$1.75 trillion is plenty of money to write a good Build Back Better bill

Here are some solid options

I don’t have a lot to say about the latest blowup between Joe Manchin and Democratic Party leaders over Build Back Better except to say that I think the whole notion of “leverage” in this situation is a farce. Joe Biden carried 25 states in 2020, and those states send 47 Democratic Party Senators to Washington. It is very lucky for progressives that Jon Tester and Sherrod Brown choose not to espouse significant deviations from the Biden agenda (though Democrats may come to regret that if those seats flip GOP in 2024), and they are also lucky that Joe Manchin is much more progressive than the median voter in West Virginia.

But unlike in Arizona where you plausibly could do better than Kyrsten Sinema, any other person who represents West Virginia in the Senate will be worse than Manchin. Indeed, we’re actually lucky that Shelley Moore Capito is a relatively moderate member.

Democrats and progressives are lucky to have Manchin in that job. It is not his fault that progressives couldn’t persuade the voters of Maine or Florida or North Carolina that their agenda was worth supporting in a way that would have made him irrelevant.

I also think that Manchin’s stated objections to the House Build Back Better draft are perfectly consistent with the Senate passing an excellent piece of legislation. The back-and-forth between him and the White House suggests some deeper and more profound breakdown, but that is a problem for a psychotherapist. All I can really do at this point is take everyone at their word. So here’s how I see it:

Months ago, Democratic leaders (over what we now know to have been Joe Manchin’s explicit wishes) unveiled a $3.5 trillion package chock full of all kinds of stuff.

Moderates balked, and the White House (trying to come closer to Manchin) announced support for a framework closer to $1.75 trillion.

House leadership, not wanting to actually cut half the stuff from the $3.5 trillion package, instead brought the headline price down largely by scheduling lots of programs to phase-in and phase-out on a weird schedule.

The recent breakdown is that Manchin said no to that idea. He will back $1.75 trillion in spending, which is a lot. But he wants it to actually be $1.75 trillion in spending.

Progressives can be mad about this, but the fact is that $1.75 trillion in spending without phase-out gimmicks is better on the merits than what House leadership put together. Manchin is not ruining anything by pointing this out. He is making life harder for his colleagues in the sense that they will have to pick winners and losers. But it’s much better to do six good programs than to half-ass a dozen of them. And the reality is that $1.75 trillion is a lot of money; you can do a lot of good stuff for $1.75 trillion.

Here’s what I’m sad about, though: the expanded Child Tax Credit is just way too expensive to fit within that framework if made permanent. The expanded CTC is one of my favorite policies, and it’s not going to work with Manchin’s demands. Back in September, David Shor and Simon Bazelon did a piece for Slow Boring in which they advocated applying a much sharper means-test to the program as a way to save it. Reaction to that idea on Twitter was very bad, but at a minimum, I think you now can understand what they were thinking.

But I have another idea for saving the CTC — keep it at its pre-Biden size, but make it fully refundable on a permanent basis.

The many complexities of the Child Tax Credit

Let’s step way back.

The United States has an unusually high child poverty rate compared to its peer countries, and the main reason for that is the U.S. does not have a cash benefit program for parents. A family with two children has larger financial needs than a family with one or zero children, so most countries provide a child allowance of some kind, which (among other things) greatly reduces family poverty.

The United States does not. Instead, we have the Child Tax Credit which, pre-Trump, was a $1,000 per child discount on your taxes. The CTC was also what we call in the policy jargon world “non-refundable” — it could not push your income tax liability below zero. So if you only owed $900 in federal income taxes, your maximum credit was $900. If you weren’t able to find work at all, you’d get nothing.

Then came the Tax Cuts and Jobs Act (TCJA), which was mostly very regressive tax cuts for corporations and business owners but also included a doubling of the CTC to $2,000 per year. It also made the CTC partially refundable. And while the classic CTC started phasing out at a very low level of income, TCJA made it so that you could get the full value with a household income of up to $400,000. The expanded CTC along with a larger personal exemption and a couple of other moves ensured that TCJA would give a tax cut to most people, even though the vast majority of the money was focused on a handful of very wealthy people.

But here’s the catch. They made the unpopular, regressive parts of TCJA permanent and reduced the headline cost by setting the middle-class provision to expire at the end of 2026.

Former Senator Bob Corker was sort of the Joe Manchin of the GOP caucus on this issue. He’s the one who set the maximum deficit increase in the bill, but unlike Manchin, he was willing to accept this phase-out gimmick as a way of meeting his demands. The other difference, though, is that Republicans took the most popular part of their bill and the part that Democrats had the least objection to and made that temporary. So the odds that at least some of these expiring provisions will be extended are very high.

At any rate, things changed again with the American Rescue Plan, which created a much larger Child Tax Credit for one year. This larger credit is both more generous ($3,600 per year for kids under 6; $3,000 for kids 6-17) and also fully refundable — i.e., you are entitled to claim the full credit regardless of income. For administrative reasons, a lot of very low-income households did not, in practice, get the ARP credit over the course of this year. But in principle they are eligible, and the administration could be improved over time. The ARP CTC has a tremendous anti-poverty impact, but it’s also very expensive. To make it permanent would cost about $1.6 trillion during the 10-year window and blow up Build Back Better. So people have been looking for ways to save it.

Options to save the CTC

One option is the Shor/Bazelon approach.

The ARP CTC fights poverty so much better than the pre-TCJA CTC in part because it’s more generous ($3,000 vs. $1,000) and in part because it’s phased in differently (fully refundable vs. not). But a large amount of the cost difference between ARP CTC and CTC Classic is that CTC Classic started to phase out at $110,000 of household income for a married couple vs. $400,000. These expenditures have no poverty-fighting value. There is a theory that by making the program broader, you increase political support for it. But what Shor and Bazelon found in their polling is that while a higher phase-out does gain you some support among high-income parents, this simply isn’t enough people to outweigh the support you gain among other people from making the program smaller.

Senate CTC champion Michael Bennet has been pursuing another option, trying to talk Manchin into abandoning his “no gimmicks” rule and do a one-year extension. Bennet believes that if the program lasts longer, the benefits will be clearer and more widely known and support will grow for making it permanent. I think that this is unlikely to persuade Manchin and unlikely to work even if Manchin does agree, but the advantage Bennet has in thinking about this is that he’s an actual United States Senator, so I’m inclined to give him some deference.

In “A Better Way to Build Back Better,” I proposed another idea: try to persuade Manchin to extend the ARP CTC through 2025 so that its expiration lines up with the expiration of those various TCJA provisions that Republicans want to extend. In that scenario, Democrats at least have some bargaining leverage to try to say that as long as Congress is extending things, they should extend the ARP CTC, too. This one I do think has a reasonably high chance of working if you could persuade Manchin. But the things Manchin has said since I wrote that post make me think he is unlikely to be persuaded.

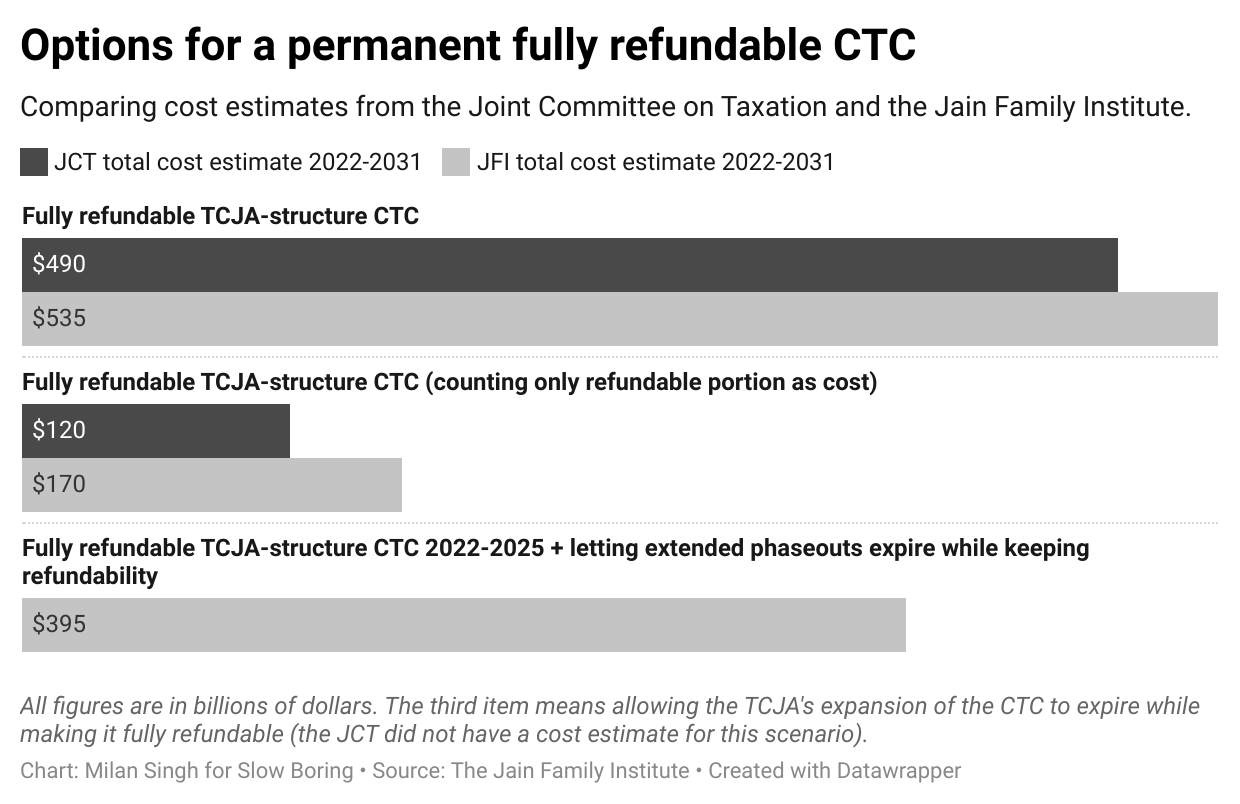

So here’s another idea. About half the poverty-fighting impact of the ARP CTC comes from making it fully refundable rather than making it more generous. And making the full refundability permanent is a lot cheaper than making the whole thing permanent. How much cheaper? Well, it’s a bit complicated because of the TCJA expiration.

Permanent, full refundability is expensive but doable

I think the “fair” way to think about this is that TCJA’s CTC is going to be made permanent in 2025. So the “real” cost of making full refundability permanent is that you should assume TCJA CTC is permanent, and then ask what’s the incremental cost on top of that. Analysts at the Jain Family Foundation think that would cost about $170 billion over 10 years, and also that the methodology that Congress’ Joint Committee on Taxation uses to produce official scores would count it as a cheaper $120 billion.

That’s quite affordable. But Manchin might still deride that as a gimmick because you’re assuming the cost of making TCJA permanent. He shouldn’t deride it as a gimmick because by his own logic, it’s the TCJA expiration that’s the gimmick. But I don’t want to count on Manchin being reasonable, so Jack Landry and Stephen Nuñez were kind enough to run it a few different ways.

First, here is a broad illustration of the scenarios we’re talking about.

Of course, real life is more complicated than this because single parents are treated differently and the age of the kid matters, etc.

But with all the micro-simulating done, you get this:

So what can we do with this?

Some ways to build back better

At the behest of congressional Republicans, the CBO wrote up scores for various provisions of the House BBB being made permanent.

On this spreadsheet, I’ve taken the CBO numbers and made three changes. One, I left out the $1.6 trillion it would take to make the ARP CTC permanent because we know that’s off the table — instead I included the two Jain Foundation numbers as options. Two, I split up the preschool and child care items, because I think the child care proposal has serious design flaws that are not present in the preschool proposal, so they really ought to be considered separately. And finally, I added the $30 billion that Biden originally request for his Apollo Program for Biodefense because I think this is really important and the House taking it off was dumb.

So now we need to do some editing to reach $1.75 trillion.

In my best-case scenario, Manchin accepts the $170 billion score for CTC, Josh Gottheimer listens to reason on SALT, and we drop the badly designed child care plan. With those optimistic assumptions, all you need to reach $1.75 trillion is to drop TAA and the tax-exempt bond financing, both of which are pretty obscure and nothing anyone is really fired-up about. I think this would be an amazing bill that, after lots of whining and complaining, would be kind of shockingly transformative.

There is also a scenario where Manchin insists on the $490 score and Gottheimer insists on the full SALT expansion.

A few things that could still work if that happened. This is one scenario:

Personally, though, I am a housing guy more than a preschool guy. I also know Raphael Warnock and Jim Clyburn see the Medicaid gap fix as a racial justice issue, and the preschool matching funds will not help their red-state constituents. So I think they might like this idea better.

Finally, here’s a middle ground scenario. In this universe, Manchin accepts the cheaper estimate for CTC and Gottheimer settles for a non-zero but smaller amount of SALT relief. But in exchange, both brands of moderates insist on including $250 billion in deficit reduction in the package.

The point of all of this is just to show how the math could work. Members of Congress could still do a lot of different things to make this work if everyone takes a deep breath and runs the numbers.

$1.75 trillion is a lot of money

The details matter, of course, but $1.75 trillion over 10 years is a lot of money. Progressives have glass-half-emptied themselves into a world where it sucks that Joe Manchin is not giving them the budgetary headroom they need to accomplish all their dreams. And it’s true, that does suck.

But it’s still a lot of money. And it comes on top of a $1.8 trillion rescue plan and an infrastructure bill that was worth nearly a trillion bucks. People also seem to have forgotten that an ambitious bipartisan science funding and industrial policy bill passed the Senate and is awaiting action in the House.

If you can get that passed and then add to it a bill that contains a massive investment in emissions reductions, a significant reduction in child poverty, some help for the elderly and insulin users, and something off the menu of other programs here, that’s a nice set of accomplishments. As I emphasized in yesterday’s post, Democrats have taken some real risks for the sake of trying to advance a fairly ideological policy agenda. But there is a reason they did that — this stuff is important. It would be a tragic error for everyone to freak out on the finish line and not get the job done. There is a ton of money on the table and a bunch of options for deploying that money in ways that will improve lives and improve the country.

I think these are great proposals. Reading this column has also crystallized for me just how much I hate the doom and gloom in my feeds (which, since I'm an academic, are mostly from the left). It's incredibly self-defeating (a testable hypothesis next November) when your message is, "everything sucks," particularly in the face of evidence to the contrary.

Kid vaccine rollout was good. Passing an infrastructure bill: good. Passing pandemic support: good. Doing expanded CTC this year: good. Judge nominations in a Dem Senate: good.

It's way easier to convince people to fight when they feel like their efforts matter, but right now it feels like there is a deep commitment to convincing people that they are riding the Fail Train. I don't need this to be a counter-narrative about unmitigated victory, but I wish people could be clear-eyed about the difference between incremental progress and overblown pessimism, because the latter will absolutely cost you winnable elections at the margin.

One thing I've learned from discussing this on Twitter the last few days is that some of the angriest people in the debate quite literally have no idea what programs are even in the proposals. All they know is that Manchin is a bad guy, so they oppose whatever he wants, plus he's lying anyway (about whatever it is he's saying, though they have no idea what that is). It's totally politics as soap opera or pro wrestling match or [choose your metaphor].

Meanwhile, normie swing voters also have no idea what programs are in the bill proposals (some probably don't even know there's a bill, or that the current bill is different from the one that passed a few weeks ago) because they all have better things to pay attention to like Christmas shopping. If the Dems can somehow get it together and pass the kind of compromise bill that Matt's outlining here, all this sturm and drang will be forgotten within a month.