Why we got more inflation than I expected

My first big forecasting error

In my December post “How To Be Less Full of Shit,” one of the quantified predictions I made was a forecast with 90% confidence that year-on-year core inflation would not go over 3% at any point in 2021.

On Thursday, the BLS not only reported eye-popping 5% overall inflation (because of gas prices) but core inflation of 3.8% relative to May 2020. In other words, I was wrong about a forecast that I was pretty confident in.

Since this is my first year making quantified forecasts, I am not all that surprised that I blew this one, and I bet my overall forecasting track record for the year will be pretty bad. The point of committing yourself to quantitative forecasts is to get better at it, but what happens right now is it’s really only done by a small and obscure group of people who are unusually good at forecasting. So the risk of trying it for someone who’s new to the game (like me) is that you are going to end up embarrassing yourself, including on topics that are close to your core area of coverage. But I am hoping that you, the gentle reader, will appreciate honesty because I really would like to encourage more people in the punditry game to follow in my footsteps here.

I also think it’s an interesting learning experience to look back at what went wrong because I do think it casts the current inflation issues in an interesting light. I would say price growth of this magnitude is not a crisis, but it is clearly into the “undesirable” range. It’s worth looking at both how it could have been avoided counterfactually and what we can do going forward to improve the sustainability of the recovery.

My blown forecast

Something I got right was a prediction with 60% confidence that Ossoff and Warnock would win the Georgia special elections. Obviously had that race gone the other way, I’d be pointing out that my confidence was low, so don’t give me too much credit for that. My main point is that even at 60% confidence that was a mildly contrarian forecast at the time — the historical track record of Democrats in those kinds of runoffs was really bad, and I think I correctly discerned that Trump’s refusal to fade away gracefully altered the dynamic.

That being said, I was not super-confident in this.

I thought there was a decent chance there would be a GOP Senate and no additional Covid relief at all.

Then given the Democratic win, the following things about the American Rescue Plan surprised me:

Biden’s $1.9 trillion ask was bigger than I thought he would ask for.

I remember being on a Zoom briefing with Biden’s team right before the public ARP rollout, taking notes, and assuming that the right way to think about this was as a bargaining tactic so that moderates in Congress could slice it down to $1 trillion, and you’d still have a lot of relief.

Given that that didn’t happen, I was surprised that congressional Democrats didn't slide more long-term priorities into the $1.9 trillion.

The upshot is that I was thinking “40% chance of a GOP Senate majority, and even if Democrats get the Senate they’ll probably do a $1 trillion stimulus, and even if Democrats do as big a stimulus as they have formally committed to (in the HEROES Act proposal for example), a bunch of the money will probably not really be stimulus.”

So I feel like we are living in a bit of a low-probability universe where we got a very large burst of very short-term spending starting at a time when Covid was still constraining the economy in very serious ways. It’s not terribly surprising that some inflation has resulted from that, but it is kind of surprising that we ended up on this policy course. At a minimum, if you were predicting in late December that Ossoff and Warnock would win and that would lead to the passage of a $1.8 trillion stimulus bill, then congratulations to you because I don’t think many of us thought that would happen.

The three inflations

Looking at the news, I think three potential channels of inflation are getting tossed around in a way that induces confusion.

One issue is that small business owners are very upset about the impact of the $300/week Unemployment Insurance bonus. Small business owners have a lot of clout with Republicans, and even though journalists are generally not that sympathetic to their worldview they do pay attention to what small business owners are saying, and the message gets out.

That’s how we get House Republicans’ campaign arm dunking on Biden for a small increase in Chipotle’s prices.

If that was all that was going on, though, we’d basically just be looking at a summer silly season story.

Food away from home went up 4% year-over-year in May, but we also saw a very low price increase for groceries, so it’s not like anyone is being pushed into starvation by a 30-cent increase in the price of a fast-casual burrito. You can have a political argument between people cheering and people booing higher labor costs, but GOP-run states are phasing out the bonus UI as we speak, and it’s going away in the Democratic ones at the beginning of September. So it is what it is, and it’s not a big deal.

Second, you have the inflation that I did predict — what I’d call “reopening inflation,” where people are making up for lost time in terms of booking vacations and traveling. It was always very predictable that hotel and leisure travel demand in the summer and fall of 2021 would be through the roof. But it doesn’t make much sense to build whole extra hotels or giant airplanes to accommodate a surge in demand that is almost certainly going to have gone back to normal by next spring. That’s a recipe for price increases — you see it happening now, and you’re going to see more of it happen later.

But then there’s this other thing happening that keeps flickering between getting ignored and getting covered weirdly with “shortages.” It’s basically just people buying tons of durable goods.

The massive durables squeeze

Unlike other stuff people argue about, the story here is incredibly clear. When society started shutting down in March 2020, I thought the country was in store for an economic catastrophe.

But Congress sprung into action with CARES, the December bill, and then the ARP and pumped tons of money into people’s pockets.

And yet at this time, most Americans were refraining from a lot of activities that they would normally spend money on. Some of that was because stuff was closed or felt unsafe. But some of it also just kind of had to do with the nature of life. Even if the takeout coffee place is open, you’re less likely to actually go there and buy the coffee if you’re not out and about doing as much stuff.

People weren’t going out as much, so they didn’t buy as much clothing as they normally would have. I didn’t get shirts dry cleaned. There were just fewer expenses in life, and everyone became more frugal as personal savings reached record levels.

This played out at the same time that the stock market hit record highs and home prices soared.

But people didn’t save all of their unspent coffee, gym, and vacation money. Instead, they bought more stuff. What kind of stuff? Well, some people did home renovation projects. Some people bought new furniture for their home office setup. Some people bought more toys for their kids. Some people just replaced furniture that was looking a little tired. People bought webcams and video game systems and new televisions. Americans were in healthy financial shape, but couldn’t or didn’t want to go to concerts and sports games and movie theaters and bars. So they bought tons of durable goods. And that’s created issues throughout the durable goods economy.

The same problem everywhere

One problem with this is that it’s hard to drastically increase global output of stuff. But a bigger problem is that because of the pandemic, stuff-makers actually made less stuff rather than more.

Some of that is because operations were directly impeded by the virus. But some of it was the assumption that there would be an economic catastrophe. I assumed this, and so did a lot of the people who own factories.

As Kevin Drum wrote in May, you can delve into the details of sawmill operations or semiconductors or whatever else you like, but the big picture is always the same — producers anticipated less demand and they actually got more demand.

Oh. So it has nothing to do with Taiwanese fabs vs. American fabs or global supply constraints or any of that. Nor is it related to a possible invasion of Taiwan or the fact that Intel may or may not have made good decisions about its future business. It's because American car companies canceled their chip orders and never bothered to reinstate them. Then in December, when car sales "unexpectedly" began to rebound, they panicked and realized what they had done. You'd think these guys had never done an economic forecast or used an MRP system before in their lives.

Anyway, be prepared for hundreds of stories like this. For each one, be careful to ignore the details and instead focus on the big picture. In about 90% of them, it will be the same: They didn't plan for the pandemic to ever end, and now they're paying the price.

This was a mistake by producers, but also I think a mistake by policymakers. Heading into last winter, it was clear there were a lot of unemployed people who needed help. And it was also clear that the idea of another round of quasi-universal checks was very popular. But there was no particularly compelling economic reason to do the checks at a time when so much of the economy was still shut down. You could have paid the money out as a July 4 Independence Day Bonus, and by then the cash might be flowing into a wider array of things like beach trips and hiring a babysitter while you go to the movies.

A lot of fussy technocrats said we just shouldn’t do the checks at all, which I think just totally defied political reality. When you have a new Senate majority that was won on the basis of checks, you’ve got to do the checks. The idea of sending them later doesn’t seem to have really registered as an option.

But if you look at where the price increases are, I think you can see that the problem is much more in the durable goods sector than anything to do with these overhyped restaurant labor issues.

The most expensive durable good that I own is my car, and I think that’s pretty typical. If you delve into it, it turns out that used car prices are a huge share of the story — accounting for a third of the rise in core inflation. I see that cited in some places kind of dismissively, but I think that on some level that’s a mistake.

The car situation is serious

Now, where I agree with the dismissive crowd is that it would be odd to raise interest rates in response to spiking used car prices.

But here’s my thinking about inflation that’s separate from how monetary economists think about it. In normal life, what you care about is your standard of living. Monetary policy often ignores food and energy prices because they fluctuate due to supply conditions — interest rates don’t fix your drought, etc. — but normal people get annoyed by that because food and energy are important to their lives. In particular, if your gasoline costs go up in the short term, there isn’t much you can do about it. You just eat the price increase. Similarly, this happens with the staple grocery commodities you eat. Demand for this stuff is fairly inelastic.

The saving grace of the economic situation, and the reason Biden’s approval numbers haven’t fallen, is that most durable goods aren’t really like that. If you got a stimulus check in March and decided to buy a coffee table and then saw that coffee tables were surprisingly expensive, you have two options. One is to decide you want the table anyway, and the other is to skip the table and go buy something else with a price that hasn’t soared (a MacBook or an Amazon Echo or whatever), or else just hang onto the cash and spend it later. We’re just talking about the world of discretionary purchases, and the stakes are low. If you could have inflation popping up anywhere in the economy, I think this would be a pretty good spot. By contrast, rent inflation has slowed. Soaring rents can be a huge humanitarian emergency. Soaring prices for chairs is just some weird shit happening at the tail end of a very weird year.

But cars make me worried. If my car vanished, I’d be annoyed, but I’d get by. But for a very large share of the population, the lack of a working car is a nearly crippling level of inconvenience. And buying a used car is the cheap alternative to buying a new car. So if your car breaks and you really need your car to get to work and around to places, you’re really just screwed right now. Fortunately, most people don’t have a catastrophic car failure in any given month. But we are still talking about a serious issue facing people who need transportation.

What happened with the cars?

Per Drum’s insight, the car story is not really different from anyone else’s story. But because cars are complicated, you have a compounding form of the issue.

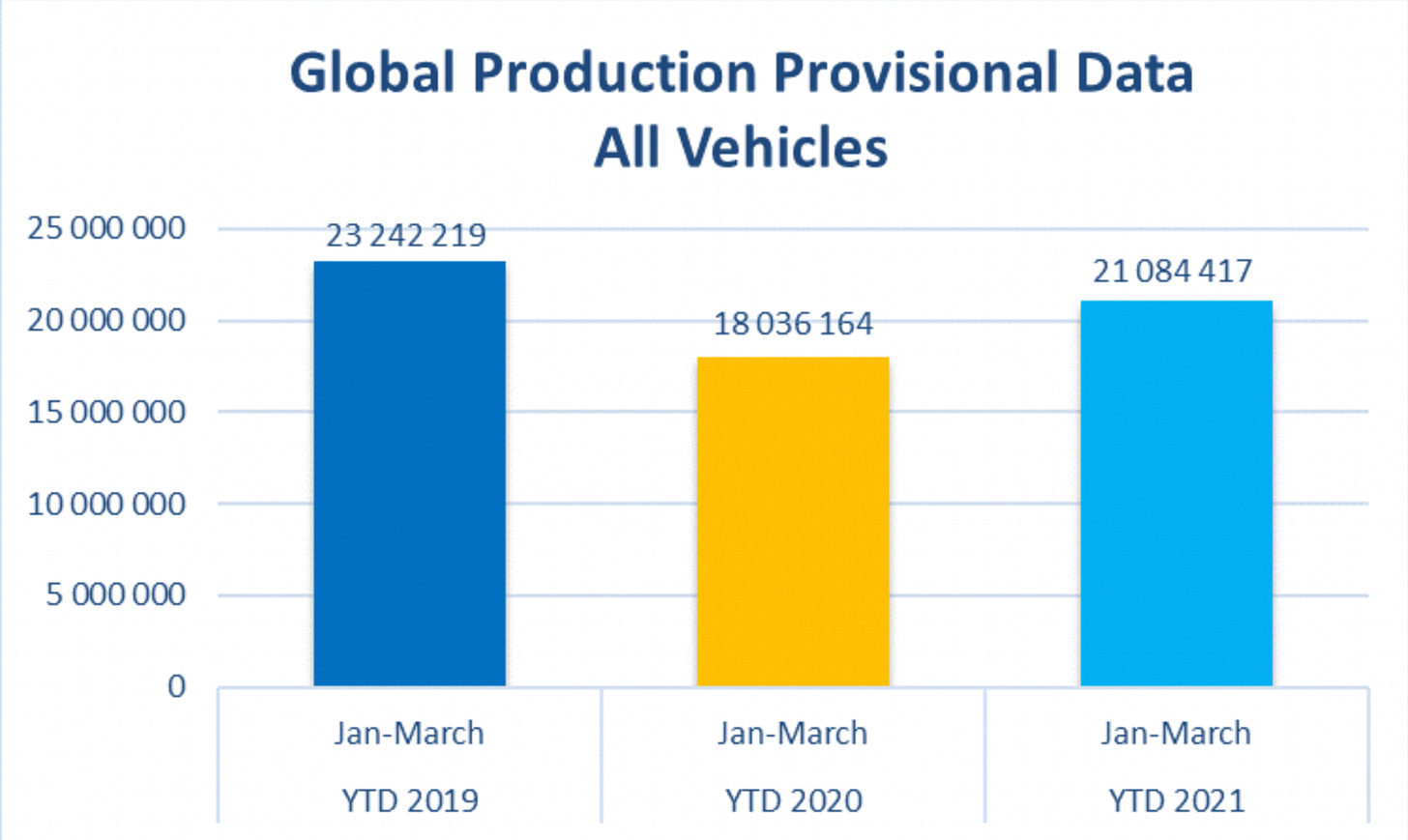

First off, we didn’t build enough cars at the beginning of 2020 because of the pandemic. But then what’s weird is that while car production rebounded in 2021, we are still making cars at a slower pace than we were in 2019.

That’s because the guys who manufacture the semiconductors that go into modern cars (but also into lots of other electronics) did the same thing. So now automakers are throttling production because they can’t get the chips they need. Then it gets worse, because rental car companies shed their fleets at the beginning of the pandemic and are now trying to buy used cars to repopulate them.

So it’s a huge clusterfuck. And while I think the advice that “policymakers should ‘look through’ transitory inflation” is reasonable to give to the Federal Reserve, I still think this is an issue worth trying to address directly.

More and cheaper cars

The federal government owns or leases about 650,000, cars and back during his first week in office, Joe Biden directed the GSA to develop a plan to replace these cars over time with electric vehicles. I think a good addendum to that order given today’s circumstances would be to direct the GSA to go as far as it possibly can to just not buy any cars at all.

Back in April of 2009, Barack Obama announced a surge of federal vehicle purchases. In a recession, that’s a great idea. The federal government should absolutely be making big countercyclical purchases of things like cars when factories are idle and workers are unemployed. But this is the opposite of that. The federal government should be looking to identify every possible opportunity to reduce the size of its vehicle fleet — selling unneeded cars into the stretched used car market, and delayed any new car purchases until the last possible opportunity.

Biden has thus far kept all of the Trump administration’s trade measures in place, including tariffs on steel and aluminum that make it more expensive to build cars.

Trump took office at the tail end of a prolonged period during which the American economy was severely depressed. One of the many perversities of a depressed economy is that all kinds of zany populist stuff can work under those circumstances. Biden has now propelled us forward into an economy that is supply-constrained rather than depressed. That means you need to look at some of this stuff in the much-derided “Econ 101” framework. Cheaper metal would be a boon to America at a time when durable goods are in short supply and people are worried about price increases.

In general, I understand that the Biden administration feels it’s politically risky to step away from any Trump-era tariff policies lest he be accused of being less pro-union than his predecessor. But it is also politically risky to let spiking prices derail what’s so far been a rosy economic story. It’s really worth going line-by-line through the tariff list and trying to think seriously about the impact of each item on prices and politics. I think it’s fine to say that these spring inflation spurts reflect growing pains rather than a fundamental problem. But the more you can ease those pains, the more likely we are to blossom into a sustainable boom.

Worrying and not-so-worrying inflation

What we have not seen so far, I think, is inflation that is driven by expectations and psychology.

For the longest time I didn’t really get what this was about, thanks to having lived my whole adult life in a low-inflation environment. Now that we’re seeing some real inflation, I think the difference becomes apparent. Some inflation is driven by scarcity — there just aren’t many cars around relative to the number of people with money to spend on buying cars, so prices are rising. Then you have cost-push inflation, where Chipotle decided it’s smart business to raise pay and prices rather than stick with lower pay and lower prices.

What we haven’t yet seen are price increases that are driven entirely by psychology. There’s no cost-push or scarcity in the Substack sector, say, and none of the people on the politics leaderboard have raised prices. I’m also not hearing people say things like “better go buy that table now, because the price will only get higher in six months.”

In other words, people are treating the price increases as annoying but anomalous. Over the pandemic year we put up with a lot of situations that were more alarming and more annoying than spiking used car prices, and we can live through this too.

I think that’s correct, and that’s why the Fed continues to say it views these price pressures as “transitory” (financial markets agree) — people expect them to be responsive to specific conditions rather than a generalized race to higher prices. But I think to keep inflation non-worrisome, you want to see the government worrying about it a little. It makes me nervous when I see people dive too deep into the component analysis and say “well if you throw out food and energy and used cars and transportation services, then it all looks pretty normal.”

The Cleveland Fed actually publishes a consistent data series called “median CPI” that just looks at the 50th percentile item in the consumption bucket. I think it’s an interesting stat and it shows inflation actually settling down. In political terms, I think that helps explain why the Biden economy is pretty popular — prices are rising, but the majority of people aren’t actually buying a new car or a new fridge in any given month, so it’s not bothersome.

But one has to be consistent here. Median CPI normally says inflation is higher than conventional estimates suggest, so unless you were consistently citing it pre-pandemic, I don’t think you have much authority to switch to it now. When I wrote about inflation contrarians, I complained that during the period of low inflation you had a bunch of people essentially saying “if you only pay attention to prices that are going up faster-than-average then there’s a lot of inflation.” Today’s component analysis debunkers sometimes strike me as doing the opposite thing — obviously if you strip out the prices that are rising inflation looks lower!

Where component analysis is useful, though, is for doing “supply-side economics.” Over the years that’s come to just mean regressive tax cuts. But it’s a good term, and it should be a real idea. Today, for the first time in a long time, we have an economy that is not really constrained by aggregate demand. So we need to identify supply-side policies that can alleviate price pressures. And that means looking at sectors where prices are either really spiking (cars) or else sectors that are really big (housing and medical care). It would be very helpful for Biden’s team to be clearly seen as focusing on things like tariffs, licensing rules, scope of practice, zoning, etc. that constrain the supply side of the economy, both to directly moderate price pressures and also, in a psychological sense, to show that we are working on this — they already solved the demand problem and the domestic vaccine availability problem. “Everyone has money and wants to buy stuff” is a pretty good problem to have all things considered. But it still merits attention!

GOP 2016: If you don't do something about it, you're going to have taco trucks on every corner.

GOP 2021: The cost of burritos is too damn high!

I have enormous respect, trust, and admiration for anyone willing to admit they were wrong. I have to see these kinds of admissions before I can fully listen to someone with an open mind and heart.

Let’s make this the norm and not the exception.