Once upon a time in America, there was Aid to Families With Dependent Children (AFDC).

Originally conceived of as essentially an income support program for widows, AFDC provided cash to poor parents, but by design, your household lost benefits if it had labor income. But after the rise of never-married mothers, this came to be seen less as “it’s nice to give single moms money so they don’t need to work” and more as “oh no, providing cash to non-working single mothers is creating work disincentives and causing the breakdown of society.”

One way to remedy that would have been to spend more on the program so the benefits didn’t need to phase out — or didn’t need to phase out so sharply. But the remedy congressional Republicans wanted to take in 1995 and that Bill Clinton agreed to was to just yank the benefits. So instead of AFDC, we got Temporary Assistance to Needy Families (TANF), which provides very little help to anyone.

Then along came the Child Tax Credit (CTC) which — like the Earned Income Tax Credit (EITC) — is structured as a Trapezoid Program where the benefits initially phase in as your income rises, then plateau for a while, and then phase out as you get affluent enough that you don’t need much help.

The trapezoids are designed to be a cost-effective means of vaulting some of the working poor above the poverty line, but by design, they exclude the neediest families to avoid the allegation of subsidizing non-work. But of course, working as a parent is expensive, so there are also programs to subsidize child care expenses. And now the American Rescue Plan has enacted a one-year version of the CTC that is more generous and doesn’t have a phase-in. And in the American Families Plan, Joe Biden is proposing to extend that and also to make child care subsidies more generous. Meanwhile, a handful of Republican senators have started putting their own ideas on the table to address some of these same issues but in different ways. The idealistic side of me hopes that the various stakeholders can get together and actually hash something out. But I’m afraid they won’t.

The knot of American family policy

This has become a tough policy issue because it’s highly multidimensional.

One dimension is basic fiscalism. Some people (liberal Democrats) are happy to spend lots of money on this stuff, while conservatives are reluctant.

Another dimension is the treatment of married mothers. Some people are very worried that a lack of public subsidy for child care will keep them out of the workforce and away from their career aspirations, while others are worried that public subsidy for child care will bias decision-making against traditionalist families and stay-at-home parents.

A third dimension is the treatment of single parents. Some are worried that cash support will induce them not to work (“welfare queens”), while others worry that failure to provide such cash support condemns a large number of children to deep poverty.

Multi-dimensional issues are hard because there is not an obvious avenue for compromise.

If your only concern is with the third set of issues, then you can provide a child benefit, make it so that it does not phase out, and also provide a child care subsidy. That way, single parents truly unable to work will still have subsistence, but the incentive to work if you can remains strong. But that kind of robust social provision violates conservative concerns on point one (it’s expensive) and on point two (the child care subsidy provides preferential treatment for two-earner families over traditional one-earner ones). You can try to address point two concerns by letting stay-at-home parents convert the child care subsidy into a home care allowance. But that makes the program even more expensive, and it also undermines work incentives from the standpoint of debate three.

I have talked myself into a position of agnosticism about most of this. If a set of family benefits created a modest work disincentive for single parents, that doesn’t seem like the end of the world to me. Or if a set of family benefits created a modest bias in favor of two-earner households, that also doesn’t seem like the end of the world to me either. Obviously, if you went really really far in either direction, that could be bad. But my main view is we should do more to support families with kids, and I would like politicians to work something out that people can live with.

Some different ideas

The leading proposals currently in the mix are:

Mike Lee and Marco Rubio want to keep the phase-in, but make the tax credit more generous. They rarely talk about the specifics with this, but they did unsuccessfully propose it as Senate Amendment 1339 to the American Rescue Plan.

The American Rescue Plan has a bigger CTC for this year only with no phase-in, but still phasing out as families get more affluent, and Biden would like to extend this new CTC into the future.

Mitt Romney has proposed a child allowance that’s a bit more generous than Biden’s for parents of young children.

And then Josh Hawley entered the arena with the idea of reverting to the pre-ARP CTC but then adding a new parents benefit that has a work requirement but no phase-in or phase-out [see correction below]1.

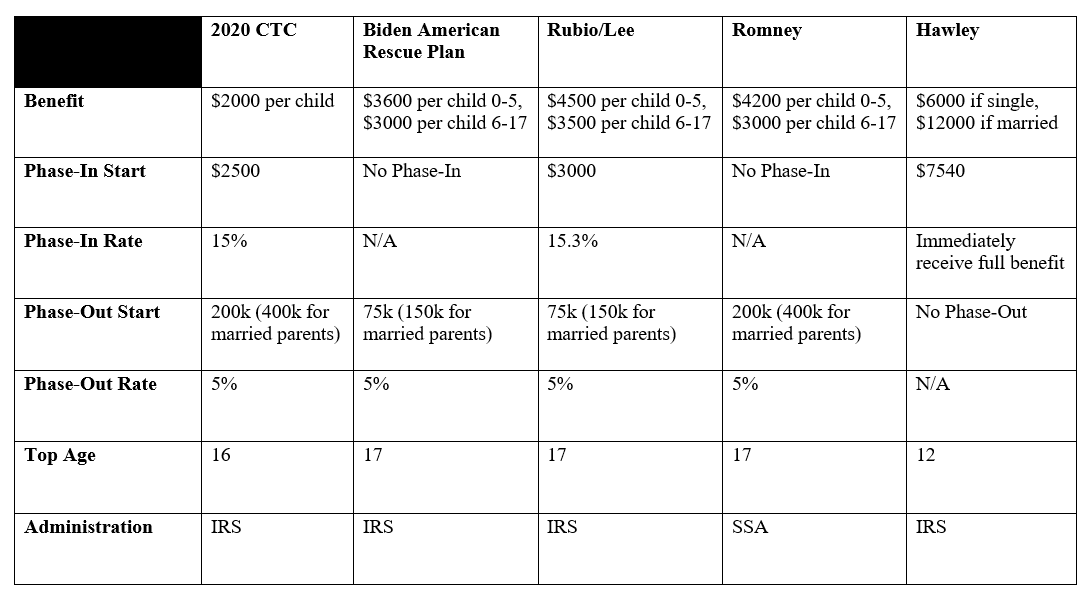

Unfortunately, it is hard to summarize these programs because there are a lot of parameters in terms of the number of children, the kids’ ages, and the number of parents in the household. But here’s a summary table that the Slow Boring Intern, Marc Novicoff, whipped up to try to simplify it as much as possible:

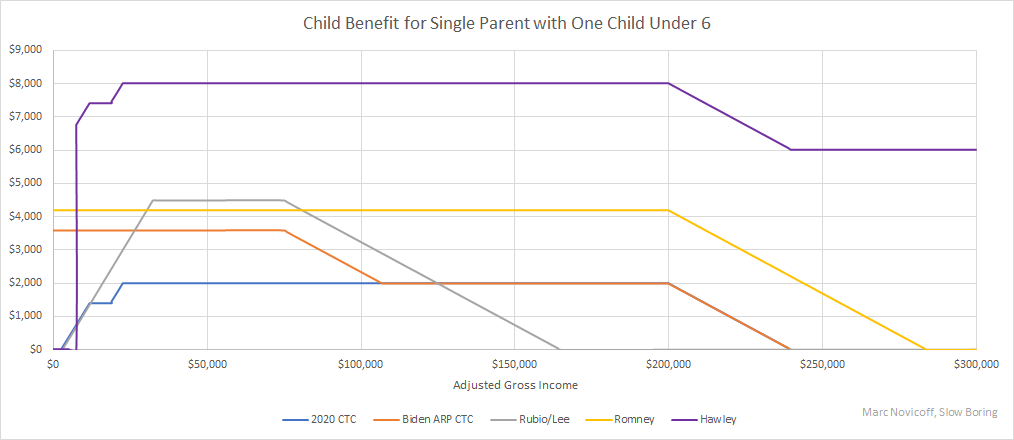

Marc also whipped up a few graphs comparing the different child benefits depending on adjusted gross income, family structure, number of children, and the children’s ages.2 Here are the offerings for single parents with one child under 6:

Here are the total benefits for single parents with one child under six and another between six and 17:

Now, the benefits for married parents with one child under six:

Finally, the total benefits for married parents with one child under six, and another between six and 17:

There are obviously more types of families, but hopefully that’s enough to get the gist.

Now a couple of provisos here. One reason Romney’s proposal is more generous than Biden’s is that he offsets the cost in part by consolidating the EITC, which benefits lower-income and middle-income families. In most cases, Romney is more generous on the net, but in some specifications, Biden is. And Biden separately has a child care subsidy proposal which is very valuable to the lowest income families, though it dwindles to nothing if you earn over 150% of the state median income.

The other thing is that while Romney sweated the details trying to come up with a way to pay for this that could plausibly qualify as conservative, Hawley just wrote down a benefit that’s much more generous in most cases through the magic of not saying how he’s going to pay for it.

Josh Hawley’s social engineering

The real ground broken by Hawley’s proposal, however, is that he has cut the Gordian knot of wanting to subsidize married stay-at-home moms but not unmarried ones.

That’s because while the other plans give you a subsidy per child (with a maximum in Romney’s case), Hawley has a subsidy per parent. Under Hawley’s plan, if you’re a single parent, you need to earn at least $7,540 per year (roughly 20 hours per week at federal minimum wage) to get the benefit, but once you hit that threshold you get $6,000. But if you’re a married couple, you still only need to hit $7,540 per year in household income, and if you do, you get $12,000 in benefits.

So under Hawley, a married couple consisting of one full-time worker earning the federal minimum wage of $7.25/hour plus one stay-at-home parent would have an annual post-transfer income of $26,500, which is exactly enough money to qualify you as non-poor if you have two kids. Hawley gives you nothing for extra kids and also never phases out the benefits.

In many respects, the upshot of this is absurd. A family with two adults and one child gets more help than a family with one adult and two children. And the poorest families get nothing at all. And when your youngest child turns 13, your annual post-transfer income drops by $12,000. A rich family like mine with one young kid would get $12,000 in cash for basically no reason.

But in exchange for embracing perverse outcomes, Hawley delivers on a conceptually clear statement of values — we want to help kids, but we want to insist that single moms work, while also insisting on absolute neutrality between working and non-working married moms.

That said, note that despite Hawley’s persona as a lib-owning culture warrior, college graduates are much more likely to be married than working-class folks. And Hawley is much more generous to high-income families than Romney or Biden, but unlike Romney and especially unlike Biden, he doesn’t give any extra money to families with large numbers of children (Romney has a $15,000 cap on total child benefits, while Biden has no cap at all). It’s Biden who is throwing uncapped subsidies at Quiverfull families with six or seven kids, while Hawley is shoveling money at Biden-voting millennial professional couples in favored quarter suburbs. It’s in the perversity of this mismatch that I find some hope that there’s room for a deal.

The childcare bit

I criticized Democrats’ interest in a child care voucher program in Friday’s post.

After getting to participate in a columnists’ Zoom with key White House officials, I have a better understanding of what they are thinking. The United States has unusually low women’s workforce participation, and on the call, Susan Rice indicated some concern that pandemic-era disruptions to school and child care arrangements could push that even lower as we recover.

That’s all fine if you ask me. But Democrats are a bit all over the map here, since they also want a new parental leave benefit — indicating to me that they can’t even decide for themselves what they are trying to do with labor force participation. The evidence from Canada is that cash benefits did not reduce labor there and existing child care subsidies in the United States seem to mostly change what kind of child care families buy. The most important thing is how much money is changing hands and who gets it.

Here I think the important point is that in Biden’s plan, the child care subsidy is much more sharply means-tested than the general child benefit. So even though the new CTC is framed as an anti-poverty program, it’s giving thousands of dollars to families with six-figure incomes — a married couple making $375,000 gets at least $3,000 per kid. And even though the child care subsidy seems to play politically as identity politics for professional class women, it’s a sliding scale benefit that’s much more lucrative if you’re poor and gives you nothing if your household income is over $100,000 or so.

I again want to emphasize some irony here relative to everyone’s position. Say you’re a typical Elizabeth Warren-loving college grad earning the national median salary for college grads of $65,000 a year. Your husband is also a median college grad, and you have one kid. And even though you both know that objectively $130,000 is more than most Americans make, you feel subjectively like you’re being crushed by the high cost of child care, and you’re so glad that Biden and his team really get it. You are going to receive exactly $0 per month in child care assistance from Biden.

By contrast, Josh Hawley, who hates you and everything you stand for (and vice versa!), is going to send you a cash benefit that’s three to four times larger — depending on the age of the kid — than what Biden is promising you. Yes, in theory, the point of that is to benefit some tradwife you saw on Instagram, but in practice, you can use it to defray the cost of child care and pursue your climb up the ladder at work. The person who benefits more from Biden’s plan is a single mother of two young kids who is too busy caring for them to work enough to make $7,540.

Can we work something out here?

The fact that these programs are, in reality, less effective at hitting their culture war targets than you might think gives me pious hope that there is some kind of a chance for a deal.

Hanging over all this, the big question is really “Do we want to spend a bunch of money on family support programs?” The answer from Romney is yes. From Hawley, it is even more yes. From Rubio and Lee, it is a slightly more tepid yes. If those four can round up six to 10 other Republicans also willing to say yes, then Democrats should sit down with them and work out a framework to do it. I don’t want to say the details don’t matter, because the details always matter. But the details will also inevitably change over time. If there is a moment of interest right now among conservatives in doing family policy, then Democrats should seize the day.

I think what that would most likely look like is doing something like Romney’s plan in exchange for Democrats foreswearing the child care subsidy idea. Basically, the 20 or so Republicans who are at least Rubio-curious (including Rubio himself) would have to decide that cash benefits for non-workers are the lesser evil to Democrats creating a big subsidized child care plan.

Is that at all realistic? In the general sense that betting against Congress to do anything is usually the winning bet, I don’t think that it is. After all, everyone in the GOP caucus already had a chance to consider Romney’s plan and it got zero support. But I dunno! At least conceptually, this strikes me as an area where talks can be fruitful once everyone admits to themselves that Democrats do not actually have a plan to subsidize the child care expenses of upscale professional couples.

I originally did not understand that Hawley was supplementing rather than replacing the pre-ARP CTC, so all the charts and such have been altered from the original draft.

One of the sources for the graphs is this cool Washington Post calculator for how much benefit you get from the new Biden CTC as opposed to the old 2020-era CTC, which is especially useful for calculating 2020 CTC benefits, which had an extremely weird phase-in.

Here's my entry, Integrated Cash Assistance: http://tiny.cc/iCa . It differs from any of the charts in that benefits start at zero income but rise with work and then phase out (like several of the others). Is neutral regarding number of parents in the family. Is more affordable because it replaces many existing programs rather than adding to them. It is all cash, no vouchers.

Any analysis of conservative proposals is futile because they are not made in good faith. All Republican programs are bait-and-switch Trojan Horses. If Democrats ever adopted them, the goalposts would shift and Republicans would then oppose them. Case in point: The ACA which was based on Mitt Romney's tenure in Massachusetts but got branded as Obamcare rather than Romney care.