MAGA’s war on the American economy

The jobs report was okay. Trump’s reaction is disastrous.

Last week was a real roller coaster of economic news. It started with MAGA taking an undeserved victory lap over second quarter economic data and ended with the president intemperately firing the head of the Bureau of Labor Statistics over some bad jobs numbers.

The irony of it, to the extent that one can find amusement in the torching of American institutions, is that just as the gross domestic product numbers weren’t particularly good, the jobs numbers weren’t particularly bad. By the same token, while the various trade “deals” the administration has been trumpeting aren’t nearly as good as they’re saying, it is true that they have successfully averted the worst-case scenarios that seemed possible in the immediate wake of Liberation Day.

The upshot of all of this is that Trump is obsessed with superficial indicators of success.

He’s avoided stock market backlash to his trade policies by ensuring that whatever else gets trampled amidst the tariff wars, the AI investment boom is still on track. He’s spinning economic numbers where he can and moving to suppress data where he can’t.

And in addition to political meddling, he’s continuing a pattern of funding cuts that make it hard for statistical agencies to function. The tariffs aren’t going to blow up America’s biggest and most successful companies, but they will exert an ongoing drag on all kinds of businesses that don’t have the clout to successfully beg for exemptions. America’s tax system and social safety net have become much less favorable for the poor. And termites are eating away at the long-term sources of American economic strength.

The economy is slowing down

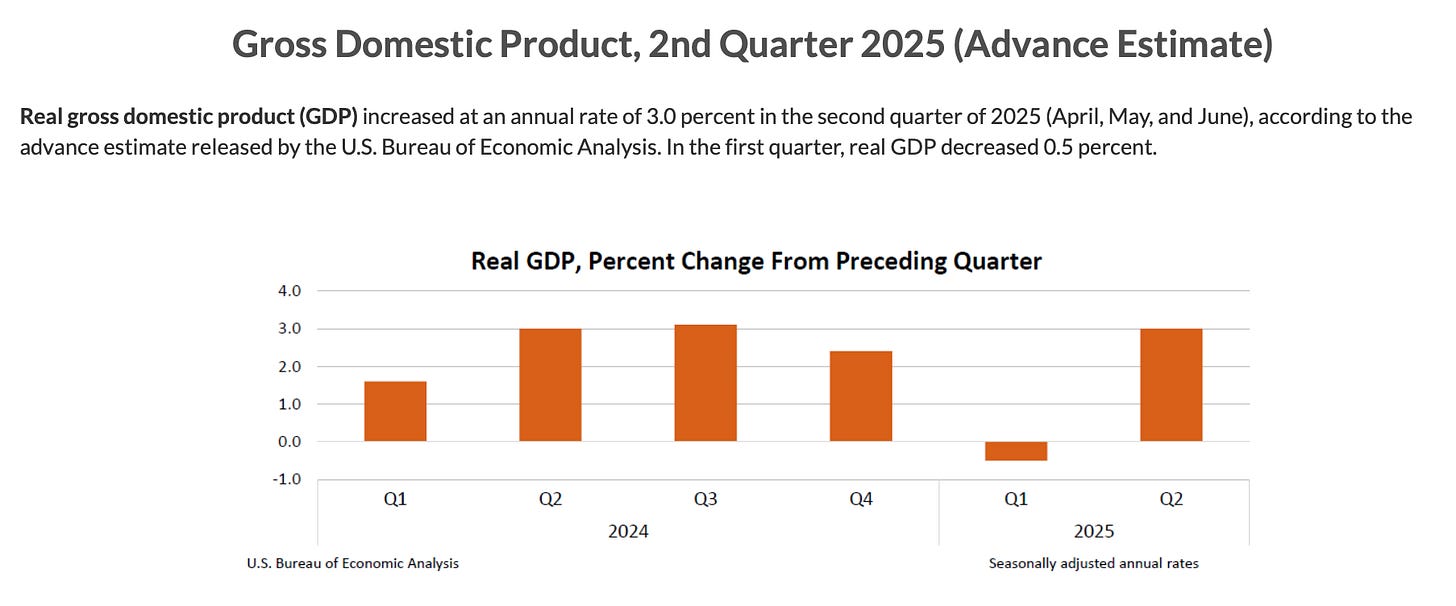

MAGA world reacted with great excitement to the news that GDP rose at a 3 percent annual rate in the second quarter of 2025. But this good second quarter just offsets a terrible first quarter. Now, if you were alive in the United States of America back in March, you probably don’t remember any visible signs of a recession. People weren’t losing jobs in droves. There was a lot of freaking out about tariffs, but no actual economic calamity.

And that freaking out is exactly what you see in the data. In the first quarter, a lot of companies were importing stuff they didn’t actually use or sell in order to get ahead of the tariffs, and this showed up as GDP shrinking. Then in the second quarter, we got a bounce-back. But across the entire first half of the year, the economy grew at a slower pace than in 2024 — and at a slower pace than was predicted before Trump took office.

Last week’s bad jobs report, which showed anemic employment growth over the past several months, confirms this same trend: the economy is slowing.

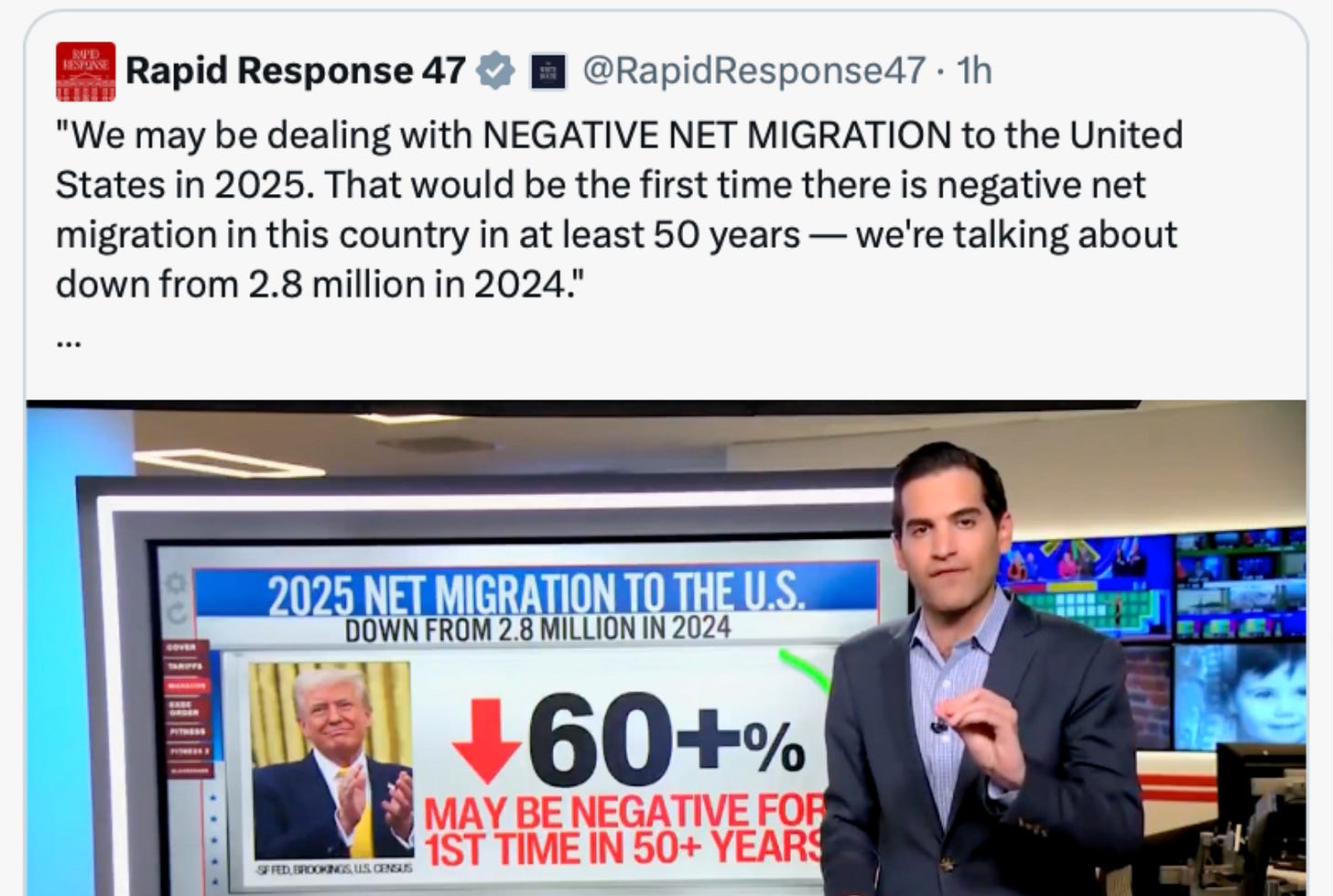

I would note that there’s no big mystery about what’s happening here. If you ignore economic data and look at immigration data (which, unfortunately, is not measured as precisely or as frequently), the White House is happy to brag that it has transformed immigration from a major source of labor force growth to a slight drag. MAGA fans get defensive when you point this out. But slow growth in aggregate employment and a negative hit to GDP growth are obvious results of this policy choice.

If you think this tradeoff is worthwhile because you believe having fewer immigrants creates benefits elsewhere on the ledger, then fine. But it’s genuinely absurd to get mad at the Bureau of Labor Statistics for pointing out that immigration cuts and mass deportation show up in the jobs numbers.

One way of looking at this is that the robust job growth during the Biden years didn’t have the political benefits you might expect because a large share of those jobs went to non-citizens who couldn’t vote. And the anemic job growth of Trump’s second term hasn’t collapsed his political standing because, again, this is mostly a question of people who can’t vote no longer getting hired.

But flipping this around raises the question of why the Trump administration is so convinced that the Fed should lower interest rates.

Inflation is still running above the Fed’s 2 percent target level and has, in fact, gone up recently. Even if you think monetary policy should ignore the impact of tariffs, it’s hard to see the case for a cut.

It’s true that job growth is slowing down sharply, but that’s not because of weak demand; it’s because the administration is strangling labor force growth. It’s never been clear to me what Trump’s team thought would happen if they pulled off their immigration policies. Grandma’s going to come out of retirement to pick up day labor gigs? Residents of depressed former manufacturing towns are going to move to coastal metro areas and work as nannies?

From my baseline of pessimism toward their policies, I’d say that things are working out okay. But a slowing economy with upward pressure on prices and interest rates is what “okay” looks like.

Trump’s tariff deals are bad

During the 2024 campaign, Trump’s platform included a 10 percent tax on all imports. This was a dumb idea, a massively regressive tax that would have a negative impact on American exporters, and it was widely criticized at the time. The Trump administration’s business community supporters would often claim that it was just a negotiating tactic — Trump was going to “escalate to de-escalate” and win big market access concessions for American companies.

Once in office, he began imposing tariffs that were actually more draconian than the 10 percent campaign pledge. But he did say that he was going to try to negotiate deals.

Now, as the text of some of those deals is coming out, we’re seeing a few things. One is that Trump is securing some market access wins for American companies. But another is that he is not interested in negotiating “zero for zero” deals where trade ends up freer than it was before. Typically, Trump is reaching asymmetrical agreements where the United States will, for example, impose higher tariffs on EU exports than the EU imposes on us and the EU agrees not to retaliate. This is pretty impressive as a feat of negotiating, and I do think it serves as a reminder that it’s dangerous to underestimate Trump. He is credibly willing to engage in tit-for-tat escalations that are bad for everyone, and this gets other countries to make settlements with him that are in some sense “unfair” or “lopsided.”

But this success just raises the question of why the United States would find the arrangement desirable.

I think the answer, from Trump’s perspective, is that tariffs concentrate a lot of power in his hands personally. Trump is able to grant exemptions to politically connected companies, and this is good for his personal quest for power and enrichment. But it’s still a bad dynamic for America.

Take this guy from the Montana Knife Company, who initially reacted with enthusiasm to tariffs because they would boost his made-in-America products … only to discover that his costs are rising due to tariffs because he relies on imported equipment and supplies. And Montana Knife Company is almost certainly not in a position to lobby for exemptions.

The initial freakout over Liberation Day tariffs represented a concern about a total breakdown of global trade. What Trump has secured with his deals is a guarantee that big successful American companies such as NVIDIA, Meta, Alphabet, and Netflix won’t be torn apart by retaliatory measures. This is the dominant consideration for the stock market, which is mostly driven by the prices of the biggest and most successful companies. But I do have to note the irony that the endgame of this entire “populist” arc is to skew the American economic model even more sharply toward companies offering intangible services in tech and finance and away from manufacturers, whose competitiveness will be hurt by disrupted supply chains.

Tariff policy as tax policy

One concern I’ve heard lately is that even if tariffs are bad trade policy, the sheer revenue impact will make them difficult for future administrations to repeal. I think it’s way too soon to make a forecast like that — the politics of the next few years are too hard to predict.

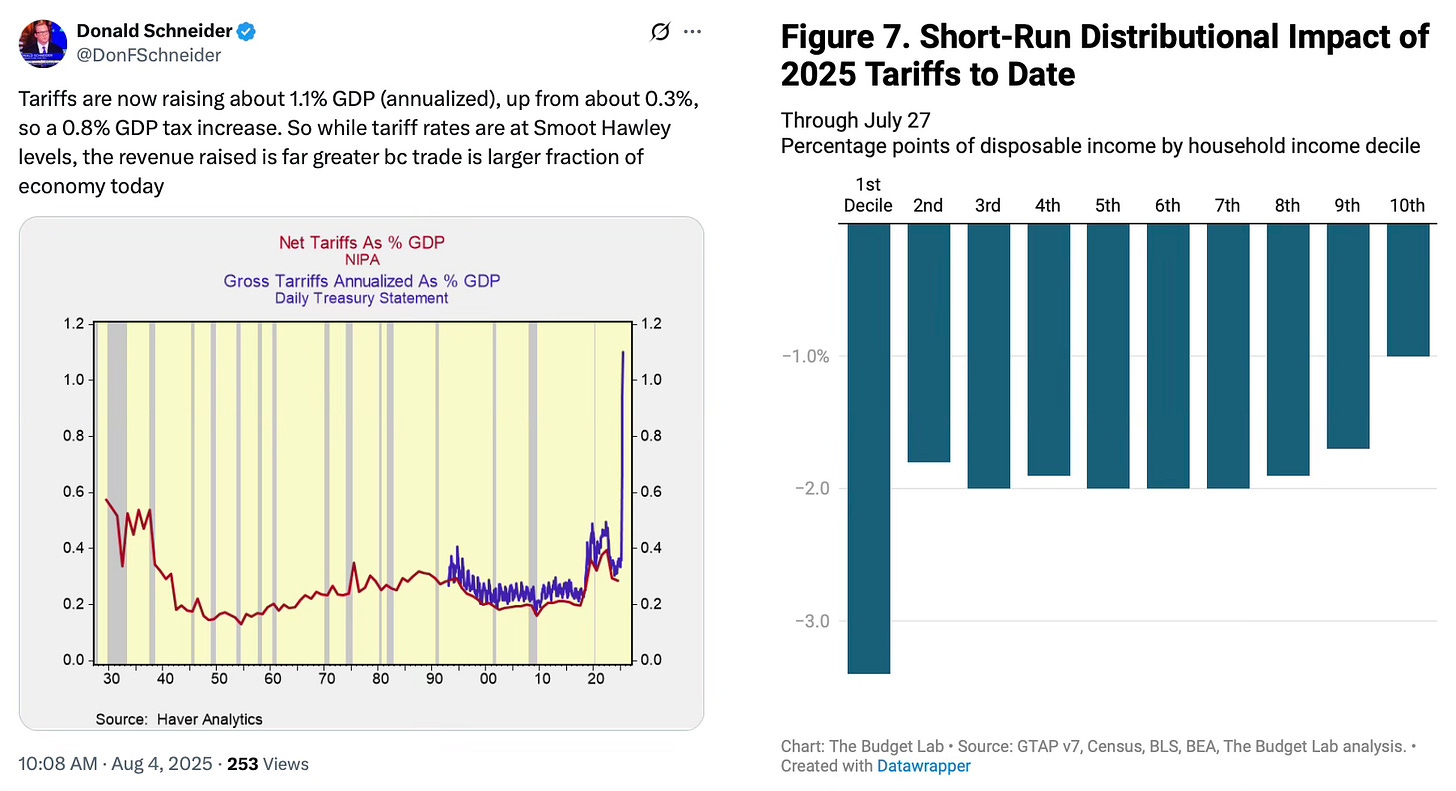

But I do think it’s worth talking through the merits. Tariff revenue is now a non-trivial piece of the economic pie. It is also, per this Yale Budget Lab analysis, incredibly bad for poor people.

If Democrats want to make economic policies that are good for poor people, I think this makes tariff repeal a compelling agenda item. On the revenue point, it’s true that offsetting tariff repeal with some new tax will be politically challenging, but raising taxes is always hard. And this one seems like an easier political win than fighting poverty with new spending.

Political speculations aside, though, I think we need to understand clearly what it is Trump’s doing here.

There’s no great boom in American manufacturing jobs or championing of the working class. Trump passed a regressive tax cut and offset part of the cost by cutting Medicaid and nutritional assistance. Now, he’s offsetting another part of that cost by raising taxes on the poor. After the initial tariff rollout was panned by financial markets, he put a lot of time and energy into negotiating deals that have safeguarded the interests of big technology and financial services companies, while continuing to harm lower-income consumers, small businesses, and manufacturing. And it only gets worse from here.

Eating America’s seed corn

Firing the BLS commissioner over a couple of unfavorable downward revisions would be bad enough, but of course, Trump can’t help but also smear the work of the commissioner and the agency as he does it.

The whole idea that releasing timely information and then revising it as more data becomes available represents “incompetence” is absurd. If Trump has ideas about how to make the estimates more precise, I’m sure they’d be welcome.

But he doesn’t.

Back in June, the Trump administration proposed huge cuts to the budgets of BLS and other statistical agencies. These are distinct issues, but in both cases we see an administration that fundamentally has no appreciation for the value of credible and timely economic statistics.

I know a lot of people questioned whether Trump would cook the books during his first term, and the answer from knowledgeable sources was always that the statistical procedures were hard to meddle with politically and that you’d see clear evidence of meddling if it happened. Today, I’m worried this is what the start of that meddling looks like. I don’t think we can say that next month’s numbers are going to be cooked, but how about three or four months from now?

And this is the pattern across the board. Decisions about everything from tariff policy to merger approval to the targeting of immigration enforcement to who runs federal statistical agencies are being made on a nakedly partisan basis.

There’s an old Adam Smith line about how “there is a great deal of ruin in a nation,” and a prosperous country like the United States can survive a lot of bad policies. I don’t think Trump’s approach to trade and immigration is good, but I am optimistic that it won’t cause long-term damage to the country. Hopefully, a future administration will establish an immigration regime that is more humane and growth-friendly than Trump’s, but also more orderly and secure than Biden’s. It’s normal for policies to ping-pong a little as we try to reach sensible outcomes.

What’s not fine is if the president reacts to the news that shrinking the labor force slows job growth by wrecking the integrity of the jobs report. Or if foreign countries decide to re-evaluate the view that the United States of America is a friendly hegemon relative to the People’s Republic of China. In the short term, demand for data center construction can keep powering the economy forward one way or another, but investment booms always come to an end, and the wreckage Trump is making is going to be very hard to fix.

A few things. First, you asked the question I think earnestly as to whether Trump, Trump syscophants and Trump voters actually believed the ludicrous story that if we get rid of all immigrants, we’re going to get all sorts of “real” Americans who will work in meat processing plants and as nanny’s just like “good ole days”. You express confusion at this idiotic mindset, but I don’t think it’s confusing; I think you underestimate the number of voters who have “drank the kool-aid”. And more importantly, I think you underestimate the number of college educated/elite voters who “drank the kool-aid”. It’s one of my biggest issues with your take that people like Elon or other Silicon Valley types are actually very smart so we should see their pro Trump public pronouncements as 4-dimensional chess gambit. And yes that certainly some of what’s going on. But you really need consider that when Marc Anderson or Bill Ackman say something on Twitter that’s objectively idiotic that they actually believe what they are saying.

Second, what happens in the all too likely scenario that a lickspittle cooks the books with both jobs numbers and CPI data (companies have been waiting to raise tariffs due to TACO and building up inventories but it’s pretty likely the dam is going to break soon on this. If CPI comes in hot next month I think we have to assume more firings)? Honest to god I think we are underrating the economic catastrophe this could be. How do you plan anything without basic reliable data?

The economy has powered along better than expected last 3 months due to TACO and AI investment. But I think we are reaching the limits of how long wile-e-coyote can keep running on air before he realizes there is no ground underneath.

"Take this guy from the Montana Knife Company, who initially reacted with enthusiasm to tariffs because they would boost his made-in-America products … only to discover that his costs are rising due to tariffs because he relies on imported equipment and supplies."

I refuse to believe that even the most MAGA of small business owners is so stupid that he doesn't understand where the inputs *for his own products* come from, or what the impact of tariffs on those inputs would be.