Inclusionary zoning is a tax on new construction

The worst possible way to finance social housing

Sometimes, policies have unintended consequences or unforeseen downsides.

Other times, I’m not sure the downsides or adverse consequences are unforeseen or unintended at all.

This is how I feel about so-called “inclusionary zoning.” Proponents claim the policies promote the building of affordable housing, but they almost always make housing less affordable than it would be without the IZ.

Earlier this year, for example, Cambridge enacted a historic zoning reform that will allow four-story buildings by right throughout the city. The original proposal, though, was to allow six-story buildings. That was changed during the course of council debates to say that five- and six-story buildings are allowed, but they’re “required to have a minimum lot size of 5,000 square feet and for 20 percent of the units to be affordable.”

If you look at the legislative history, I think that change was pretty clearly made in order to deter the construction of six-story buildings. Similarly, the Cambridge zoning reform also has a proviso which says that if your building has ten or more units, then 20 percent of the units need to be set aside as affordable.

That’s a pretty significant limitation when you think about it. A lot of what gets built in urban multifamily construction is small one-bedroom apartments catering to young professionals who place a premium on proximity to restaurants and retail amenities. By making that kind of project harder to pull off, Cambridge is again blunting the impact of the reform.

As long as you understand it in those terms, it’s fine. The zoning changes are still a big deal. Allowing four-story structures by right is a big deal. The fact that six-story projects probably won’t get built doesn’t change that. And if non-profit developers take advantage of the opportunity to do a few mixed-income six-story buildings, that’s icing on the cake. Limiting the new projects to nine units or fewer is similarly unfortunate, but it’s still a big deal — there’s a lot that can be done through four-story buildings with nine or fewer units.

If it were up to me, of course, those limits wouldn’t exist. And buildings wouldn’t be capped at six stories either. But no one gets everything they’d like in life, and pairing a historic reform with some limitations is totally reasonable pragmatic politics.

What’s not good, though, is if these affordability rules are understood as mechanisms for actually making housing more affordable.

What makes housing more affordable is increasing the supply of housing. Affordability requirements do generate some quantity of subsidized units, which is nice for the people who get them. But it finances their construction in what has to be the most destructive possible way: a focused tax on nearby new construction. If Cambridge wants more subsidized housing, the way to do that is to zone as permissibly as possible, then use general tax revenue to pay for the construction of subsidized units.

The impact of inclusionary zoning

The whole concept of inclusionary zoning arises, historically, out of an older pre-YIMBY discourse about land use.

Some on the left noticed that a major driver of the suburbanization in America wasn’t people liking backyards or taking advantage of the practical utility of automobiles, they were physically isolating themselves from America’s social and economic problems.

Of particular interest to progressives, who aren’t predisposed to say nice things about free markets, was the racial angle. In the bad old days of Jim Crow, the Supreme Court ruled that cities were not allowed to formally designate specific parts of town as white only. As a result, city planners started using facially race-neutral zoning rules to re-enforce de facto segregation. Late 20th century scholars and activists were aware of this, and developed the concept of “exclusionary zoning” — the creation of neighborhoods that used bans on multi-family housing as a way of excluding lower-income (and, presumptively, non-white) people from living there.

Inclusionary zoning, in the most abstract sense, is the opposite of that, the view that zoning laws should be crafted so as to specifically ensure that neighborhoods are socioeconomically integrated.

This sort of intersects with the progressive concept of “affordable housing,” which does not mean the market price of housing is cheap on a per square foot basis, but rather describes a situation in which housing is leased at sub-market rates to people with low incomes. This leads to the idea that cities should impose inclusionary zoning rules that require a certain share of new housing to be rented at sub-market rates to people with low incomes.

There are a number of empirical studies of the impact of inclusionary zoning, and they mostly show that it reduces the supply of housing and raises prices.

In defense of IZ, the empirical studies do not uniformly show adverse impacts on supply and prices. Sometimes you get null effects. But no study finds that IZ has the effect of increasing housing supply or reducing prices.

As I said at the top, it often seems to me that the intention of IZ is to reduce housing supply, in which case job well done. Many sources, however, claim that IZ is genuinely intended to make housing more affordable. Wang, Kang, and Fu, for example, have a new study published in the journal Cities which says that the spread of IZ in the United States “represents a significant supplement to the federal and state efforts aimed at expanding affordable housing supply nationwide.”

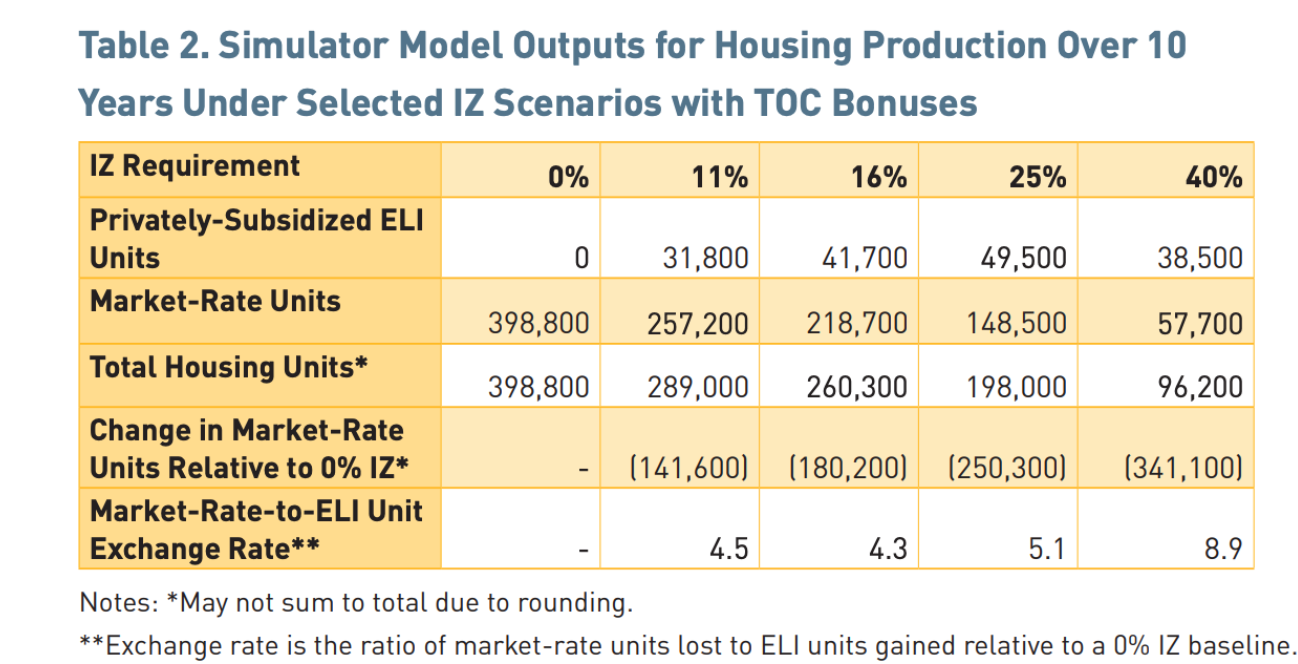

If that’s the goal, then it doesn’t work very well! I think the problem is best illustrated by this modeling exercise Shane Philips did for the Terner Center, which looks at the impact of different IZ rules on housing production in Los Angeles. He says that with no IZ rule, nearly 400,000 new units would be built. If a 25 percent IZ rule were imposed, that would result in 49,500 new affordable units, but at the cost of creating 200,000 fewer units overall.

One can, of course, dispute these specific empirical parameters. But the general point is hard to deny: IZ generates additional non-market units, but each non-market unit displaces more than one market unit, because projects are less profitable overall. You are, in effect, subsidizing the construction of non-market housing with a tax on new market-rate housing, which is very bad for market-rate supply in a way that I think would be uncontroversial in almost any other context.

A housing tax is a bad way to create housing

I get what policymakers are thinking. Often a city experiencing rising demand will see the construction of a lot of new “luxury” apartment units with high-end finishes that are marketed to affluent young professionals. The city council thinks that what the city really need is housing that’s affordable for struggling families, so they end up turning to IZ ordinances.

But suppose that instead of IZ, the city council decided that because these affluent young professionals sure love going out at night, they’re going to raise taxes on bars and restaurants and put that money into a grant program for the construction of new social housing. Obviously, the local bar and restaurant industry is going to hate this idea. They’re going to tell you that it’ll make it harder to profitably operate bars and restaurants, raise the price of meals, and lead to a lower supply of bars and restaurants. City officials might reasonably decide that they don’t care about that, that fewer bars and restaurants is a small price to pay for the creation of more social housing units. But I think it would be pretty crazy to deny that a targeted tax on bars and restaurants would be bad for the bar and restaurant industry.

Conversely, suppose the council doesn’t care about affordable housing at all.

They’re just monolithically worried about crime and really want to hire more cops and need a revenue source for this cop-hiring binge. But all these new buildings going up full of yuppies, so the council decides to place a per unit tax on every new apartment that goes up, with the money paid into the Cop Fund.

Real estate developers argue that this will mean less construction and higher prices.

Again, a reasonable person might decide that’s a price worth paying for safer streets. But it would be kind of crazy to deny that a targeted tax on new apartments is going to reduce the supply of apartments. These are just normal policy tradeoffs — you decide to tax one thing in order to subsidize another thing, and that’s bad for the thing that you’re taxing.

What’s weird about IZ is that it’s essentially taxing housing in order to subsidize housing, which doesn’t make sense if your concern is the cost of housing.

On a conceptual level, people go for this because certain analysts have gotten unduly obsessed with the idea of “housing submarkets” — the idea that certain types of housing are for certain categories of people, and so instead of taxing housing to subsidize housing, you’re actually taxing luxury housing to subsidize affordable housing.

I’m not saying that submarkets are totally fake. Obviously, when someone throws up a building full of one-bedroom apartments with a rooftop pool and a courtyard dog park, they’re not aiming for a building full of working class families. But it’s just not the case that a metro area’s housing inventory consists of hermetically sealed submarkets. Academic studies from Finland to the United States confirm that there are cross-linkages across all submarkets. Both “filtering,” where a formerly brand-new building becomes less-new over time and gets cheaper, and gentrification, where rich people buy houses and renovate them, are things that clearly occur. If you happen to be the person who wins the lottery and gets a below-market housing unit that was created thanks to an IZ ordinance, that’s great for you. But reducing the total amount of housing in an in-demand area is ultimately going to make housing less available.

If you want subsidized housing, just subsidize it

I find the recent revival of interest in public housing schemes to be a bit perverse.

A bunch of people have decided, for a variety of reasons, that even a hypothetical market without deliberate anti-supply measures would fail to generate adequately cheap housing (see this recent J.W. Mason essay for a sophisticated version of the argument), so we need to deliberately subsidize the construction of non-market housing.

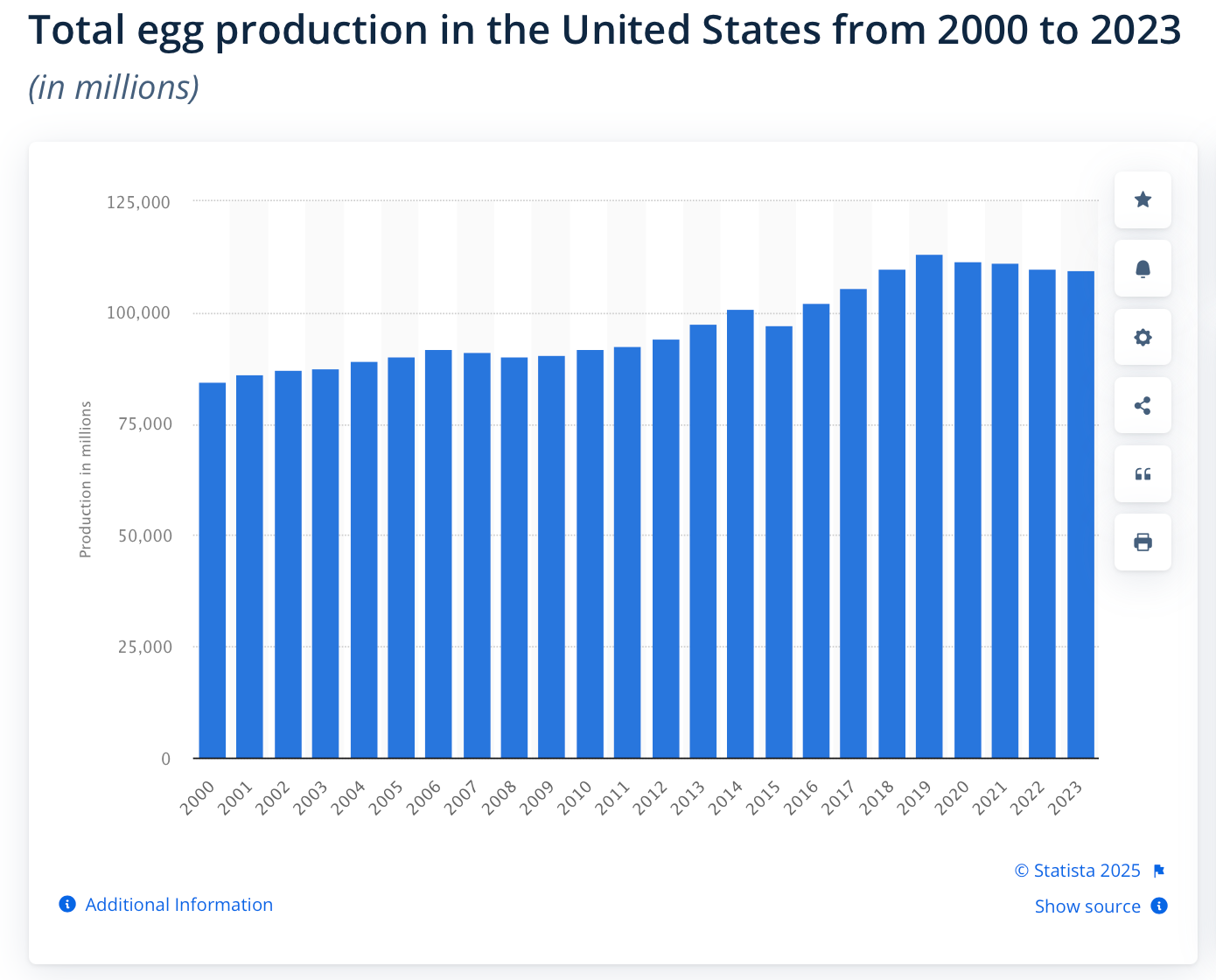

It is extremely unclear to me that this is true, and I think the people making the case for it are severely underrating the extent of anti-supply rules that are on the books. The other point I would make is that when you’re dealing with inelastic demand, the relationship between price and supply can be highly non-linear. If you look at the fluctuations in egg prices associated with bird flu, for example, you might be surprised to learn that we’re talking about a relatively small decline in the actual number of eggs.

The issue here is that eggs are the cheapest form of animal protein and also a production input into baked goods whose overall cost is dominated by non-egg sources. As a result, to balance supply and demand in the face of a negative shock to egg supply, the price needs to go way up. The market for housing is very different from the market for eggs, but it is similar in that demand is not very elastic. People really like to have a place to live, and when rent rises, most people’s reaction is to cut back on non-rent expenses.

But maybe I’m wrong and even if we eliminated supply constraints, we wouldn’t have enough ultra-cheap housing. Or maybe for social engineering reasons, we want to make sure that our cities have deliberately mixed-income buildings, which won’t be produced by market forces. These don’t seem like crazy ideas to me.

If you want to do that, though, you should treat it as a normal public expenditure. If you want more police officers, you spend money on cops. If you want more parks, you spend money on building parks. If you want to run the bus more frequently, you spend money on hiring bus drivers. And if you want to build social housing, you spend money on building social housing. Maybe you’re spending money already on something that’s wasteful, inefficient, or just less valuable than your pet social housing scheme. Or maybe you want to raise taxes, in which case you want to try to think of an efficient general tax, not a dedicated tax on new housing.

In fact, whatever it is you would like to spend money on it’s easier to find money to spend if you have a rapidly growing economy which in a local government context is easiest to achieve by eliminating regulatory barriers to new housing.

The other day there was a comment thread in which City of Trees asked the SB crowd about issues on which they’ve done a “180,” and I would have to say that “affordable housing” is probably mine. It’s the kind of thing where, how could you be against this? It’s right there in the name! You’d have to be some kind of reactionary idiot! But then peel back the “affordable” layer, and…

Lot of the desire for IZ policies and their ilk seems to be a way to politically square progressive voters' deeply and sincerely held desire for zero urban development and zero net population change (really zero change of any kind) with their ideological commitments to poverty reduction and the working poor. Doesn't matter if it works, it lets everyone Do The Right Thing (engage in purely expressive politics).