestions would be:

Give the state a fund to purchase old timber company land, and grant small lots to homesteaders who build a structure (not a trailer) there. This would mostly be in the rural 2nd District. Is this a huge-scale solution? No, but it would encourage a certain type of person to move to Maine, and any little bit helps on the margin. This could be funded with a bond, where the lifetime value of new residents is greater than the cost of purchasing the land. Maine was revitalized by a wave of hippie homesteaders moving in the 70s (including my parents!)- maybe the next wave could bring a new generation of off-the-grid types.

More radically, the state could find a financial way to keep recent grads- possibly a rent subsidy? Unlike most poor rural states, Maine has excellent colleges (Colby, Bates & Bowdoin), but of course most grads of elite colleges leave immediately upon graduation. A two or three year rent subsidy to live in Maine maybe could help keep them. It could also benefit Bangor (home of UMaine, a huge college) and Lewiston (home of Bates) just as much as Portland, so the 2nd District might be more amenable if they see a direct benefit to their largest cities