How the stock market learned to love Trump

Opportunism, corruption, and Wile E. Coyote

Whenever Donald Trump does something that amounts to putting the institutional foundations of American prosperity through the wood chipper — whether that’s attacking Fed independence, turning his back on mRNA technology, attacking the integrity of federal economic statistics, or any of a dozen other things that happened this summer — I check the financial market reaction, since in principle wrecking the country is bad for business.

But the S&P 500 keeps hitting new record highs and is up about 10 percent so far this year.

That’s nothing extraordinary (it rose 23 percent in 2024 and 24 percent in 2023), but it’s also not a panicked response. It sometimes feels to me like we’re living in the waning days of a dying empire, but you certainly don’t see it in the markets. Technical economic posts are rarely good for Slow Boring’s business, so I was happy to see that Paul Krugman recently wrote a great explanation of the “Keynesian Beauty Contest” dynamic and the fact that stock market crashes always arrive too late. The standard analogy here is to Wile E. Coyote in Looney Tunes: Markets don’t notice that we’ve run off the cliff until it actually happens.

I do think that there are also some more prosaic factors at work here, though.

Whatever you think about Donald Trump, American software companies have been the most successful businesses in the world for a long time. And Nvidia has emerged as the most important chip company in the world, despite the broader struggles of the United States as a location for chip manufacturing. If Meta were a Japanese company rather than an American one, signs of the American political system becoming completely dysfunctional might be a reason to bet on it, rather than on Alphabet or Amazon. But the leading tech companies are almost all American companies, and nothing Trump has done has me thinking that SAP is poised to dominate the future of global software.

In other words, there is currently a lot of investor optimism about artificial intelligence in general, and about big American tech companies with AI-related investments in particular. That optimism might prove misplaced (many people on the internet are sure it’s a bubble), and a change in investor sentiment about AI would crash the market.

But Donald Trump is clearly aligned with corporate America’s AI aspirations, so you wouldn’t really expect anything crazy that he does to cause panic about American AI companies’ prospects. Whatever else he’s up to, Trump is clearly a guy who wants to see the line go up.

The parties are not symmetrical

When Trump announced his bizarre plan for the government to own 10 percent of Intel, many people observed that if a Democrat did this, we’d hear howls of “Socialism!” from the business community.

That’s definitely true. It’s worth saying, though, that there’s more to the asymmetrical reaction than partisanship or hypocrisy. The reason businesspeople scream “socialism” when left-of-center political parties do things that are socialistic is that they believe left-of-center parties are full of socialists who don’t like businesspeople, and they fear any sign that those people are calling the shots. Democrats themselves say that the Republican Party is in hock to big business and the class interests of the wealthy, so of course it’s hard to make businesspeople panic that a GOP administration is poised to liquidate the kulaks.

Conversely, the reason you hear cries of “fascism” at the specter of national guard deployments in D.C. is that a lot of people believe the MAGA movement is full of fascists! If Joe Biden had surged additional federal resources into the city, most residents wouldn’t have found it threatening, and the whole national debate would be about how the libs are wasting money on big cities again.

The two parties and their respective coalitions and ideologies aren’t arbitrary or interchangeable. People read specific events through the lens of their general assessment of the parties.

Another example: The Obama administration used “Dear Colleague” letters from the Education Department to try to induce colleges and universities to make various policy changes. These generated political controversy but did not generate widespread resistance and litigation from university administrators or widespread outcry from college faculty. That’s because these institutions are full of progressives who are disposed to view a Democratic administration’s actions generously and also inclined to agree with their objectives on the merits. When Trump tries to twist the arms of universities, it’s seen as an attack on freedom full of dark portents. That’s in part a baseline lack of sympathy for Trump among the relevant stakeholders, but also a sincere assessment that Trump and his team don’t value higher education or scholarly research.

Republicans, the party of business, benefit from similar dynamics vis-a-vis the business community.

That’s relevant to market sentiment, and it matters in concrete ways. Part of the larger Trump dynamic is that so much attention is paid to extraordinary happenings that it’s easy to lose sight of “boring,” “normal” policy stories.

But Trump has a former chemical industry lobbyist working at the Environmental Protection Agency, doing industry-friendly stuff like blocking regulation of “forever chemicals” in drinking water. This is happening at every federal agency — regulations are being shifted to reflect less concern about things like pollution or safety. Some of Trump’s regulatory changes are probably good on the merits. But even the changes that are not good on the merits tend to involve a regulator making some calculation like “Relieving $X of costs on business will inflict $3X worth of harm in terms of lives saved.” We are talking about a trade-off between a financial cost to American business versus the statistical value of a human life.

The stock market, I’m sad to say, does not really care if someone lives to 87 rather than dies at 69 thanks to reduced air pollution. It does care about businesses being more profitable.

The fact that Republicans err on the side of making the business-friendly call on these questions when the business-friendly call is correct and also when it’s wrong is precisely why they are the party of business. This tendency tends to make the line go up, and also means that financial markets are inclined to read ambiguous signals from a Republican administration in an optimistic way.

Many people agree with Trump

A related issue, of course, is that while I think Trump’s policies are a menacing threat to the American constitutional order, clearly a lot of people disagree and think he’s good.

He’s got a 44 percent approval rating in the Silver Bulletin dashboard, which is low but not that low. Even in 2020, he got 47 percent of the vote. The marginal voter in the 2024 election was narrowly mad about inflation and border security and not necessarily bought in on the larger MAGA project. But the people who voted for him the time that he lost and the people who still like him even now that it’s clear he’s not actually going to bring the cost of living down are people who do have some affection for that project. Anti-Trumpers often seem to be unaware of what this project even is, but the basic idea is that institutions dominated by the educated professional class in America have become so fatally compromised by “woke” left-wing ideology that only a cleansing fire can save our civilization.

This is clearly not what most people believe or Trump would have won in 2020, Republicans would be leading in the midterms, and his approval rating would be above 50 percent.

But it’s a large minority viewpoint that says all this institutional destruction is good for the long-term growth potential of the economy. When Elon Musk talks about the “woke mind virus,” this is what he’s saying: that the integrity of Bureau of Labor Statistics data is a small matter beside the stakes of rebuilding educational and cultural institutions from the ground up in order to celebrate individualism and meritocracy.

In terms of the stock market, an important counterpoint is that plenty of Democrats have positioned themselves as rhetorically opposed to the existence of big, successful companies. When progressives talk about the need to “break up big tech,” how America is an “oligarchy,” and how “billionaires should not exist,” they are heard in the business world as saying that the United States should be more like Europe, where the largest companies have market caps that are less than one-tenth of the largest American companies.

I feel like purely partisan Democrats, like my Politix co-host Brian Beutler or even Krugman, don’t think seriously enough about the meaning of this. Whatever you make of comparisons between the United States and Europe, it’s indisputable that the value of shares of stock in our companies is a lot higher — more or less by definition that’s what happens when Europe does not have big successful companies like we do.

So if progressives say …

If we win power, we are going to make corporate America look more like corporate Europe.

Trump is trying to establish a dictatorship that will make it impossible for us to win power.

… it follows that Trump doing authoritarian-style consolidation would be bullish for stocks.

To be clear, I am not saying these things are true, in part because I think progressives are more full of shit about (1) than their rhetoric lets on. But I do think the broader anti-MAGA community should think harder about what we are putting out here, because some people take politicians’ rhetoric quite seriously and I don’t think it’s a good idea to polarize people into being pro-Trump.

Tactics aside, though, my larger point is that the Trump movement includes a lot of true believers. And they not only vote, they invest, and so much of what you and I see as disturbing they see as good.

The market loves to be loved

Finally, there is an equilibrium issue with Trump and the stock market.

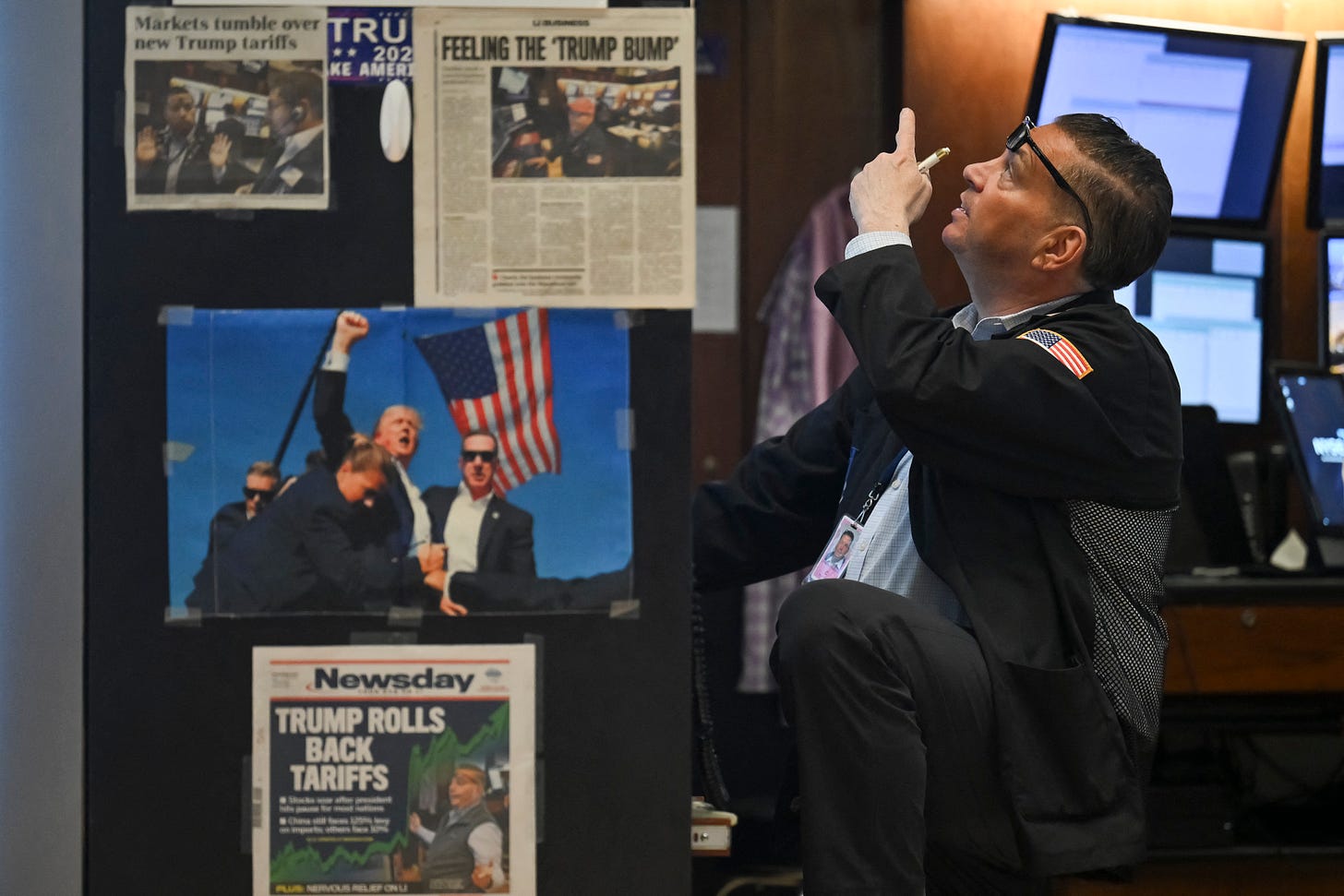

When he first won, markets soared, even though on its face, his promise of trade wars should have been disruptive. But the logic you heard for Trump’s trade plan was pretty simple: Trump cares a lot about financial markets, so even though he’ll probably do dumb stuff that generates sell-offs, he’ll back down from anything that has that consequence. You don’t want to be the sucker who sells in the face of Trump doing something dumb; you want to be the savvy guy who buys the dip. The basic logic of “buy stocks because if the market goes down Trump will make sure it goes back up” fueled a tremendous stock rally. Eventually, Liberation Day broke through that wall of confidence and the market crashed. But then Trump did back down! And the market started going back up.

Of course, since backing down, he’s substantially backed down from the back-down in a way that is costing consumers dearly.

But there’s an important difference, namely that as he’s rejiggered the tariff situation, Trump has consistently prioritized avoiding foreign retaliatory measures that would hurt major American companies. Getting Europe or Japan to agree to a “deal” where America taxes foreign-made products and the other countries don’t retaliate is not actually in the interest of the typical American, who is still suffering from regressive and inefficient tax policy. But from the standpoint of the stock market, what really matters is that Alphabet and Amazon and Netflix and other big drivers of the indexes aren’t feeling retaliatory pain. These companies mostly don’t rely that much on imported intermediary products, and Apple (which could be devastated by import taxes) got itself a convenient exemption. Similarly, despite Trump’s putative hawkishness on China, he’s decided to go soft on export controls that could hurt Nvidia’s sales.

This tendency to prioritize the interests of America’s biggest companies not only mechanically pushes stock prices up, it reassures investors that Trump is watching the market, and if bad things happen, he will likely shift course.

In terms of the long-term future of the country, of course, this tendency to prioritize the narrow interests of companies that are already big and important makes things even worse.

But in terms of where we started, the confidence that Trump is sensitive to market reaction only makes the Wile E. Coyote phenomenon more severe. If a Democrat did something bad for markets, people would sell. But if Trump does something bad for markets, many will hesitate to sell because they believe that others will sell, and that will prompt Trump to change course — that’s the TACO Trade. But that means the market may not crash, and he may actually not need to change course!

Eventually, of course, the actual financial results matter. But the confidence that Trump will do his best to keep the line going up means we can probably run pretty far off the cliff.

Hello from Taiwan! Just wanted to flag that I’m back from my brief hiatus and will be hanging out with you all in the comment section again.

" The Obama administration used “Dear Colleague” letters from the Education Department to try to induce colleges and universities to make various policy changes. "

There is no moral equivalence between those letters and what the Trump regime is doing to universities. Those letters were not followed by the withholding of grants for research, the destruction of NIH, NSF, USAID, and other sources of funding for research. The Obama administration did not trash due process in order to extort pots of money from universities for paying reparations to students allegedly harmed by discrimination. The Obama administration did not set out to reduce the enrollment of foreign students as a way to choke off tuition revenue to universities.

Furthermore, the Obama administration did not make a pretext of pretending to care about Jewish students while running an administration filled from top to bottom by vicious anti-semites -- real ones, i.e. people who hate Jews because they are Jews, not people who criticize Netanyahu.

The reason that the Obama-era "Dear Colleague" letters "did not generate widespread resistance and litigation from university administrators or widespread outcry from college faculty," is because they were not part of a concerted effort to feed universities into the wood-chipper in violation of contracts, laws, and due process.

If you want to use the "Dear Colleague" letters in order to illustrate your point that "The Parties are not Symmetrical," then start with the most significant asymmetry: only one party is trying to destroy American higher education and scientific research, and using thuggish and illegal means to do it.